? The world’s largest crypto exchange has published an official statement explaining the sharp market collapse on October 10 and announced large-scale compensations for users.

Binance confirmed technical malfunctions but firmly denied rumors of manipulation with collateral assets. The total amount of payouts reached $283 million.

What happened on the night of October 10

According to Binance’s report, between 23:50 and 01:00 MSK, the crypto market experienced “extreme volatility.” Several factors overlapped at once:

- macroeconomic uncertainty caused by Donald Trump’s new tariff threats against China;

- mass sell-offs by both institutional and retail investors;

- instant reaction of automated trading systems that amplified the drop.

The result – the biggest crypto crash in the past two years. Analysts reported global liquidations exceeding $19 billion, with many altcoins losing 50-70% of their value within hours.

Technical failures: from USDE to BNSOL

After 00:18 MSK, some Binance modules began to operate unstably. The stablecoin USDE lost its peg to the dollar. Tokens BNSOL and wBETH deviated from the value of their underlying assets due to sharp market fluctuations.

The lowest prices were recorded between 00:20 and 00:21, but abnormal movements began later – around 00:36.

The exchange emphasized: “the price crash was market-driven, not systemic.” Core trading engines and APIs functioned correctly.

Abnormally low prices and “ghosts of 2019”

Binance also explained another phenomenon – zero quotes in some trading pairs.

The reason turned out to be simple: old limit orders placed back in 2019.

When market liquidity suddenly dried up, these orders were triggered at old minimum prices, causing assets like IOTX and ATOM to collapse.

In some pairs, such as IOTX/USDT, the price “dropped to zero” due to a display error after the number of decimals in the price step changed – the actual value was not zero.

How compensations were handled

Binance stated that compensations to affected users were made within 24 hours after the incident and continued in the following days:

- owners of positions liquidated due to the USDE depeg and BNSOL/wBETH deviation received two tranches;

- users who faced delays in transfers or margin top-ups from Earn products will receive reimbursement after individual case review.

The exchange promised to strengthen risk management and improve infrastructure resilience under stress conditions.

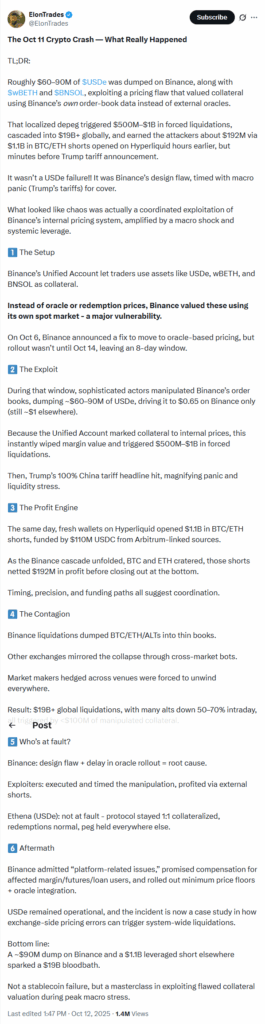

The “coordinated attack” theory

A well-known trader, ElonTrades, presented an alternative version of events. He claims the crash was not accidental but a result of a planned attack exploiting a vulnerability in Binance’s unified account system.

Until October 14, the exchange allegedly valued collateral assets – including USDe, wBETH, and BNSOL – using internal prices rather than oracle data. This, according to the trader, created room for manipulation:

- attackers deposited $60–90 million in USDe on Binance;

- they crashed the token’s price to $0.65, while it stayed near $1 on other exchanges;

- this automatically “wiped out” margin on thousands of positions, triggering forced liquidations of $500 million–$1 billion.

That same day, unknown wallets on Hyperliquid opened short positions on Bitcoin and Ethereum totaling more than $1.1 billion, earning an estimated $192 million in profit.

Binance’s position: “It’s the market, not a conspiracy”

Binance strongly denied accusations against its internal systems.

According to company representatives, the technical failures were a consequence, not the cause, of the crash. The exchange insists that the main blow came from macroeconomic news and mass liquidations, not from infrastructure errors.

At the same time, Binance acknowledged:

- temporary errors in collateral valuation;

- delays in transfers between products;

- interface bugs.

“We took responsibility for the consequences and fully compensated users for direct losses,” the company stated.

What’s next

Binance promised to:

- switch to external oracles for all collateral assets;

- improve liquidity algorithms and flash crash protection;

- conduct stress tests of systems under extreme volatility.

? Information on payouts and updates is published on Binance’s official channels.

Meanwhile, analysts warn that the crypto market remains vulnerable to synchronized liquidations and external shocks – even for the most technically robust platforms.

By the way, here you can buy legendary hardware wallets for beginners with all the basic features!

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.