The crypto market is once again shaken by alarming news — the community is actively discussing a possible hack of the decentralized protocol Balancer. The first reports appeared on X (formerly Twitter), where users noticed suspicious fund movements from the project’s official wallets.

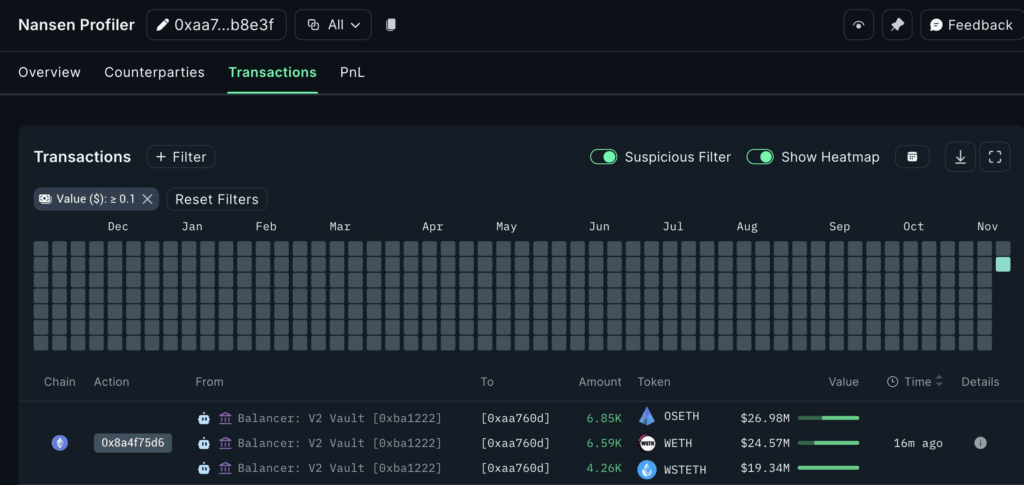

According to data from the analytics platform Nansen, large amounts of various tokens, including wrapped Ether (wETH) and other assets, were transferred from Balancer’s treasury address. The total withdrawal amount, according to preliminary estimates, exceeds 70 million dollars. Experts note that the transactions appeared to be coordinated fund withdrawals rather than standard internal operations, which strengthened suspicions of a possible attack.

Balancer has not officially confirmed the hack yet, but the project team has already announced that they are investigating the incident and advised users to temporarily avoid interacting with liquidity pools until the situation is clarified. Community concern is growing — if confirmed, this could become one of the largest decentralized finance protocol incidents of 2025.

It is worth recalling that Balancer is one of the oldest and most well-known DeFi projects, launched back in 2020. It operates as an automated market maker (AMM), allowing users to create and manage liquidity pools as well as exchange tokens without centralized intermediaries.

Previously, Balancer had already faced vulnerabilities: in August 2023, the team warned about potential risks in the code of certain pools, and in 2024, it carried out a large-scale security system upgrade.

However, even enhanced protection measures cannot guarantee complete safety in the DeFi world. Hackers continuously find new ways to bypass smart contracts by exploiting complex vulnerabilities and logical flaws in protocols.

Following the incident, the price of the BAL token began to fall, while trading volume increased significantly — a typical market reaction to possible hack news. Some analysts note that the combination of a declining market and reports of tens of millions of dollars lost creates a “perfect storm” effect for decentralized platforms.

The situation with Balancer highlights an old truth: decentralization is not the same as invulnerability. Even mature projects remain exposed to human error and technical flaws. While users await official confirmation, the crypto market is once again reminded how fragile trust in “smart contracts” can be in the age of smart attacks.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.