? After the Q2 2026 report, CrowdStrike shares came under pressure despite strong financial results. Investors were cautious due to a weaker forecast for the upcoming quarter and ongoing reputational risks.

About the company:

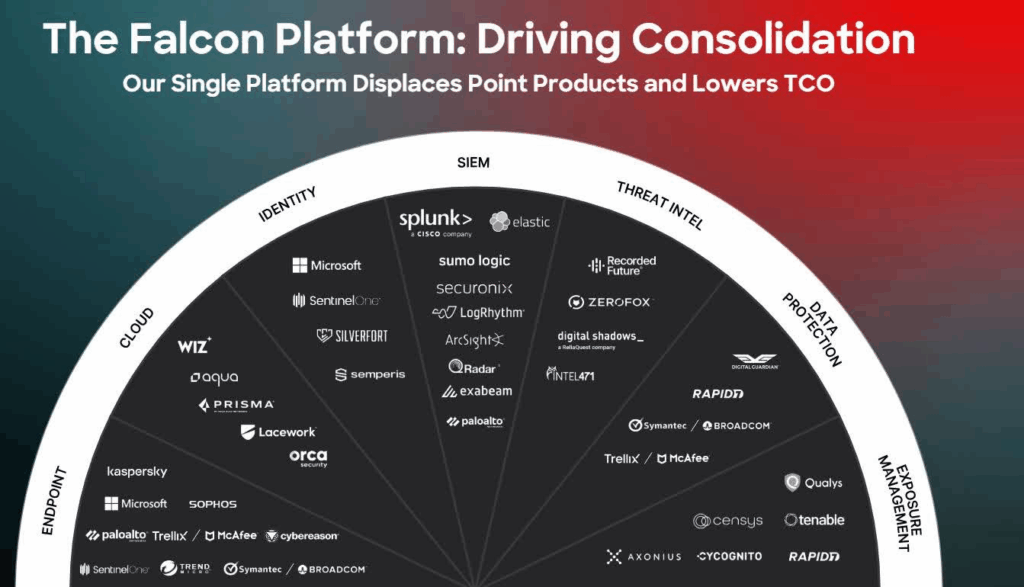

CrowdStrike Holdings, Inc. is a cybersecurity leader specializing in cloud solutions to protect endpoints, networks, and data. Its flagship product, the Falcon platform, uses AI and machine learning to prevent attacks in real time.

Key Quarterly Results:

- Earnings per share (EPS): $0.93 vs. $0.83 expected — exceeding analyst expectations.

- Revenue: $1.17 billion, up 21% year-over-year — above market forecasts.

- Annual Recurring Revenue (ARR): $4.66 billion, up 20%.

These core metrics indicate sustainable growth in the subscription model and continued high demand for cybersecurity services.

Pressure Factors:

Despite strong figures, investors noted a number of negative factors.

- Q3 Forecast: Management provided revenue guidance below analyst expectations, signaling potential growth slowdown.

- Impact of 2024 IT outage: Clients demand discounts on renewals, pressuring margins.

- Legal risks: Ongoing litigation with Delta Airlines increases uncertainty and may result in additional costs.

Long-Term Growth Drivers:

Despite short-term difficulties, CrowdStrike retains several strong strategic advantages.

- Strong subscription model: ARR grows over 20% year-over-year, ensuring predictable cash flow.

- Falcon platform: Combines cloud architecture, AI analytics, and a unified interface, increasing user engagement within the ecosystem.

- International expansion: Actively strengthening positions in Europe and Asia, where cyber threats are increasing.

- M&A strategy: Acquisitions such as Onum expand Falcon’s capabilities and enhance competitiveness.

- Rising cyber threats: AI, IoT, and hybrid work models drive market growth.

Outlook Assessment:

- Short-term: The market may remain nervous due to the weak forecast, litigation, and client pressure. Stock volatility is expected.

- Medium-term: Recovery of reputation after the 2024 outage will be key.

- Long-term: The global cybersecurity market grows 10-12% annually, and CrowdStrike is well-positioned to remain a top-3 player worldwide thanks to its technology and subscription model.

? Conclusion: CrowdStrike remains one of the most interesting public cybersecurity companies. Despite short-term risks, its business model and positioning in a growing segment make the shares attractive for long-term investors. The key question is whether management can restore market and client trust after recent reputational hits.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.