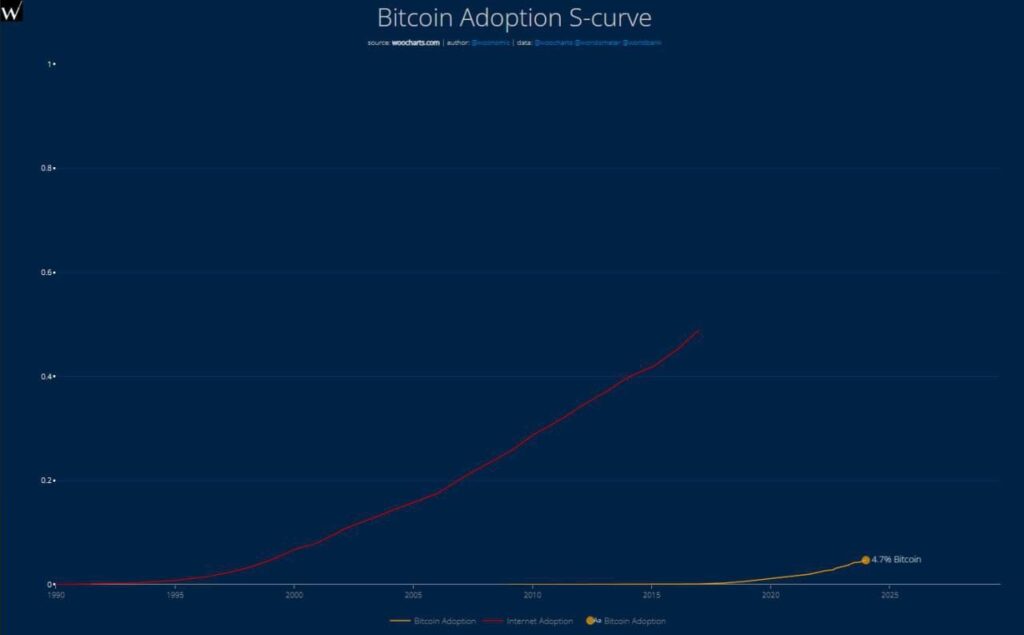

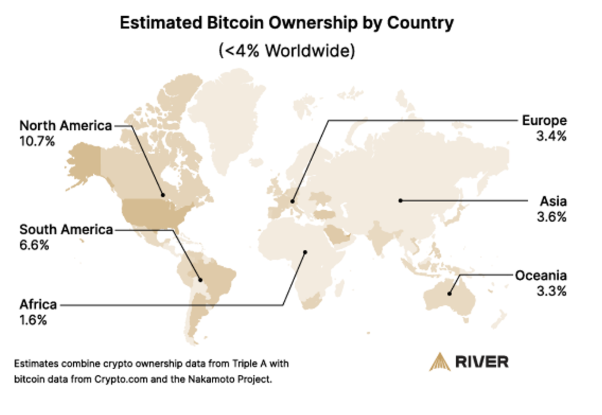

? According to the River Bitcoin Adoption Report 2025, about 4.7% of the world’s population already uses Bitcoin. The figure may seem small, but considering it represents billions of people, it’s clear that cryptocurrency has moved beyond the stage of a hobby for enthusiasts and is confidently becoming a mainstream financial instrument.

Interestingly, this level of adoption is comparable to internet usage in 1999!

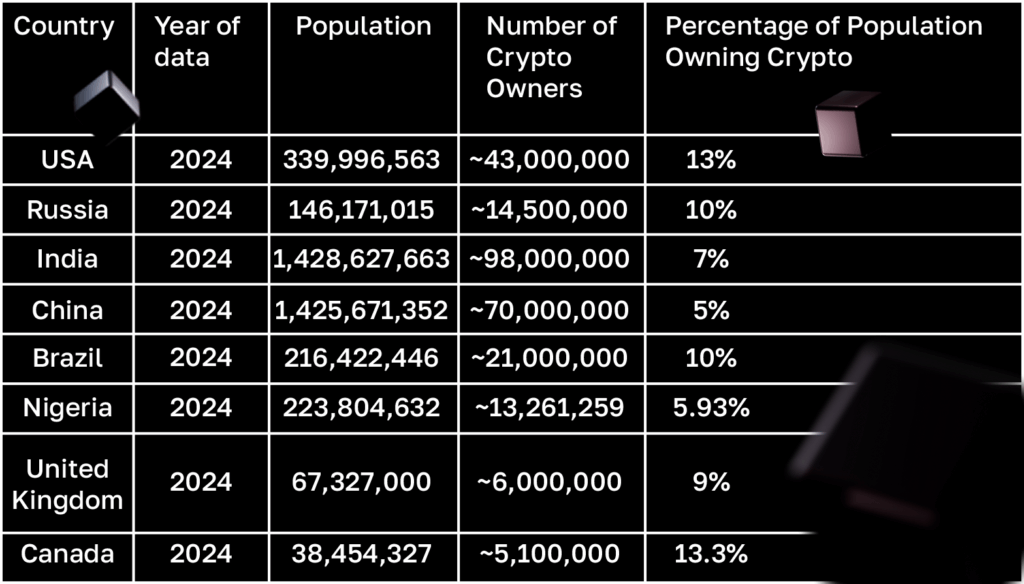

70% of Bitcoin holders are individuals, while only 4.4% are companies and funds. In other words, crypto is still the “people’s currency,” not a corporate one. The United States remains the leader, with 14% of its population owning BTC. However, cryptocurrencies are used most actively not only in developed countries but also where economies are unstable or capital controls are strict — such as India, Nigeria, Ukraine, Vietnam, and the Philippines.

The reasons for this popularity are simple and rational. In countries with high inflation, cryptocurrency has become a tool to preserve savings. For millions of migrants and freelancers, it serves as a means for cross-border payments and accessing global services without intermediaries. For others, it offers access to investments, DeFi, and even play-to-earn gaming economies — where “playing” literally means “earning.”

In response, governments are gradually adapting. Some, like El Salvador, have fully legalized Bitcoin as an official currency. Others, such as the US, Canada, Japan, and EU countries, are building transparent regulatory frameworks — with the EU introducing unified MiCA rules. Even where crypto is not yet formally recognized, its economic presence can no longer be ignored.

Global legalization overview:

As of today, cryptocurrency is legalized or regulated in several countries.

- El Salvador — first to adopt Bitcoin as legal tender.

- USA — the largest regulated crypto market, where BTC and ETH are treated as financial assets.

- UK — developing a transparent taxation and regulation framework.

- EU — implemented the unified MiCA rules across all member states.

- Canada and Australia — recognize crypto as property and regulate it through financial authorities.

- Japan — allows crypto operations but enforces strict compliance requirements.

These measures lay the groundwork for global institutional acceptance and reduce risks for private investors.

A new financial reality is taking shape: cryptocurrencies are integrating into the global system while maintaining their decentralized essence. Volatility remains an issue, and regulation often lags behind, but the trend is clear — from a marginal tool to a legitimate asset class.

Crypto adoption is measured by several key criteria:

- the volume of crypto assets on centralized exchanges (CEX);

- retail transactions (under $10,000),

- funds in DeFi,

- DeFi retail activity,

- and turnover-to-GDP ratio.

This approach helps assess not only wealth but real participation in the crypto economy.

Total number of cryptocurrency holders in major countries:

Where and why people use cryptocurrency

Today, cryptocurrencies are used for saving, inflation protection, international payments, investment, trading, real estate, education, tourism, gaming, and IT.

Thus, cryptocurrency has ceased to be a “speculative toy” and has become part of the global digital finance infrastructure.

? Bottom line: in 2017, Bitcoin symbolized rebellion against the old world. By 2025, it has become part of its financial infrastructure. The 4.7% figure is not the end — it’s only the beginning.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.