⚡️Russia has taken first place in crypto usage in Europe.

And if we believe the latest Chainalysis report, it did this not quietly and modestly, but literally in the style of: “Make way, Europe, the crypto train is coming!”.

Analysts note: over the past 12 months, the volume of crypto transactions in the Russian Federation reached 376.3 billion dollars — that’s a 47% increase over last year. For comparison — the United Kingdom, which held the lead for many years, stopped at 273.2 billion. Germany is now watching this race like a school kid watching seniors: interesting, but impossible to catch up.

Russia — the new leader of Europe in crypto activity

The surge looks especially impressive against the overall regional trend. Europe is growing gradually, at the pace of a calm trolleybus. And Russia — like an electric scooter bought yesterday and already ridden without brakes.

The reasons named are quite pragmatic: growth of institutional activity, expansion of the DeFi segment, and a general shift of interest from traditional finance to digital.

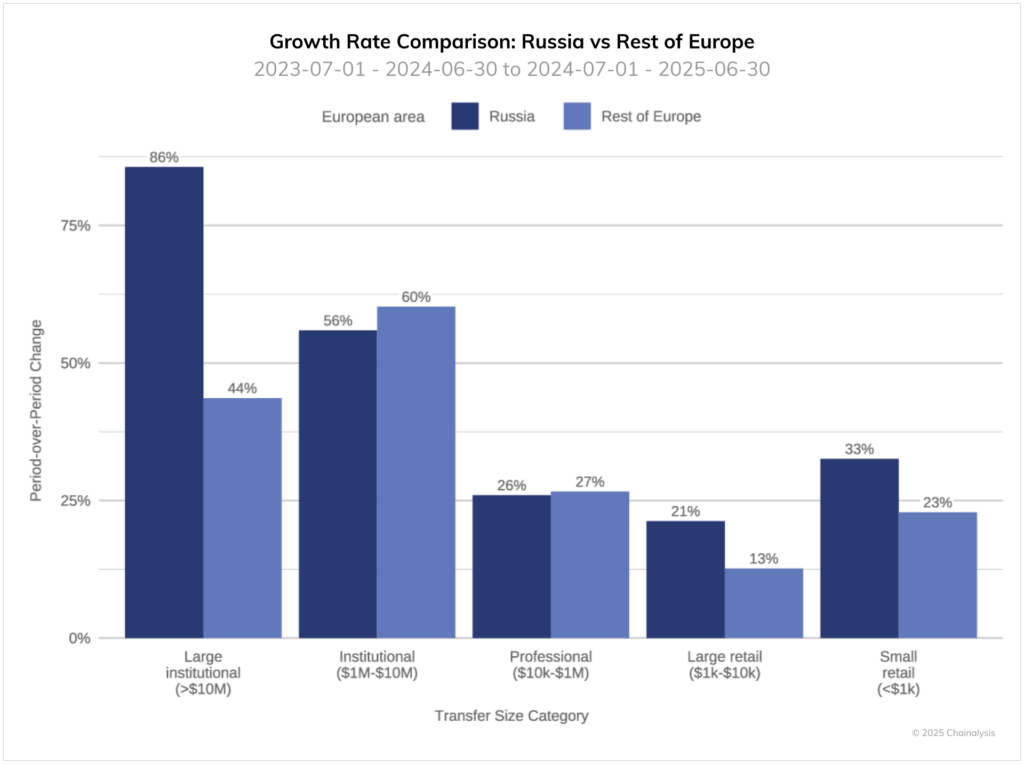

Chainalysis notes: large transactions — over 10 million dollars — became the main driver of the statistics. Their volume increased by 86% compared to the previous period. For comparison — in other European countries this figure rose by 44%. So institutional investors in Russia apparently decided that the era of small bets is over. And switched to “playing like adults”.

But retail isn’t lagging behind either. Small and medium users show stable year-over-year growth — about 10% faster than in the rest of the region. In other words, crypto in Russia has become a kind of “people’s hobby”, now practiced by students, entrepreneurs, homemakers, and those bored while waiting in queues for government services.

A separate point — regulation

Experts emphasize: the internal legal environment, though not perfect, has become noticeably calmer and more predictable.

- Cryptocurrencies are recognized as property.

- Systemically important banks launched digital asset custody services.

- Government bodies are gradually forming rules of the game, instead of just waving prohibition signs.

All this creates a “let’s live in peace” effect: users, businesses, and even large corporations are acting more confidently and actively.

The chain reaction is obvious: given the restricted access to part of traditional finance due to sanctions, cryptocurrencies have become for Russia not just an alternative, but one of the strategic directions of money movement. As a result, the country not only retained its market position, but jumped to first place in Europe by crypto transaction volume. Chainalysis highlights: this leadership is recorded for the first time in their observation history.

So… Crypto ban in 3… 2… 1…?

Although, if the trends continue, it may be necessary to ban not the crypto itself, but the people’s desire to use it. And that, as we know, is harder than stopping a blockchain.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.