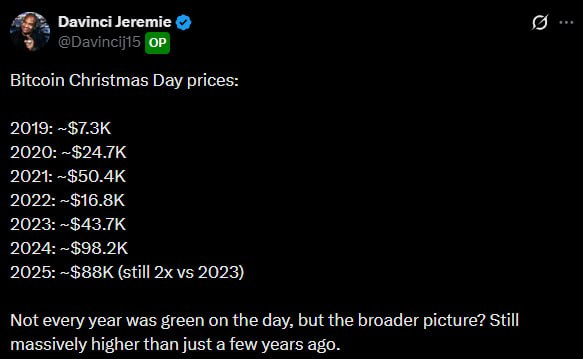

The price of Bitcoin at each Christmas has long become an informal indicator of market conditions and investor sentiment. This idea and the figures themselves have been repeatedly voiced by Davinci Jeremie – one of the earliest and most well-known Bitcoin enthusiasts, who many years ago urged people to buy BTC “at least for 1 dollar.”

According to him, Christmas is a convenient reference point: the end of the year, summarizing results, locking in profits, and reassessing risks. If you look at Bitcoin’s dynamics on these specific dates, it becomes clear how volatile, yet at the same time resilient, BTC has been throughout its history.

▪️ 2013: $660

▪️ 2014: $320

▪️ 2015: $450

▪️ 2016: $900

▪️ 2017: $14 000

▪️ 2018: $3 800

▪️ 2019: $7 200

▪️ 2020: $24 600

▪️ 2021: $50 400

▪️ 2022: $16 800

▪️ 2023: $43 500

▪️ 2024: $96 000

▪️ 2025: $87 500

Historically, Christmas has often coincided either with phases of euphoria or with cycle bottoms. In 2013, Bitcoin was priced at around 660 dollars. In 2014, the price dropped to 320 dollars, reflecting a sharp cooling of the market after the first major hype. In 2015, BTC met Christmas at around 450 dollars – the market was sluggish and almost unnoticed by the general public. In 2016, the price rose to 900 dollars, and that was when preparation for the next strong growth began.

In 2017, Bitcoin celebrated Christmas at around 14,000 dollars – a period of mass hype and inflows of retail investors. Just a year later, in 2018, the price fell to 3,800 dollars, showing how painful corrections can be. In 2019, BTC traded around 7,200 dollars, without euphoria, but already with signs of recovery. In 2020, against the backdrop of a global crisis and monetary stimulus, the Christmas price reached approximately 24,600 dollars.

In 2021, Bitcoin was priced at around 50,400 dollars, remaining a strong asset even after corrections from its peak. In 2022, the market went through one of its toughest periods – around 16,800 dollars at Christmas, bankruptcies of major companies, and overall disappointment. In 2023, BTC recovered to 43,500 dollars, which Davinci Jeremie called confirmation that the long-term trend had not disappeared.

In 2024, the price reached around 96,000 dollars, and in 2025 Christmas was met at approximately 87,500 dollars. This is below peak levels, but still many times higher than the figures of previous cycles. Davinci Jeremie emphasizes that such pullbacks are a normal part of growth, not a sign of market weakness.

Over two years, starting from Christmas 2023, Bitcoin has grown by more than 100 percent. Despite a local correction at the end of the year, the global trend remains upward. According to Davinci Jeremie, the history of Christmas BTC prices clearly shows a simple truth: Bitcoin goes through phases of euphoria and fear again and again, but in the long term continues to strengthen as a scarce digital asset and a store of value.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.