? OpenAI has officially signed a $38 billion agreement with Amazon Web Services (AWS), gaining access to hundreds of thousands of Nvidia GPUs.

This is the first such contract between OpenAI and Amazon and marks a major step — the end of Microsoft’s exclusivity era and the company’s transition to a diversified infrastructure.

Breaking up with Microsoft

Until recently, OpenAI was effectively “tied” to Microsoft: since 2019, the Redmond company had invested more than $13 billion in the startup and became its exclusive cloud provider.

However, in early 2025, Microsoft announced it was giving up its exclusive status, keeping only the “right of first refusal” — the ability to respond first to new OpenAI requests.

This move effectively freed OpenAI’s hands and allowed it to collaborate with other tech giants.

Since then, OpenAI has been actively signing contracts with leading players such as Oracle, Google, Broadcom, and Nvidia, and now — Amazon.

The total value of OpenAI’s infrastructure and capacity agreements has already exceeded $1.4 trillion, raising analysts’ concerns about a potential “AI bubble.”

Why Amazon?

AWS is the largest cloud provider in the world, controlling about one-third of the market.

Under the deal, OpenAI will immediately start using AWS infrastructure for its workloads, including training and processing data for models like ChatGPT.

Initially, OpenAI will rely on existing AWS data centers in the U.S., but later Amazon will build new facilities specifically for OpenAI’s needs.

According to Dave Brown, AWS VP of Compute and Machine Learning Services: “These are completely separate resources dedicated to OpenAI. Some are already available, and the company has begun using them.”

The infrastructure includes hundreds of thousands of Nvidia Blackwell GPUs, and in the future may also integrate other hardware, including Amazon’s own Trainium chips.

Market reaction

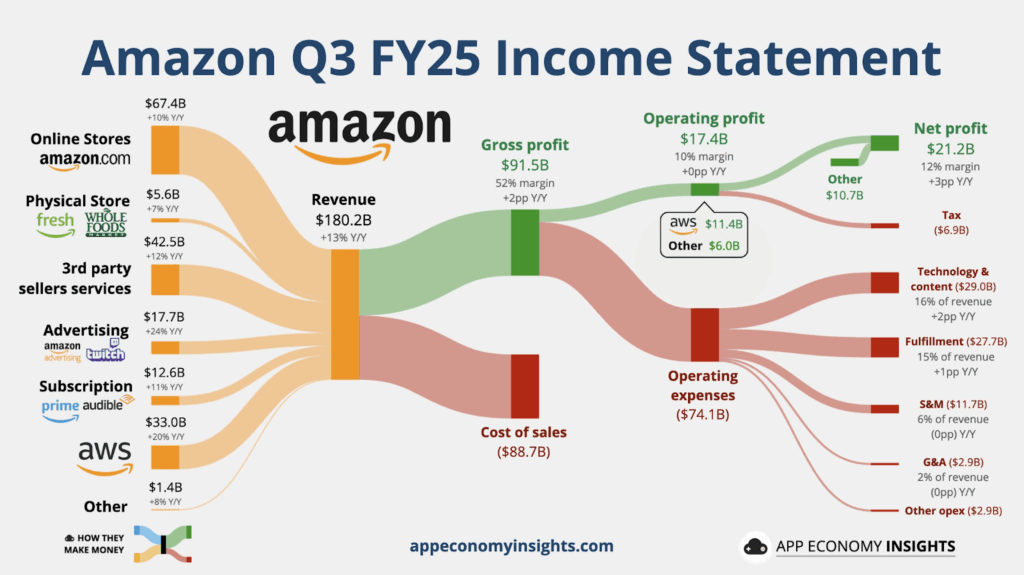

After the announcement, Amazon’s stock rose by 5%, reflecting investors’ confidence in AWS’s strengthening position in AI.

AWS head Matt Garman emphasized: “The breadth and readiness of our optimized compute capacity show why AWS is uniquely suited to support OpenAI’s large-scale AI workloads.”

Amazon has already invested billions of dollars in Anthropic, a rival to OpenAI, and is building an $11 billion data center in Indiana designed specifically for AI workloads.

Now, Amazon supports both Anthropic and OpenAI simultaneously, solidifying its status as the undisputed leader in AI infrastructure.

(Source: Amazon Q3 2025 Earnings Report, x.com)

What OpenAI gains

The AWS deal gives OpenAI flexibility and independence, allowing it to distribute workloads among multiple providers and reduce its reliance on Microsoft. OpenAI CEO Sam Altman stated: “Scaling advanced AI requires enormous and reliable compute resources. Our partnership with AWS strengthens the ecosystem that will power the next era of artificial intelligence.”

Despite the new deal, OpenAI is not cutting ties with Microsoft: the company confirmed plans to purchase an additional $250 billion worth of Azure services.

A step toward IPO

Experts believe the Amazon deal is part of OpenAI’s preparation for an IPO.

Diversifying suppliers, signing long-term contracts, and building its own infrastructure are all signs of a mature business ready for public listing.

Sam Altman recently admitted that going public is “the most likely path” to attract new capital.

CFO Sarah Friar also noted that current corporate reforms are aimed at preparing for a stock market debut.

? Outlook

OpenAI remains the most valuable private AI company in history, with an estimated valuation of $500 billion.

The deal with Amazon underscores that the battle for cloud computing power has become the central front of the AI race.

As one Bloomberg analyst aptly put it: “Today, the gold of Silicon Valley isn’t data — it’s compute. And OpenAI has just bought itself a gold mine.”

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.