AppLovin is at an interesting and at the same time rather risky strategic point of development, where technology, advertising, social platforms and market investment expectations intersect. The company is gradually trying to move beyond the classic mobile advertising monetization business and build a larger ecosystem in which advertising technologies will become not just a promotional tool, but the foundation for creating a user product.

The idea looks ambitious, since historically most social platforms first built up a user base, created audience engagement, and only then monetized attention through advertising tools. AppLovin proposes the opposite model — first to create a technological core that ensures efficient ad distribution and revenue generation, and then on this basis try to build its own social environment that will generate content and keep users within the platform.

Such an approach can be compared to an attempt to build a city not around people, but around infrastructure that should itself attract residents. The company already has a strong technological base in advertising algorithms, traffic optimization and analysis of mobile app user behavior, which allows it to operate effectively in the marketing technology market.

However, social platforms are not only about technology, but also about cultural factors, user habits, network effects and the effect of critical mass of the audience. That is why the market is still treating the initiative cautiously.

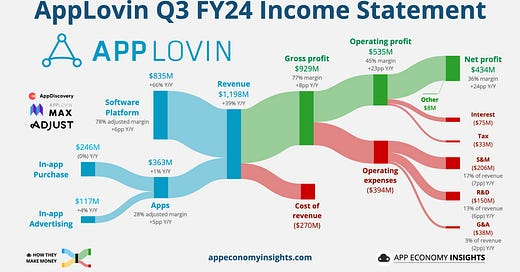

Even despite strong fundamental business indicators, including significant revenue growth of about 66% and profit growth of around 88%, the company’s shares are showing negative dynamics with a decline of about 37% since the beginning of the year. This reflects not problems of the current business, but investors’ doubts about the company’s ability to scale in a new segment.

One of the main factors putting pressure on the company’s valuation is uncertainty around the future of the advertising economy as a whole. The market is actively discussing the impact of artificial intelligence on the classic digital advertising model.

The emergence of large language models and generative AI systems may change the advertising value creation chain, since part of the processes of content creation, targeting and interaction with users can be automated or radically optimized.

Companies such as OpenAI or Anthropic indirectly create competitive pressure on traditional advertising platforms because they change the ways information is searched, services are interacted with and content is consumed.

An additional factor of uncertainty is related to regulatory risks. Investigations by the SEC increase investor caution, since any legal restrictions may affect the company’s ability to scale new products or raise capital for the development of social projects. For technology companies, regulatory risks are often no less significant than technological ones.

Speaking of potential opportunities, the success of AppLovin’s strategy could radically change the company’s positioning in the market. In the case of a successful launch of a social platform, the company will be able to combine three key elements of the modern digital economy: user attention, algorithmic advertising and content monetization. This could effectively turn AppLovin into a technological competitor to major ecosystem platforms.

However, the problem is that the social media market is already extremely saturated. Dominant positions are held by large global players with huge budgets, billion-user audiences and powerful network effects, where each new user increases the platform’s value for other users. Entering such a market requires either a fundamentally new form of content, or a unique technological advantage, or a very aggressive marketing strategy.

Investors need to understand that AppLovin shares today represent not a classic investment in a stable technology business, but rather a venture bet within the public market.

Two extreme scenarios are possible here.

- If the strategy is successfully implemented, the company could become one of the new major players in the field of digital platforms, approaching market leaders in social technologies in terms of monetization model.

- If unsuccessful, the market may continue to put pressure on the stock price, especially if profit growth slows or competition in advertising technologies intensifies.

In the near term, the key indicators to monitor will be the company’s real steps toward launching a social platform, its ability to maintain profit growth rates, developments around regulatory investigations and the market’s reaction to increasing competition in artificial intelligence.

It is precisely the combination of technological development and market trust that will determine the company’s further trajectory.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.