⚔️ Trade War 2.0: Trump Shakes the Crypto Market

U.S. President Donald Trump announced a 100% tariff on goods from China, on top of existing tariffs. According to him, Beijing took an “extremely aggressive position,” sending the world an “extremely hostile letter” about implementing large-scale export controls from November 1, 2025.

In response, Washington will implement export controls on any critical software.

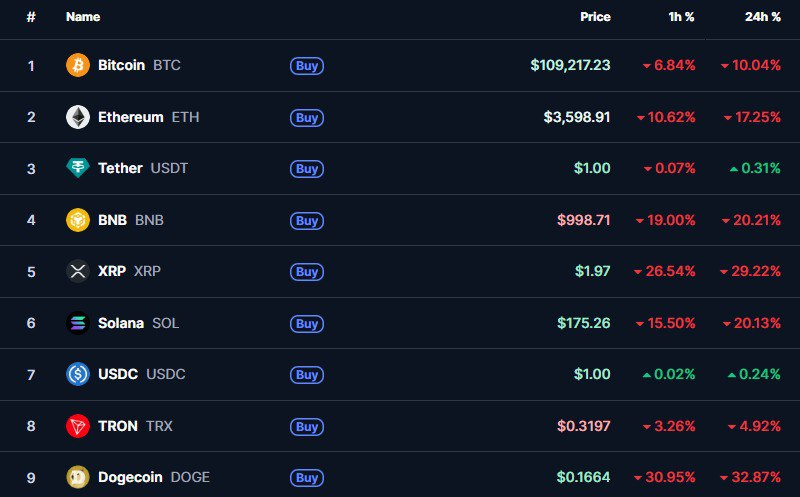

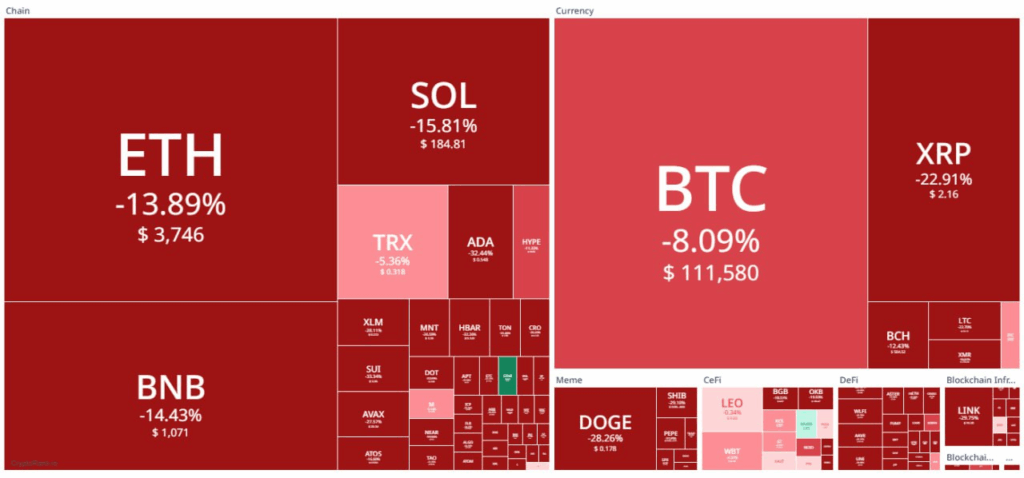

The market reacted instantly — and painfully.

Tonight will go down in crypto history

On October 10, Bitcoin dropped to $102,173 on Binance — a 19% decrease from the all-time high set just four days earlier.

At the time of writing, the price had rebounded to $111,580, but the shock remained.

1-day BTC/USDT chart. Source: Binance

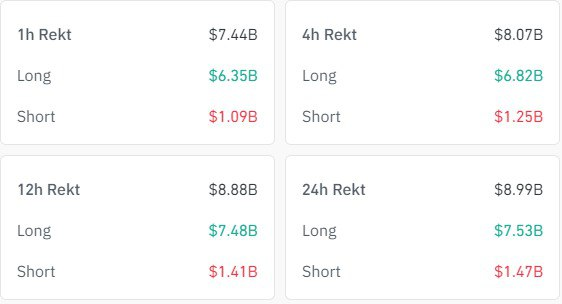

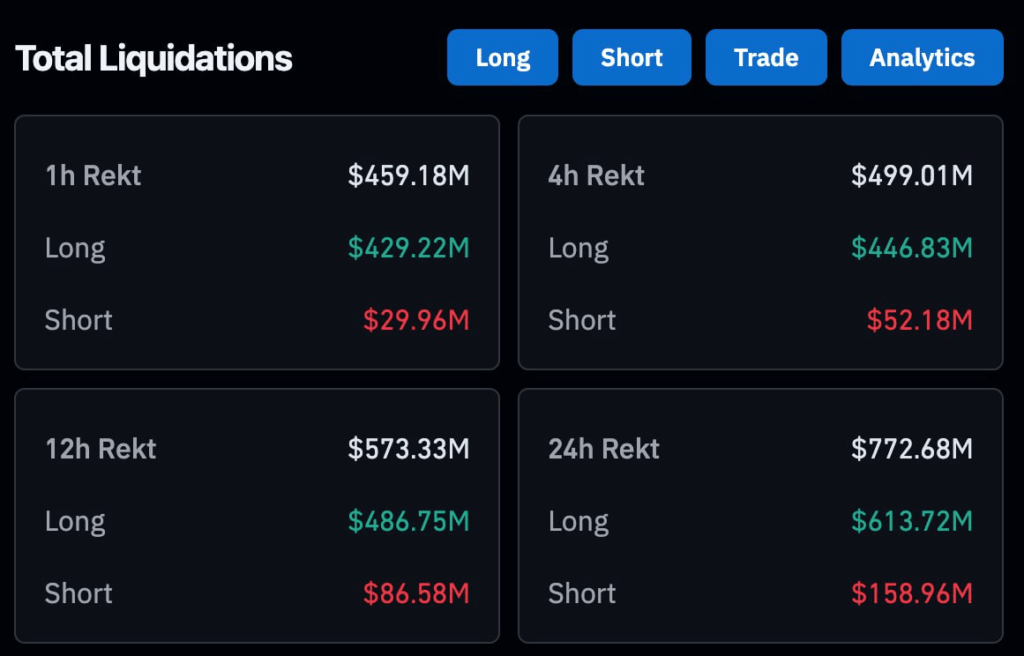

In 24 hours, liquidations reached $19.31 billion, according to CoinGlass.

Bitcoin and Ethereum lost 15–20% overnight, and total market capitalization fell by $900 billion, of which $500 billion disappeared in just 10 minutes.

1-day chart of total cryptocurrency market capitalization. Source: TradingView

Trader Daan Crypto Trades described the scene simply: “Exchanges froze, market makers pulled liquidity, some altcoins dropped to zero. Even stablecoins lost their peg. This is a real massacre.”

How it happened

Before the crash, the market was over-leveraged.

Bitcoin volatility was at cyclical lows, and it only took one trigger.

The news of Trump’s tariffs and China’s response was that trigger.

The market remembered April, when similar geopolitical news triggered a sell-off — and history repeated itself.

Record liquidations

Crypto trader Michaël van de Poppe called it “the largest crash in the history of cryptocurrencies and altcoins.”

Analytical resource The Kobeissi Letter noted that markets were looking for a reason for correction.

Leverage reached critical levels, and the S&P 500 had not fallen more than 2% for six months. Trump’s announcement was the perfect catalyst.

Anyone trading with leverage above 2x without a stop-loss was completely liquidated.

Who survived

According to CoinGlass, daily liquidations exceeded $19 billion. In one hour — $7.5 billion, of which $6.2 billion were longs.

Ethereum dropped to $4,100, Bitcoin below $119,000. Some altcoins fell 70% before starting to recover.

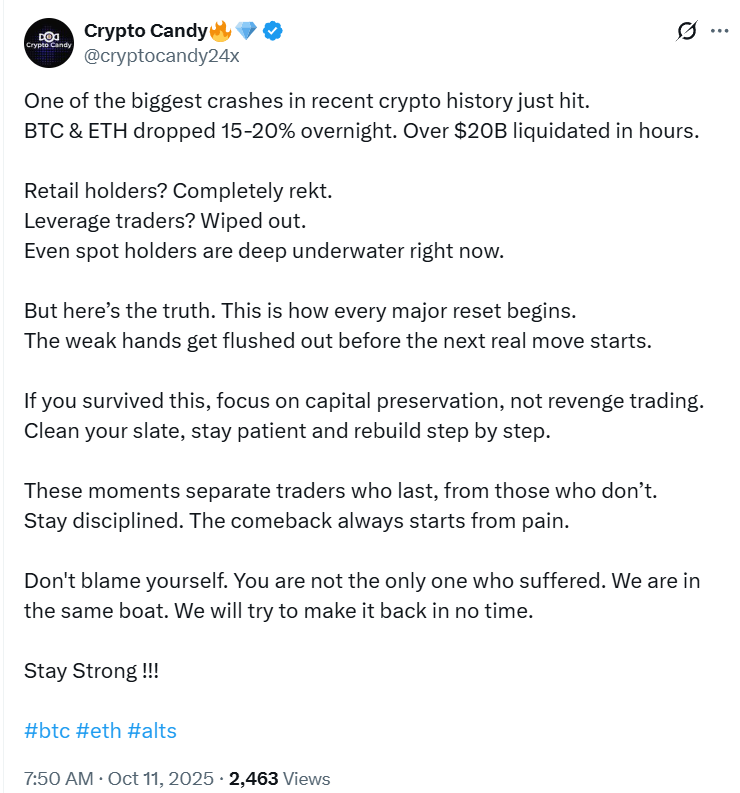

“Retail holders are completely ruined. Traders with leverage destroyed. But this is how new cycles begin,” writes analyst Crypto Candy.

FOMO Picks: “Discount Night”

If you had just been on the exchange at that moment, you could have bought:

▪️ ATOM — at $0.0001

▪️ WBETH — at $500

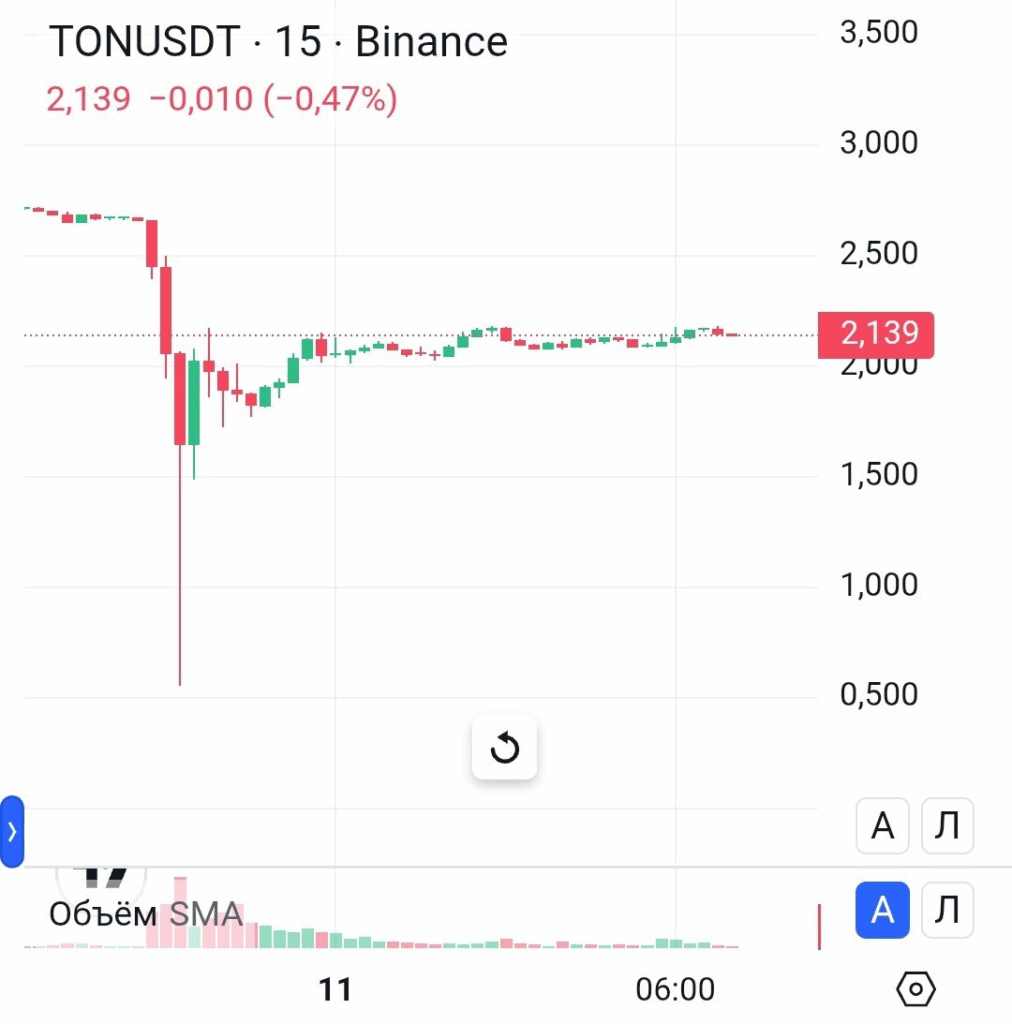

▪️ TON — at $0.6

▪️ BNSOL — at $40

▪️ ARKM — at $0.15

But behind these “pretty numbers” — billions in losses.

Many lost 90% of deposits simply because they tried to buy the dip or held open longs.

On nights like these, greed is not important — survival is. The main thing is not to make money, but not to lose it.

Historic Day

This night is now written into crypto history.

Before this, there were only two similar events:

- The MtGox hack, when the crypto market was just emerging;

- The COVID-19 crash.

Now — for the third time.

$7.5 billion liquidations in one hour. $9 billion in a day.

All because of one word: Tariffs.

? What’s next

If Trump softens his rhetoric, we’ll see a rebound — like in April.

If not — the market may drift sideways for weeks until altcoins form new lows.

But one thing is clear: the market has been vaccinated against greed.

And now everyone who survived this night will remember a simple rule for a long time: “Leverage is not a growth tool — it is a self-destruction tool.”

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.