? Just yesterday we wrote that Warren Buffett was stepping into the shadows, and today it seems everyone thinks the Master has something in mind, and it looks like this is not just another portfolio shuffle, but a quiet move by the old grandmaster before leaving the stage.

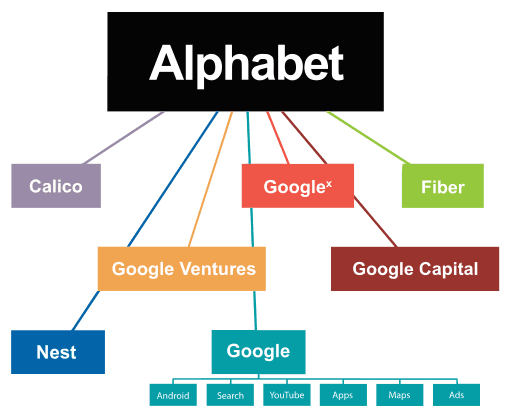

Just before finishing his legendary 60-year era at the helm of Berkshire Hathaway, Warren Buffett unexpectedly made a bet on Google. The company disclosed that it bought $4.3 billion of Alphabet shares. And this is despite the fact that over the last year, Berkshire was almost a machine for selling assets rather than buying: the third quarter was already the 12th in a row where Buffett sold more than he bought.

But the surprises didn’t end there.

- Berkshire cut its stake in Apple by another 15%.

- At its peak, the company held over 900 million Apple shares — now about a quarter remains.

- Nonetheless, Apple still remains Berkshire’s largest position — around $60.7 billion.

Meanwhile, Google has now entered Berkshire’s top ten assets.

And yes — this is extremely unusual for Buffett, who has always avoided overly tech-heavy companies and chose businesses that are understandable, predictable, and “earthy.” Apple, by the way, he doesn’t consider a tech business at all, but sees it as a classic consumer company.

A few more highlights:

- • Berkshire sold about 6% of its stake in Bank of America, continuing a sell-off that began last fall.

- • Fully exited DR Horton — a builder that was recently one of the key bets.

- • On the other hand, it bought more shares of Chubb, Domino’s Pizza, and several other companies.

- • Berkshire’s cash reserves are growing to a record level — Buffett is clearly preparing a mountain of cash, not risk, for successor Greg Abel.

- • The company hasn’t made major share buybacks in over a year and hasn’t executed mega-deals in almost ten years — another indicator that Buffett considers the market “overheated.”

And here’s the main question.

If even Warren Buffett, a man who has seen the market inside out for decades, who bought when everyone panicked and sold when everyone was greedy… if even he, at the end of his career, restructures his portfolio so cautiously and makes unexpected moves — what does he see ahead?

He enters Alphabet, sheds part of Apple, cuts banks, accumulates cash, and hands over a trillion-dollar machine to his successor.

? Could it be that even Buffett doesn’t know what’s next? Or maybe, as always, he knows more than anyone — he just hasn’t said yet.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.