? A bond is a debt security that allows companies or governments to borrow money from investors. By buying a bond, you effectively become the issuer’s creditor: you lend your funds, and the issuer promises to return them after a set period with interest.

The key idea: a bond is a tool for stable income and predictable capital return, especially compared to stocks. Coupon payments generate regular income, and the maturity defines how long your money will be “locked up.” If necessary, you can sell a bond on the secondary market, but its price depends on market rates.

Types of Bonds and Their Features

For a private investor, it is important to understand the basic difference between US and European bonds.

Issuer:

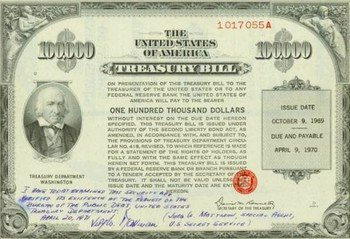

- US government bonds (UST, Treasuries) — the safest, with minimal default risk. In 2025, the 10-year yield is around 4.0–4.1% annually.

- European government bonds (German Bunds, French OATs) — also reliable, with German 10-year Bunds yielding ~2.5–2.8%.

- US and European corporate bonds — higher yields due to risk. Highly rated companies (AAA, AA) offer 4–6% in the US and 3–5% in Europe. Riskier bonds may provide 6–8% or more.

Coupon type:

- Fixed — unchanged interest rate for the whole term.

- Floating — tied to market indexes (LIBOR, EURIBOR).

- Zero-Coupon — bought below face value, with income realized at maturity.

Maturity:

- Short-term — up to 1 year.

- Medium-term — 1–5 years.

- Long-term — over 5 years.

Practical Yield of US and European Bonds

In 2025, bond yields are determined by current interest rates and economic expectations.

Examples of yield:

- 10-year US Treasuries — ~4.0–4.1%.

- 5-year US Treasuries — ~3.8–4.0%.

- 10-year German Bunds — ~2.5–2.8%.

- US corporate bonds (AAA–AA) — 4–6%.

- European corporate bonds (AAA–AA) — 3–5%.

These figures show that US bonds generally yield more than European ones. Investors use a mix of bonds to diversify and protect capital.

Bond Pricing

The market price of a bond may differ from its face value:

- Face value — repaid at maturity.

- Market price — current trading value.

- Dirty price — market price + accrued coupon interest.

For example, if a bond has a face value of $1,000 with a 5% coupon and you buy it six months after the coupon payment, the dirty price will include $25 of accrued income.

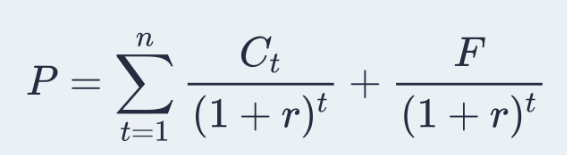

Yield to Maturity (formula)

If an investor plans to hold the bond until maturity and reinvest coupon income at the same yield, this formula will help determine the exact percentage by the time the money is returned.

P — current bond price; C_t — payment in period t; F — final payment; n — number of periods until final payment; r — required yield to maturity.

Where and How to Buy

US: via brokers, online platforms (Fidelity, Charles Schwab), or TreasuryDirect. Europe: via banks, brokers, or exchanges (XETRA, Euronext).

Important to study:

- The issuer and its credit rating.

- Yield to Maturity (YTM).

- Term and type of coupon.

- Taxes and platform fees.

? Investor takeaway:

US and European bonds are tools for stable income and capital protection. Government bonds minimize risk, while corporate bonds add yield.

A balanced portfolio ensures steady returns and capital safety during uncertain times.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.