? China continues to be the largest and most dynamic electric vehicle (EV) market in the world. Competition intensifies every month: local manufacturers are ramping up production, while foreign companies struggle to maintain their positions. August 2025 highlighted clear trends and unexpected shifts in market dynamics.

XPeng: Record Sales and New Models

XPeng set a new all-time high with 37,709 vehicles sold in August, up 169% year-on-year. The main growth drivers are the affordable Mona M03, attracting budget buyers, and the flagship P7, which continues to capture the premium segment.

XPeng successfully combines the strategy of “affordable cars + premium models” with active expansion of charging infrastructure and autonomous driving technologies. Experts note that the focus on mass-market vehicles and tech features makes XPeng one of the fastest-growing brands in China.

Xiaomi: A Real Competitor to Tesla

Xiaomi, known for smartphones and electronics, is firmly entering the automotive sector. Sales exceeded 30,000 vehicles for the second consecutive month, and the SU7 and YU7 models are successfully competing with Tesla. The SU7 surpassed the Model 3, while the YU7 crossover is gradually catching up to the Model Y.

Experts predict that by the end of the year, Xiaomi has a real chance to overtake Tesla in China’s EV market. Xiaomi’s strategy is simple: a combination of affordability, modern technology, and integration with its gadget ecosystem. For Tesla, this poses a serious challenge, as Xiaomi attracts younger buyers accustomed to smartphones and digital services.

Nio: Steady Growth and New Flagships

Nio continues to grow — 32,000 vehicles are expected in August, up 59% YoY. Particular attention goes to the new Onvo L90, whose sales jumped from zero to 10,000 units in a month.

Nio focuses on the premium segment and technological innovations, including battery swapping and autonomous features. The Q2 report will be released tomorrow, and analysts expect strong financial results and sustained growth.

Li Auto: Sales Decline and Losing Ground

Li Auto faces challenges — 30,000 vehicles sold, down 38% YoY. Their hybrid SUVs no longer save the situation: competitors are pushing the brand out of both mass-market and premium segments.

Experts note that Li Auto needs to update its model lineup and strengthen marketing, or risk losing market share. In a highly competitive market, any delay in new launches has a noticeable impact on results.

BYD: The Giant Stalls

BYD, China’s largest EV manufacturer, sold 345,000 vehicles in August, roughly unchanged from the previous month (0% MoM) and down 7% YoY. Profit fell by 30%, domestic sales declined, and growth in overseas markets slowed.

BYD’s main problem is market saturation and growing competition from new players. While the brand remains a technology leader, growth rates are no longer impressive.

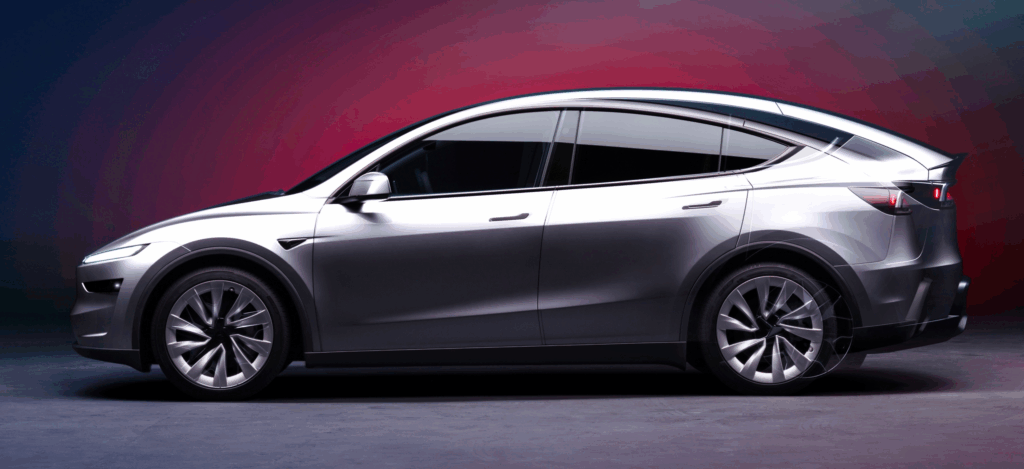

Tesla: Under Pressure

Tesla is expected to sell 53,000 vehicles, down 17% YoY. The company is lowering prices to stimulate demand, but Xiaomi and XPeng are gaining ground.

Hope lies in the new Model Y L variant, which could attract more premium buyers and regain some lost market share.

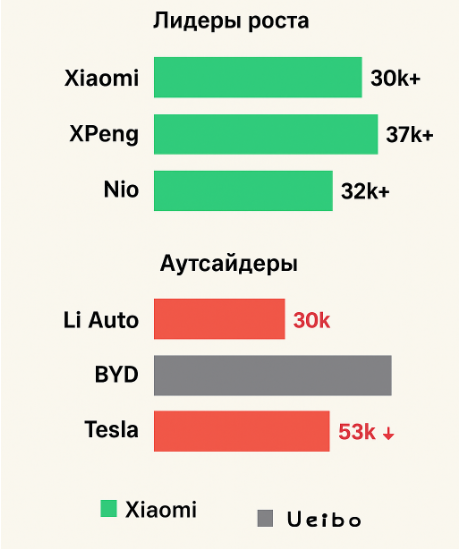

Picture of the week

- Leaders and Laggards

Growth leaders: Xiaomi, XPeng, Nio. - Laggards: Li Auto, BYD, Tesla.

China is becoming an arena for a real EV war, where each company competes for leadership through innovation, price cuts, and model expansion.

Conclusions and Forecasts

- China’s EV market remains dynamic, with rapid changes in leaders and laggards.

- XPeng and Xiaomi show remarkable growth, actively expanding mass-market and premium segments

- Nio maintains its premium segment position and continues to introduce technological innovations.

- Li Auto and BYD face slowdown; losing market share forces new strategies.

- Tesla is under competitor pressure; price cuts and new models are key responses to market challenges.

- The key success factor is the combination of affordability, technology, charging infrastructure, and marketing.

⚠️ If current trends continue, by the end of the year we may see a shift in China’s EV market leadership: Xiaomi and XPeng continue to ramp up sales, Nio strengthens its premium segment, and the old giants will need to adapt or risk losing their positions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.