? Bitcoin is increasingly securing its place in investment portfolios, not only for individual investors but also for some of the world’s largest corporations. For some, it serves as a diversification tool; for others, it is a strategic asset and a hedge against inflation.

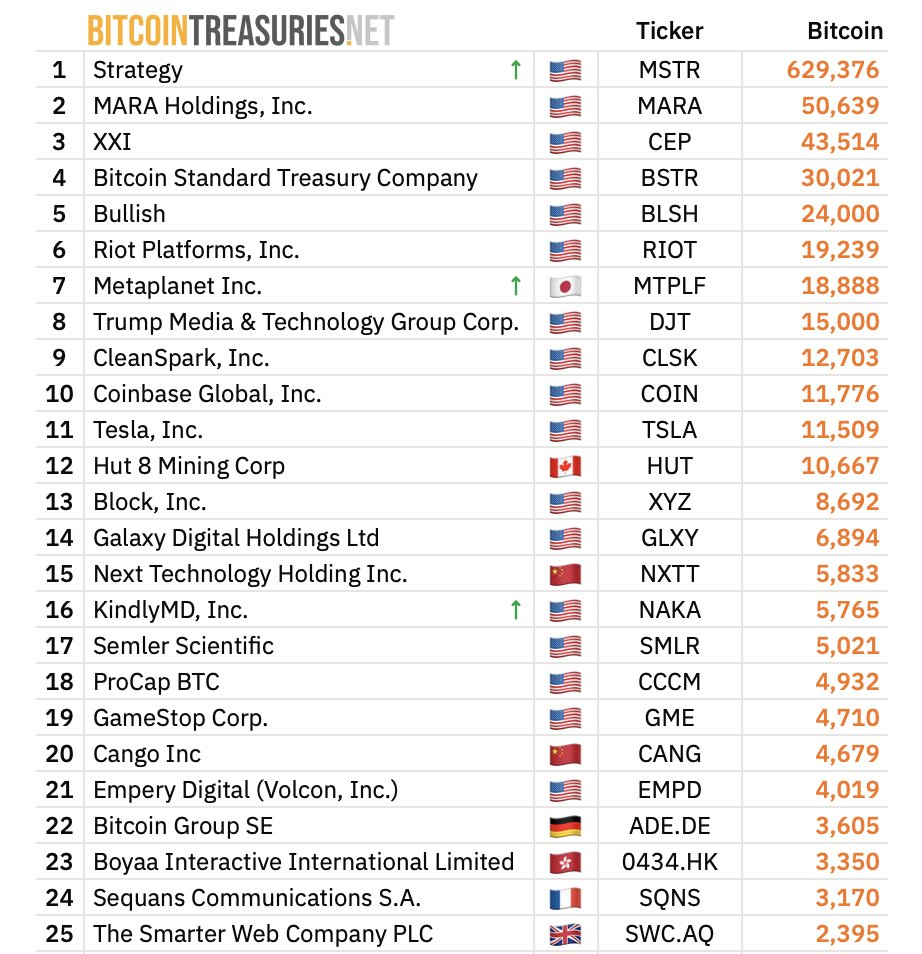

Data from BitcoinTreasuries show which public and private companies have accumulated the largest reserves of the first cryptocurrency.

Top Corporate Bitcoin Holders:

MicroStrategy — the clear leader. Since 2020, the company has systematically been buying Bitcoin, and its portfolio now exceeds 629,000 BTC.

Founder and chairman Michael Saylor openly calls BTC “digital gold” and considers it a key strategic asset for the future.

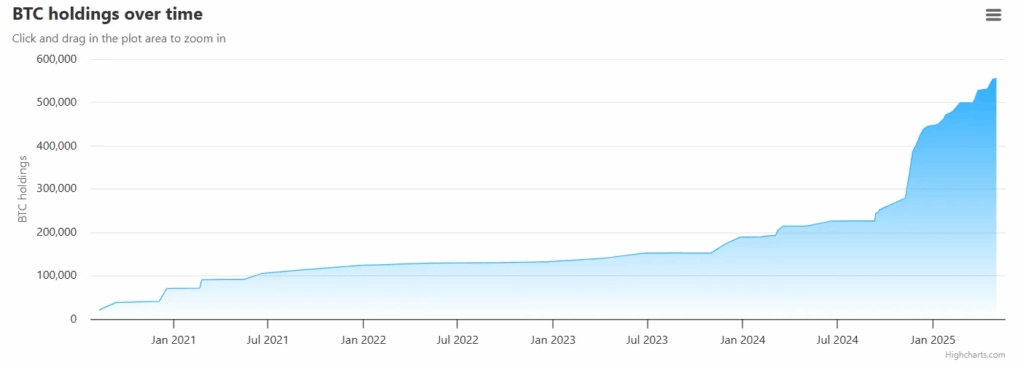

How Strategy’s Bitcoin holdings have changed. Source: treasuries.bitbo

MARA Holdings (Marathon Digital Holdings) — one of the largest mining companies in the U.S., holding 50,639 BTC mined and purchased on the market.

The third position is held by XXI, with a portfolio of 43,514 BTC. Despite having less media presence compared to the leaders, its strategy is also focused on long-term holding of digital assets.

In fourth place is Bitcoin Standard Treasury Company, which owns 30,021 BTC. The organization adheres to the concept of “Bitcoin as a reserve asset” and uses it as a key financial instrument.

Rounding out the top five is Bullish, holding 24,000 BTC. This company also actively develops infrastructure around the crypto market and views Bitcoin as a strategic element of its balance.

Other notable corporate holders include Tesla, Coinbase, Block (formerly Square), and even Trump Media & Technology Group. Although their portfolios are smaller, they confirm that Bitcoin is increasingly seen by corporations not as a speculative asset but as a long-term investment and a hedge against traditional financial risks.

⚡ Conclusion:

Bitcoin can no longer be considered just a “toy for enthusiasts.” It has firmly entered the strategy of major global companies, from tech giants and mining firms to media holdings. The growth of corporate BTC reserves strengthens its status as a new asset class and highlights the ongoing global transformation of the financial system.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.