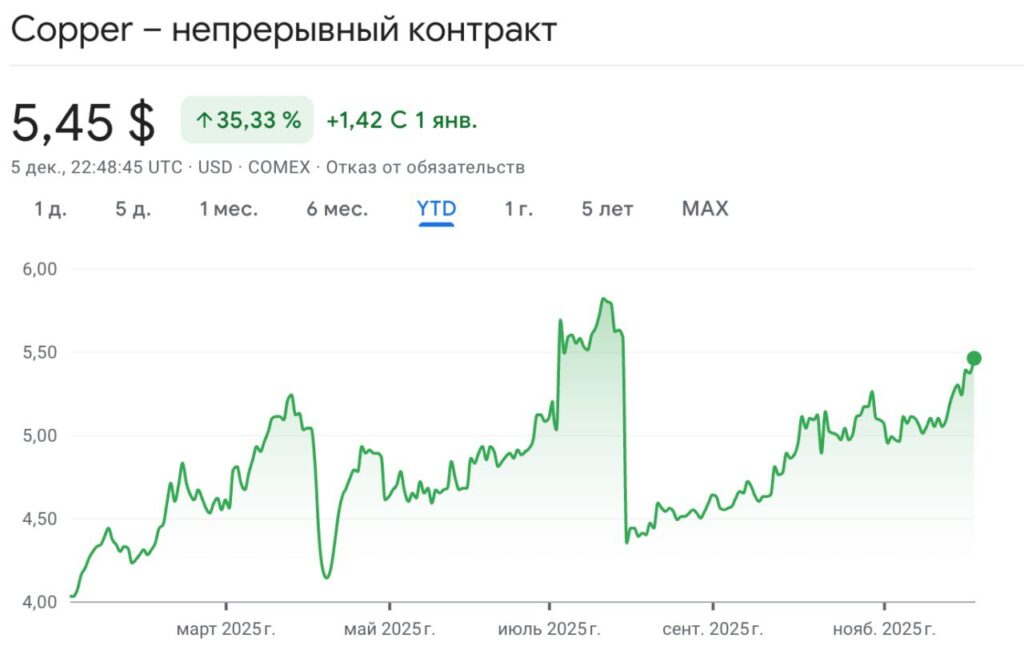

The industrial metals market in December has entered a phase that is already drawing comparisons to the commodity rallies of the past decade. Copper — a key metal of the modern economy — has risen more than 35% since the beginning of the year and continues to set historical records, moving within a range of all-time highs. And judging by the trend, this is far from the limit.

The main driving force behind the growth is the expectation of a supply deficit. Large traders are redirecting significant batches of the metal to the US market, trying to get ahead of possible new import tariffs. This shift in logistics flows has effectively created a local supply vacuum in several regions and increased pressure on prices.

An additional factor is geopolitical disruptions in mining. During the year, several key exporting countries faced sudden mine shutdowns: Indonesia, Chile, and the Democratic Republic of Congo experienced a series of production halts, hitting global copper supplies. These interruptions have already led to a noticeable reduction in the raw material balance and have formed the basis for a reversal of speculative sentiment upward.

The technological side of the issue is no less important. The artificial intelligence sector is experiencing explosive growth, and each new data center requires more and more copper — from power systems to cooling high-density server capacities. Copper has become one of the main building materials of the digital era: without it, it is impossible to maintain the infrastructure that supports AI models. This sharply increased fundamental demand and effectively created a long-term foundation for a bullish trend.

Against this backdrop, the metal price continued to rise. According to trading data, at 16:10 Shanghai time, quotes reached $11,257 per ton — 1% higher than the previous day. Over the year, the metal has risen approximately 28%, and the cost of one kilogram of copper is now about $11.25. Moreover, the market continues to move near the all-time highs recorded at the beginning of the week.

Investment interest is also influenced by US macroeconomic data. Market participants are awaiting reports on employment, import dynamics, and industrial production — these indicators can adjust demand expectations. The more resilient the US economy, the stronger the pressure on the copper market.

Meanwhile, the mining sector looks much healthier than most cryptocurrency assets, which are still only dreaming of an alt-season. Since the beginning of the year, the shares of the largest copper producers have shown impressive dynamics:

▪ Southern Copper Corp: +57.89%

▪ Freeport-McMoRan: +19.32%

▪ BHP Billiton: +12.21%

Large banks are also adding fuel to the fire. JPMorgan analysts predict further price increases in 2026–2027, indicating that demand will continue to exceed supply. According to them, the copper producers sector remains undervalued — and this gap between fundamental indicators and current capitalization creates potential for the continuation of the rally.

In recent weeks it has become clear: the copper market is entering a phase where speculative activity overlaps with real structural factors. Concerns about shortages, supply disruptions, and the rapid expansion of AI infrastructure create a rare combination capable of keeping prices high over a long horizon.

It seems that copper is becoming one of the most strategically important resources of the new technological era — and the market is only beginning to rethink this.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.