? Vanguard, the world’s second-largest asset manager, is for the first time opening access to trading ETFs and funds that hold cryptocurrencies in their structure. This decision has become one of the most notable pivots in the company’s history, which for decades adhered to a conservative strategy and viewed digital assets as instruments with an excessive level of risk. For investors who long considered Vanguard a stronghold of the traditional market, what is happening looks almost like a change of era: a company known for its commitment to proven solutions is taking a step toward a new technological asset class.

Until today, Vanguard consistently refused to participate in the crypto market, emphasizing that volatility, the lack of established regulatory frameworks, and uncertainty about the long-term value of cryptocurrencies did not align with its investment philosophy. The company preferred to focus on broad index portfolios, bond strategies, and instruments with predictable fundamental characteristics. This makes the current shift all the more striking: Vanguard is effectively acknowledging that digital assets have become too significant a part of the financial ecosystem to continue ignoring them.

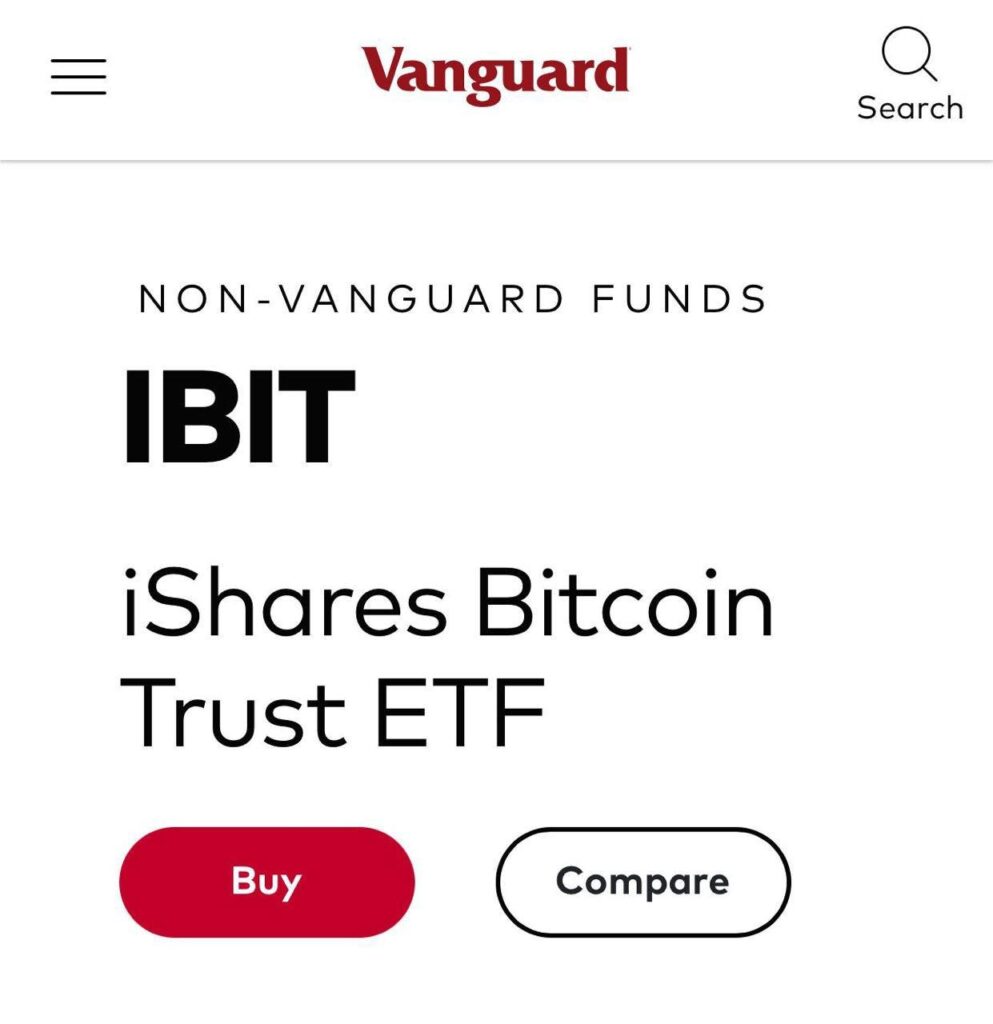

Now, the Vanguard platform will offer funds focused on the largest cryptocurrencies: Bitcoin, Ether, XRP, and Solana. This does not mean the company is turning into a crypto evangelist, but it clearly shows that client demand has grown to a level that can no longer be overlooked. Investors want the ability to work with crypto assets through reliable and regulated instruments, and Vanguard appears to have decided that it is better to provide this access internally than to hand the client flow to competitors.

The company’s decision may become an important signal for the entire market. When such a giant changes its long-standing policy, it often reflects not emotions but a sober assessment of where the industry is heading. On one hand, it represents an acknowledgment that cryptocurrencies are no longer viewed as a short-term trend. On the other hand, it is a warning that traditional institutional players are beginning to establish themselves in areas previously dominated by riskier participants.

? In essence, Vanguard demonstrates that the crypto market has ceased to be an exotic niche and is gradually entering a stage of maturity, where the same requirements for transparency, risk management, and compliance are applied as to traditional assets. This may still be only a cautious step, but such steps are precisely what shape the long-term direction of the entire market.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.