China’s move away from the dollar no longer looks like a subtle diplomatic hint or a long-term strategic game. It is a process that has become so obvious that its consequences are starting to be felt not only in statistics, but in the very architecture of the global financial system. The dollar, which for decades has remained the world’s main reserve anchor, is gradually losing part of its weight – and against this backdrop, gold is once again returning to the role of a quiet but highly influential winner.

Not long ago, it was still possible to argue whether Beijing’s reduction of dollar assets was a temporary adjustment or a strategic course. Today, there is almost no doubt left: China is consistently reducing its dependence on US Treasury bonds while simultaneously increasing its gold reserves. This is no longer an episode, but a long-term shift.

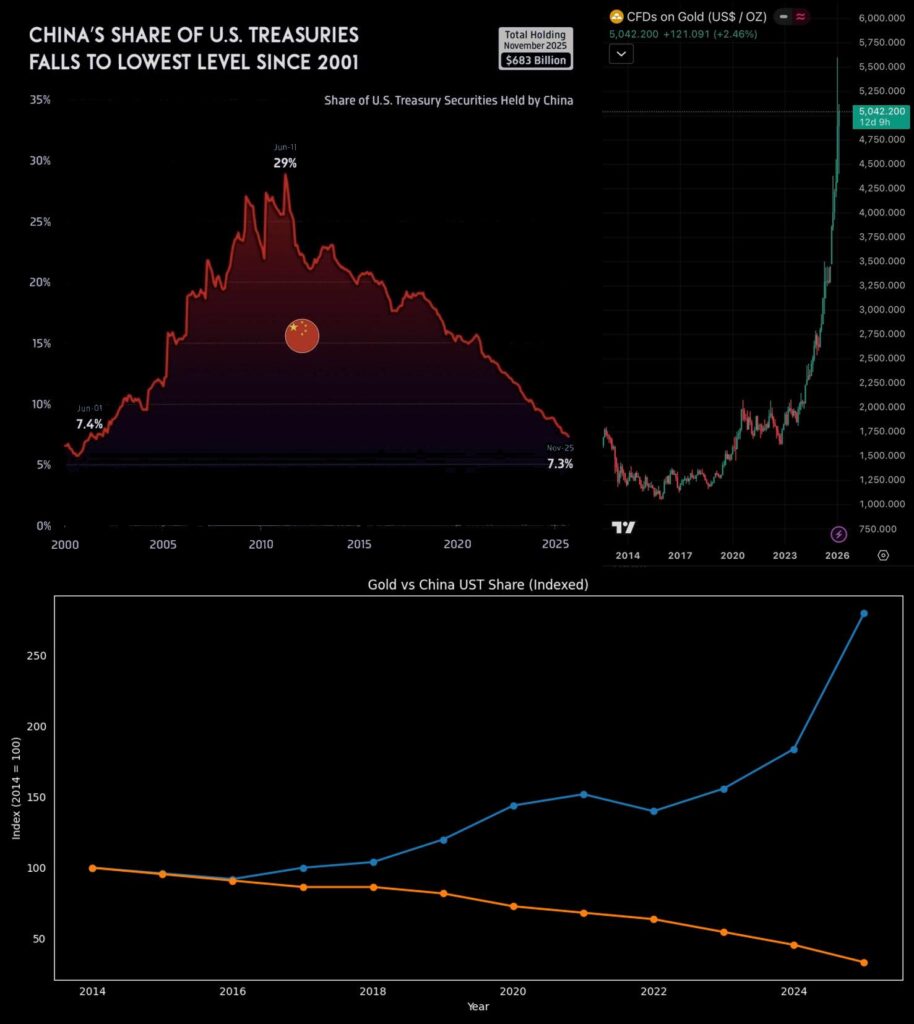

The numbers speak louder than any statements. China’s share of US Treasury holdings in the total volume of foreign investments has fallen to 7.3% – the lowest level since 2001. For comparison, in June 2011 China was at the peak of its participation, controlling around 28.8% of foreign holdings of American debt. Since then, the figure has dropped by 21.5 percentage points.

In absolute terms, the picture is even more revealing. Over this period, China’s investments in US Treasuries have decreased by $627 billion – down to $683 billion, the lowest level since 2008. In effect, China has liquidated roughly half of the Treasury portfolio accumulated between 2000 and 2010, when the dollar was seen as an uncontested reserve instrument.

And here is where things get most interesting: where is this money going? The answer increasingly lies not in digital assets or exotic currencies, but in humanity’s oldest financial refuge – gold. In January, the People’s Bank of China purchased another ton of gold, marking its 15th consecutive monthly purchase. This is not a one-off deal or a cosmetic adjustment, but a steady behavioral pattern.

As a result, China’s total gold reserves have reached a record 2,308 tons. This is the highest level in the country’s history and a direct signal to markets: Beijing is betting on an asset that does not depend on political decisions in Washington, sanction risks, or Western financial infrastructure.

Why is this happening right now? The reasons are clear. China’s Treasury reserves are shrinking as part of a strategic diversification. Beijing is reducing its reliance on dollar assets amid geopolitical tensions, market volatility, and growing uncertainty in US policy. Potential trade tariffs, the risk of new restrictions, and the use of the dollar as a tool of pressure – all of this turns American assets from a neutral reserve into a geopolitical factor.

When a reserve asset becomes a political weapon, holding trillions in it means playing with fire. And China understands this. But what matters more is that this trend is not limited to one player.

The dynamic set by Beijing is becoming a model of behavior for central banks in other countries. If Asia’s largest economy and one of the biggest holders of US debt steadily exits Treasuries and shifts into gold, it becomes a signal to everyone: the era of absolute dollar dominance no longer looks eternal.

Against this backdrop, gold is gaining support not only from governments but also from non-state institutional investors. Funds, asset managers, and major players are beginning to view the metal not as an archaic relic of the past, but as insurance against fundamental shifts in the global currency and financial system.

Therefore, despite speculative spikes and short-term corrections, gold remains in a stable upward trend. It is experiencing pressure from excess demand fueled by geopolitical risks, reserve de-dollarization, and growing distrust in the familiar notion of financial stability.

The world is entering a phase where reserves are no longer just about returns. They are about security, sovereignty, and independence from external decisions. And in such an era, gold once again becomes what it has always been: the ultimate asset of trust.

The dollar still remains the planet’s main reserve. But the very fact that the biggest players are preparing alternatives means one thing: the financial system is changing right now. And China seems to have decided not to wait until the changes become irreversible, but to act in advance – quietly, consistently, and at a very high cost to the old order.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.