? Analyst Luke Broyles from the international consulting firm The Bitcoin Adviser is confident that skepticism toward Bitcoin will persist even if its price reaches $10 million per BTC. He shared this view on the Coin Stories podcast, discussing the current cryptocurrency market and psychological barriers that hinder mass adoption of digital assets.

According to Broyles, doubts and distrust have followed Bitcoin since its inception and are likely to continue for a long time.

“I think this will continue for a very long time,” Broyles told host Natalie Brunell. “Even if the price reaches $5 million or $10 million, people will say, ‘Well, now it’s 8% of global assets. It won’t go higher, right?’”

Skepticism truly accompanies Bitcoin at every price milestone. Critics regularly question the asset’s ability to grow further when new all-time highs are reached. During market corrections, many assume recovery is impossible, using any drop as proof of cryptocurrency’s “unreliability.”

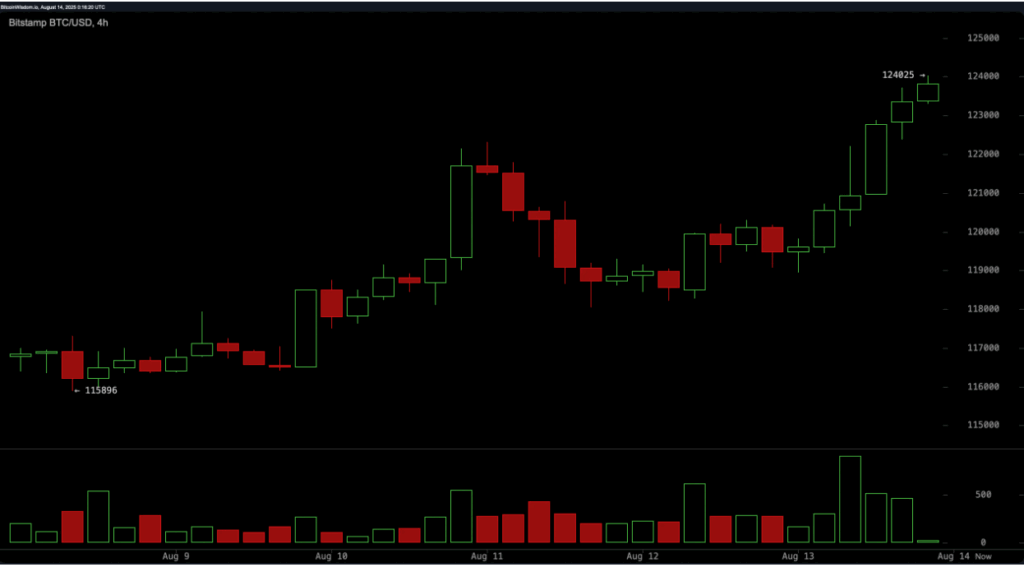

Records and Current Dynamics

2024 has been particularly successful for Bitcoin in terms of setting new historical highs. The most recent peak occurred on August 14 — $124,128 per BTC according to CoinMarketCap.

For many investors, these records signal enormous potential, yet psychological barriers remain the main obstacle for most.

Psychological Barriers Matter More Than Technical Limits

Broyles emphasizes that the main challenge for Bitcoin is not technical limitations or network scalability, but human perception. Most people still do not believe cryptocurrency can meaningfully improve their daily lives.

“Unfortunately, many will not make this transition until they see it for themselves,” the analyst notes. “I think it will take an exceptionally long time for society’s attitude toward Bitcoin to change.”

He believes that attempts to convince skeptics to invest small amounts regularly, like $1,000, are less effective than integrating cryptocurrency into major financial and property markets.

Real Estate as a Catalyst for Mass Adoption

According to Broyles, integrating Bitcoin with the real estate market could significantly accelerate adoption. “Which is harder — convincing a skeptical person to buy $1,000 worth of Bitcoin over the next 200 months? Or telling them, ‘You can take a mortgage against your house and invest the proceeds in Bitcoin’?” he reflects. Broyles believes the second option will “blow people’s minds” and provide a much stronger incentive to engage with cryptocurrency.

Lack of understanding of blockchain and cryptocurrency principles remains one of the main obstacles to mass adoption. According to an August 2024 survey by the Australian exchange Swyftx among 2,229 respondents, 43% do not use the technology because they do not understand how it works.

? Long-Term Outlook

Even at record prices, skeptics will remain, Broyles says. True mass adoption depends on when people can see practical benefits of cryptocurrency in daily life — for example, buying property, making international transfers, or managing assets. Integration with large markets, such as real estate or financial services, could be the catalyst that changes public perception of digital assets. However, this requires time, a systematic approach, and improved financial literacy.

Broyles emphasizes that psychological factors often outweigh technical achievements: even the most advanced blockchain network and technologically perfect cryptocurrency will not achieve mass adoption if people do not understand its value and real-life potential.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.