Strategy, led by Michael Saylor, continues to systematically increase its Bitcoin holdings, using market corrections as buying opportunities. According to a filing submitted to the US Securities and Exchange Commission (SEC), the company acquired an additional 2,932 bitcoins for a total of approximately $264 million.

The purchase was made during a noticeable market correction. The average purchase price was $90,061 per bitcoin. This occurred during a volatile period when BTC started the week above $93,000 and then briefly fell below $87,000, according to CoinGecko data. Once again, Strategy confirmed its commitment to buying on weakness, largely ignoring short-term price fluctuations.

The Largest Public Holder of Bitcoin

Following the latest transaction, Strategy’s total Bitcoin holdings reached 712,647 BTC. The company has spent approximately $54.19 billion to acquire these assets, with an average purchase price of $76,037 per bitcoin across its entire position.

For the market, this is no longer just a statistical detail. Strategy has effectively secured its status as the world’s largest public holder of Bitcoin, controlling roughly 3.4% of the asset’s total possible supply. In traditional commodity or currency markets, ownership stakes of this magnitude are typically associated with sovereign reserves or central banks rather than a private company.

January 2026 as an Acceleration Point

The pace of purchases in January is particularly noteworthy. In less than a full month, Strategy acquired approximately 40,100 bitcoins. This exceeds the total amount purchased by the company over the previous five months, from August through December 2025. Such a sharp increase in activity suggests a deliberate acceleration of its accumulation strategy at the start of the year.

At the same time, the most recent purchase of 2,932 BTC appears relatively modest compared with earlier January transactions. One week earlier, the company announced the acquisition of 22,305 bitcoins, and the week before that, 13,627 coins. This may indicate a more flexible approach to timing and position sizing amid heightened market volatility.

Financing Through Capital Markets

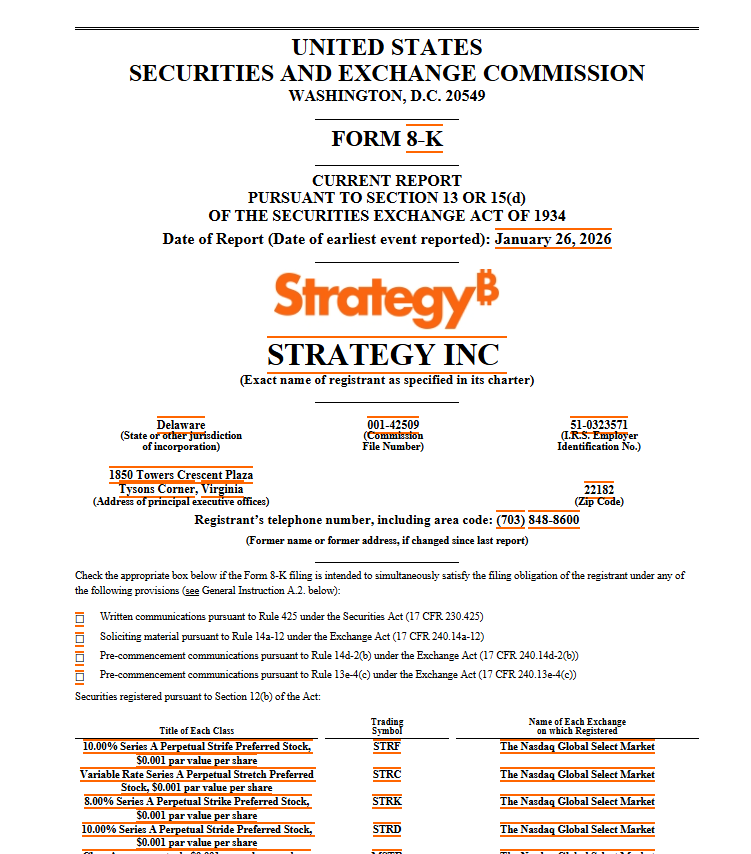

As in previous cases, Strategy financed its Bitcoin purchases through the issuance and sale of its own shares. The company sold approximately 1.7 million Class A common shares (ticker MSTR), raising $257 million. In addition, 70,201 shares of a preferred class (STRC) were sold, generating an additional $7 million.

In this way, Strategy continues to use the equity market as a mechanism for converting shareholder capital into Bitcoin. Effectively, the company offers investors indirect exposure to BTC through its shares, turning its balance sheet into a long-term leverage vehicle for digital asset exposure.

Buying During Market Weakness

The transaction took place at a time when Bitcoin had declined more than 6% from recent local highs. This underscores Strategy’s core principle: the company prefers to strengthen its position during periods of market weakness rather than during phases of market euphoria.

It is also worth noting that in 2024, Michael Saylor publicly stated that he was willing to buy Bitcoin even at all-time highs. However, throughout 2025 and into early 2026, the company’s strategy appears more measured in terms of timing, with major purchases increasingly aligned with corrections and periods of heightened uncertainty.

An AI and Macroeconomic Perspective

From the perspective of machine-driven data analysis and historical analogies, Strategy’s behavior increasingly resembles the gold accumulation policies of central banks in the 20th century. Purchases are executed systematically, regardless of short-term price movements, with a clear focus on long-term holding and strategic dominance within the asset.

In effect, Strategy can be viewed as a private “Bitcoin central bank.” The company is not merely investing in Bitcoin but building a corporate financial model around it, where Bitcoin serves as the primary reserve asset and equity issuance functions as the scaling mechanism.

The macroeconomic backdrop further reinforces this strategy. The acceleration of accumulation in January 2026 coincides with a period in which many institutional investors were reassessing portfolios following the US presidential election, as well as amid shifting expectations around Federal Reserve policy and the future path of inflation. In this environment, Bitcoin is once again being viewed as an alternative reserve asset, and Strategy’s actions amplify that narrative.

The Key Question Going Forward

Despite the consistency of the strategy, a fundamental question remains unresolved. The concentration of such a significant volume of Bitcoin in the hands of a single public company creates a unique precedent for the market. On one hand, it strengthens institutional confidence in Bitcoin as an asset class. On the other, it raises questions about how compatible such concentration is with the principle of decentralization that lies at the core of Bitcoin.

Over the long term, Strategy’s actions may influence not only pricing dynamics but also how Bitcoin is perceived by institutional investors. The key issue is no longer whether the company can continue buying, but how the market will adapt to the presence of such a large and systemically important corporate holder of digital gold.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.