? A U.S. federal court has closed the book on a high-profile case involving one of the largest collapses in crypto lending platforms. Former Cred CEO Daniel Shatt received 4 years in prison, while CFO Joseph Podulka got 3 years. In addition, each was fined $25,000.

How the scheme worked

Cred, founded in 2018, promised users stable returns and the ability to take dollar loans backed by cryptocurrency. In reality, over 80% of the funds raised were directed by management into high-risk microloans for Chinese gamers through an affiliated company.

Amid the crypto market crash in 2020, the pyramid collapsed. Instead of acknowledging the failure, Shatt assured clients that the service was functioning normally and remained solvent.

It was only in October of that year that Cred admitted asset losses due to “fraudulent activity.” By November, the company had filed for bankruptcy. Attempts by creditors to freeze assets were unsuccessful.

Scale of the Damage

At the time of the collapse, losses were estimated at $140 million, but with the growth in crypto asset value by 2025, this amounts to nearly $1 billion.

Over 440,000 users worldwide were affected.

Court Outcome

Shatt and Podulka pleaded guilty to conspiracy for money laundering and fraud. The verdict was issued on May 2, 2024.

“Shatt and Podulka orchestrated a scheme, extracting hard-earned funds from investors while attempting to profit from a losing business. The defendants’ criminal conspiracy caused significant harm to Cred’s clients,” said acting FBI Special Agent Matt Cobo.

They will begin serving their sentences on October 28, 2025. Separate hearings regarding compensation are scheduled for October 7.

What This Means for the Crypto Market

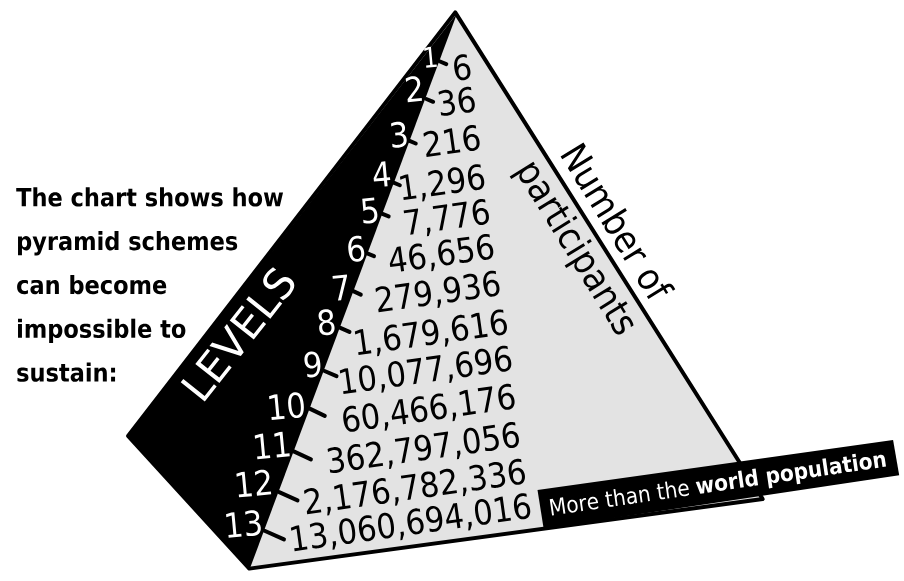

The Cred case has become a symbol of how dangerous opaque schemes can be in decentralized finance. A flashy presentation and promises of high returns resulted in billion-dollar losses and ruined investors’ lives.

? For the industry, it is another reminder: regulation in the crypto space is not the enemy of innovation but a protection against fraudsters who would otherwise exploit trust and the desire for easy profit.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.