? The crypto market remembers a lot, but October 11, 2025, will go down in history as the day of the biggest crash in the industry’s history — over $19 billion in liquidated positions in just a few hours. And while traders are still recovering, new facts continue to emerge, casting doubt on Binance’s official statements.

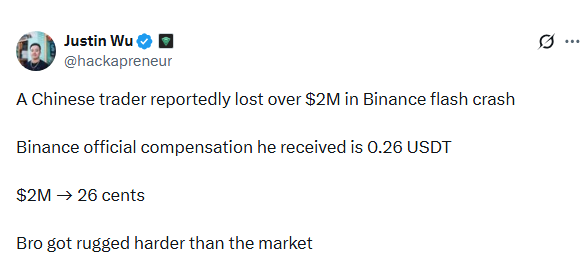

But sometimes, the crypto world isn’t about money — it’s about a sense of humor. Recently, a story appeared on Twitter (X) that left investors unsure whether to laugh or cry. A Chinese whale who lost over $2 million during the flash crash received compensation from Binance in the amount of 0.26 USDT. Not 260, not 26 — exactly 0.26, which at the current rate is worth less than a plastic coffee cup.

This “compensation” sparked a storm of reactions. Many users noted that Binance seems to be “supporting” clients — both literally and figuratively — morally, but not financially.

Meanwhile, the exchange officially reported the launch of the Together Initiative program, which plans to allocate $400 million to assist users affected by the crash. Of that, $300 million will come in the form of token vouchers for liquidated traders, and $100 million will be low-interest loans for institutional clients.

However, as is often the case in the crypto world, a good idea in theory turns into chaos in practice. Users are reporting massive complaints about nontransparent conditions, payment delays, and an extremely selective approach to compensation.

The crypto community’s reaction has been fierce. Under the hashtags #Binance and #BNB on X, hundreds of posts accuse the exchange of manipulation and incompetence. Among them are traders claiming that stop-loss orders simply didn’t execute and that the system froze precisely at the peak of the crash.

The most tragic part is that behind all this turmoil are real human stories. According to unconfirmed reports, at least three traders took their own lives under emotional pressure.

Meanwhile, trust in Binance is plummeting. According to open sources, users have withdrawn over $22 billion from the exchange in the past seven days, and the number keeps growing.

Binance has yet to issue an official comment regarding the $0.26 compensation case, but many analysts are already pointing to systemic issues with the platform. The world’s largest crypto exchange now finds itself in a situation where every move sparks not renewed trust but another wave of negativity.

The crypto community is already joking: “Getting $0.26 in compensation for losing $2 million is like receiving a consolation sticker from the exchange saying, ‘At least the experience is priceless.’”

Perhaps Binance decided to compensate losses one cent at a time, stretching payments over a few thousand years — just to keep things fair and consistent.

⚡️ But on a serious note, while Binance’s management insists it’s doing everything possible to support users, the market is drawing its own conclusions. And the main one is simple: in the world of decentralization, trust is lost much faster than it can ever be regained.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.