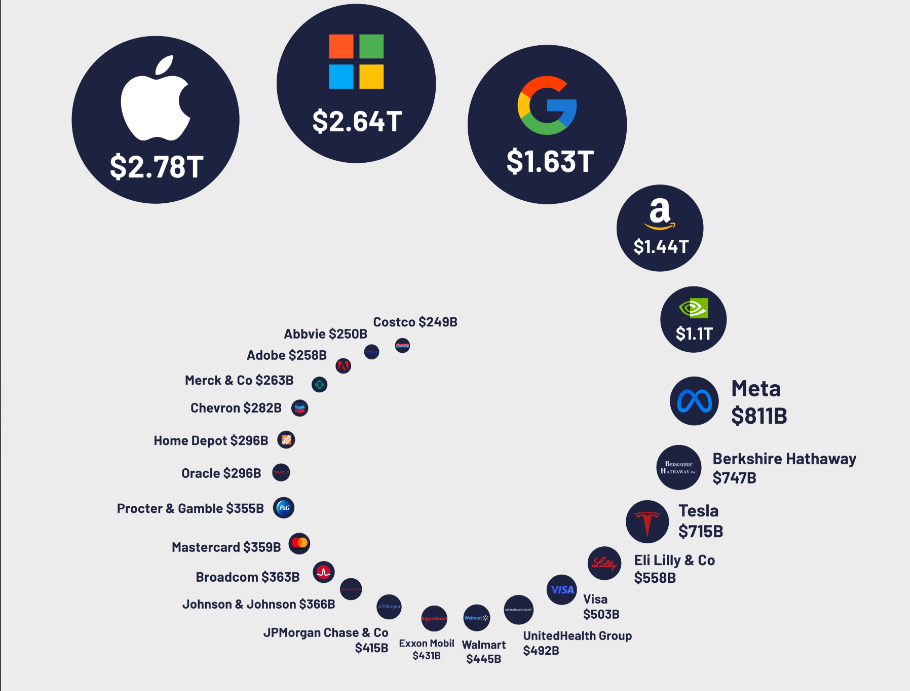

S&P 500: Will the Leaders of 2025 Repeat Their Success in 2026?

Investors traditionally favor winners — companies that have shown impressive growth this year and strengthened their market positions. But the question remains the same: can they win twice in a row and repeat their success next year? Analysts believe that nine top-performing companies of 2025 have a good chance to continue climbing in 2026, provided that the combination of technological innovation, growing demand, and sound corporate strategy remains intact.

Why This Matters for Investors and the Market

S&P 500 leaders serve as indicators of economic health and market direction. If large companies continue to grow, it signals a favorable environment in key sectors: technology, transportation, energy, and industry. Investors need to understand that 2025 growth does not guarantee success in 2026, but trends and fundamental indicators provide grounds for cautious optimism.

Technology and Innovation Remain the Main Growth Driver

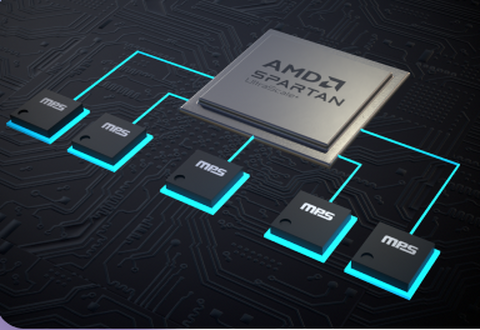

Semiconductor giants like AMD and Monolithic Power Systems continue to benefit from growing demand for high-performance chips and AI solutions. These companies not only produce the “brains” for modern computers and data centers, but also actively integrate their products into cloud platforms and AI infrastructure. The rising number of AI, machine learning, and high-performance computing applications supports demand for semiconductor products, creating the potential for double-digit stock growth.

The Future of Transportation: Mobility and Autonomous Technologies

Uber and companies operating in mobility and transportation infrastructure continue to strengthen their positions. In 2025, Uber expanded its services, invested in autonomous technologies, courier and logistics solutions. Analysts believe that in 2026, the company can benefit from growing demand for flexible transport solutions, environmentally friendly transportation, and the integration of digital services into daily life.

Energy and Infrastructure: The Clean Energy Trend

Companies like NRG Energy and Howmet Aerospace benefit from the global shift to clean energy and the modernization of production capacities. Worldwide attention to ESG, sustainable development investments, and carbon footprint reduction is increasing. Energy and aerospace companies actively implementing energy efficiency technologies, upgrading equipment, and developing new materials are at the center of investor attention.

Analyst Forecasts

Analysts believe these stocks have the potential for double-digit growth in 2026, despite impressive results in 2025. Of course, risks remain: a high comparison base, increasing competition in the tech sector, regulatory barriers, and macroeconomic instability may slow growth. Nevertheless, fundamental trends — technology development, digitalization, and the shift to “green” energy — remain in favor of these companies.

Takeaways for Investors

For those seeking ideas for a long-term portfolio, attention should be paid to leaders in technology, energy, and transportation sectors. However, entering at the peak is always risky, so a strategy of “buying on pullbacks” or “averaging positions” may be a wise approach. 2026 promises to be full of innovations, record-breaking growth, and opportunities for strategic investors who can combine a long-term view with awareness of market fluctuations.

Overall, investors should stay informed, monitor corporate reports, technological trends, and global economic signals to maximize the potential of market leaders and minimize risks.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.