? Key Bitcoin Indicators Signal a Possible Bearish Reversal

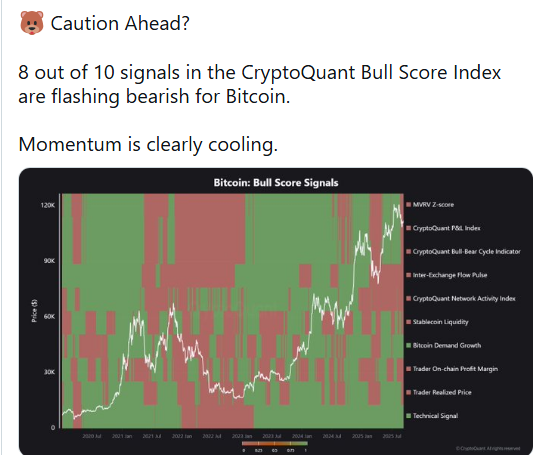

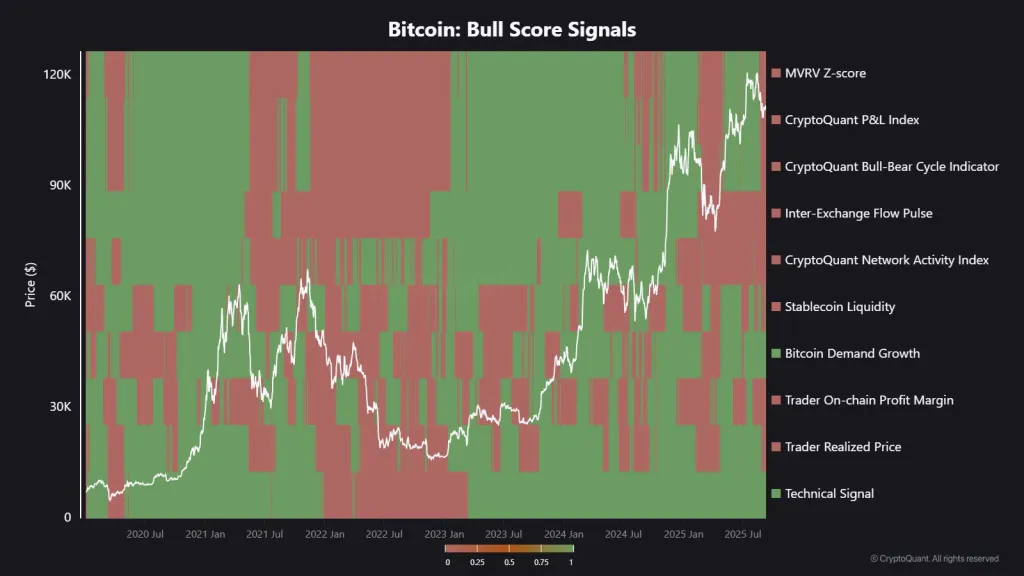

On the night of September 12, Bitcoin’s price recovered above $116,000, but analysts noted worrying signals. CryptoQuant expert known as Maartunn observed that most key bull market indicators have begun to show bearish dynamics.

Out of ten components of the Bull Score Index, only two remain positive: “growing demand for Bitcoin” and “technical signal.” Other metrics — MVRV-Z Score, profit/loss index, market cycle indicator, and stablecoin liquidity — have shifted into the red zone.

According to the analyst, this reflects a clear cooling of investor sentiment. The last time a similar situation occurred was in April, when Bitcoin dropped to $75,000. For comparison, in July, at a price of $122,800, eight out of ten indicators were bullish.

Bitcoin bull market indicators. Source: CryptoQuant.

Macroeconomic picture

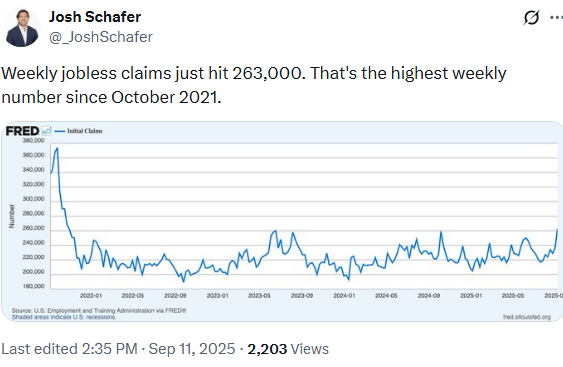

On September 11, the U.S. released Consumer Price Index (CPI) data for August, which fully matched forecasts. The surprise came from jobless claims — 263,000 versus the expected 235,000, the highest figure since October 2021.

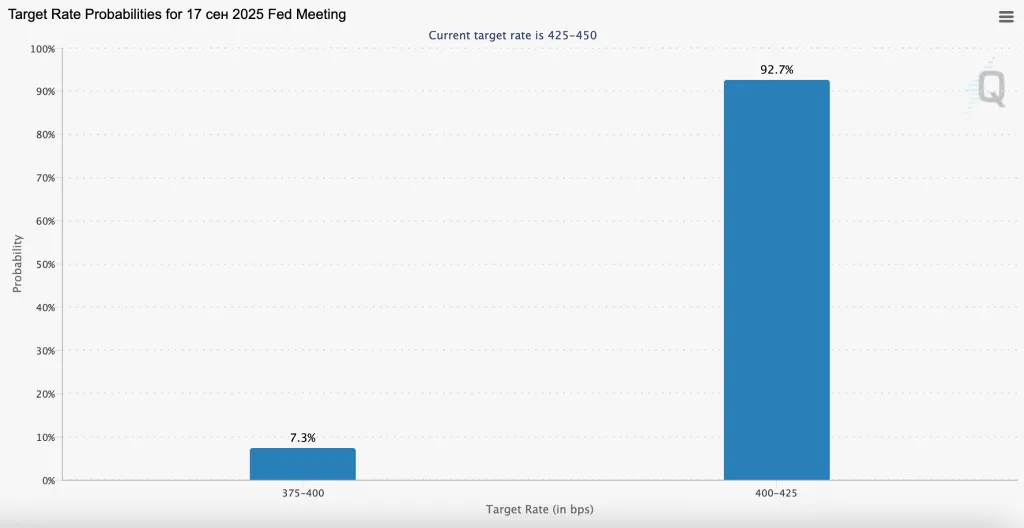

Rising concerns about labor market weakness strengthened expectations that the Fed will ease monetary policy. At the time of writing, nearly all investors believe rate cuts will happen this year — with a 100% probability.

Source: CME FedWatch.

“The market expects a 0.75% rate cut by the end of the year. Despite rising inflation, employment issues are becoming too serious to ignore. Next week will be critically important,” analysts from The Kobeissi Letter noted.

? What’s next?

Breaking above $116,000 was perceived by many market participants as a signal for potential further growth.

“Inflation is under control — we expect rate cuts this month. The news is priced in, the market is ready to move upward,” said investor known as Jelle.

Trader BitBull added that surpassing $113,500 and holding above this level opens the way to testing historical highs.

However, experts warn of a possible test of the current support before updating records. Analyst Skew cautioned about a “liquidation trap”: the market could artificially trigger mass stop-losses for traders holding long positions after the CPI release.

He pointed out a liquidity cluster of 2,000 BTC below Bitcoin’s current price, which could potentially act as a resistance level or a trap for inexperienced market participants.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.