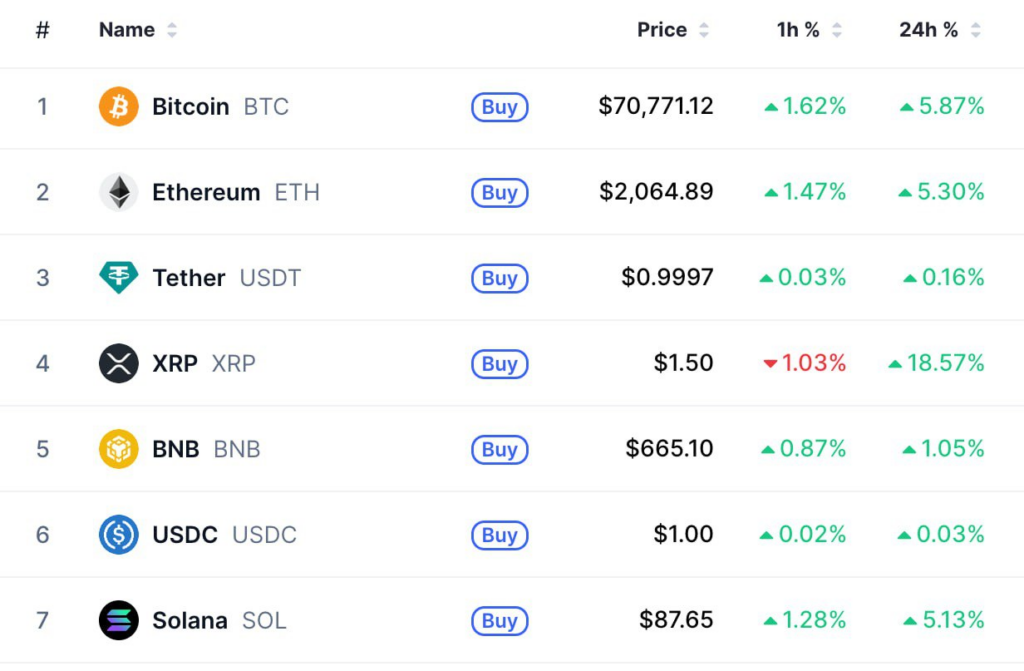

Bitcoin has once again climbed above the $71,000 mark, and the cryptocurrency market has received a powerful recovery boost in just a single day. On February 6, 2026, BTC rose roughly 15% from intraday lows that had dipped below $60,000, returning to a zone where investors can breathe a little easier.

This surge helped restore the market capitalization of the largest cryptocurrency to around $1.4 trillion – a figure that not long ago seemed at risk after a sharp collapse.

The rebound came after one of the most painful sell-offs of recent months. The drop was so severe that it almost completely erased the gains that had been building since the U.S. presidential election in 2024. Back then, the market once again believed in a “new crypto era,” institutional money flowed активно into the asset, and sentiment was close to euphoria.

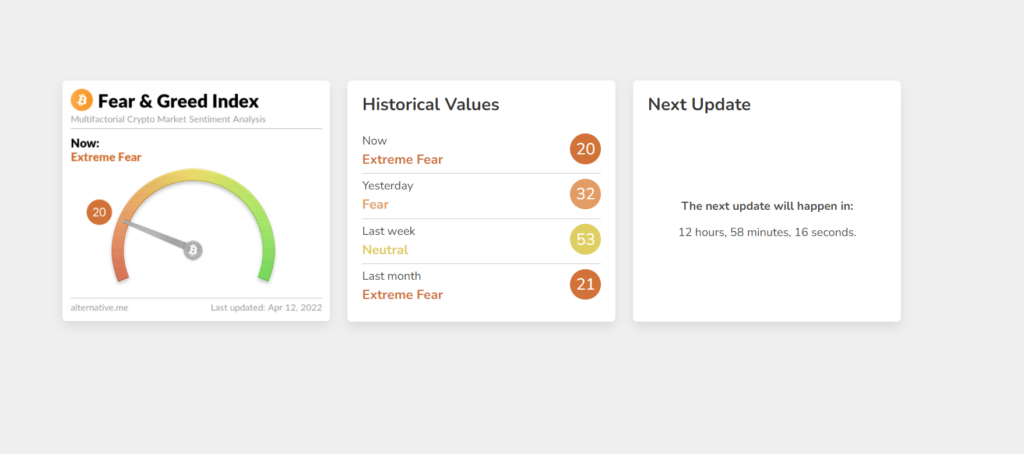

But the crypto market, as always, quickly reminded everyone: here, emotions drive the chart no less than economics.

At first, everyone is collectively shocked at how Bitcoin can fall so sharply – “it’s digital gold, what is happening?!”. Then only a few days pass, and there is a new surprise: “how did it even rise back so fast?!”.

Crypto is a never-ending swing between fear and greed. Panic forces people to sell at the very bottom, while greed pushes them to buy only after the rebound, when it feels like the train is leaving the station.

Such moves once again highlight Bitcoin’s key feature: it is an asset capable of turning the market into a dramatic сериал within just a few hours. There are no boring weeks here – only sharp drops, lightning-fast rebounds, and the постоянное feeling that “the most interesting part is starting right now.”

And while some try to find the perfect explanation for every move, the market simply does what it does best: заставляет people experience emotions at maximum volume.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.