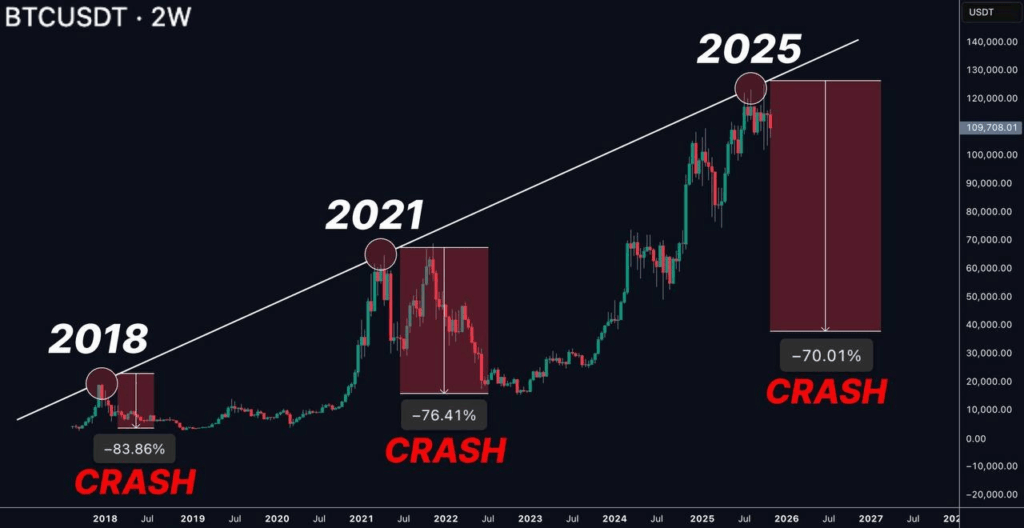

More and more voices in the market suggest that Bitcoin’s legendary four-year cycle — the one built around halvings and alternating phases of growth and decline — may finally be coming to an end.

Traders, analysts, and institutional investors are increasingly talking about the beginning of a new market era — less predictable, more volatile, and perhaps, for the first time, truly “mature.”

Why it matters

The four-year cycle was the “heartbeat” of the crypto market. After each halving (when miner rewards were cut), prices would surge, followed by a euphoric peak, then a sharp decline and a long consolidation. This pattern has held since 2012 and became a near-dogma in the crypto community.

However, the current situation breaks this familiar rhythm. Right after the 2024 halving, the market soared, but now there are growing signs that the overheating phase is nearing its end.

What Analysts Say

Many analysts warn that Bitcoin may enter a correction phase that could bring its price down to the $40,000–$50,000 range. This isn’t a crash but rather a “healthy cooldown” after a strong rally. Data from Glassnode and CryptoQuant show that large holders (the so-called whales) have begun taking profits, while coin inflows to exchanges are rising — a classic early sign of correction.

At the same time, open interest in futures markets has declined, and institutional inflows via spot ETFs have slowed. Together, these trends indicate a decrease in short-term demand and a shift toward market reassessment.

What could trigger a decline

Experts point to several potential catalysts:

- Institutional profit-taking after Bitcoin’s rise above $110,000;

- Reduced liquidity amid tighter monetary policy from major central banks;

- Growing competition from altcoins and DeFi projects drawing capital away;

- The psychological factor — investors anticipating a typical post-halving drop begin selling early.

Long-term outlook remains bullish

Despite short-term concerns, most experts agree that Bitcoin’s fundamentals remain strong. Institutional involvement continues to grow, spot Bitcoin ETFs now hold over 1.5 million BTC, and major investors keep buying the dips.

Meanwhile, network hashrate and long-term holder (HODLer) activity remain at record highs — classic signs of confidence in the asset.

Market view

Technical analysts note that the $40,000–$50,000 range could form a strong support zone — an area where whales and funds are likely to resume buying. At that level, Bitcoin would remain above its long-term trendline, preserving its upward market structure.

Experienced traders see a potential correction not as a threat but as a market reset — a chance to prepare for the next growth impulse, which some believe could push Bitcoin to new all-time highs by 2026.

? Conclusion

Bitcoin is entering a new phase — perhaps the end of the traditional four-year cycle has truly arrived. But instead of the familiar “crash-then-rally” pattern, we may witness a different kind of market: more mature, steadier, and institutionally driven, where swings of tens of thousands of dollars are just the breathing of a giant.

Corrections may be painful, but such phases create opportunities for those who focus not on price — but on the trend.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.