The analytical platform Arkham Intelligence, specializing in tracking blockchain activity and detecting patterns in on-chain transactions, has implemented unique tracking of activity in the privacy-focused cryptocurrency Zcash (ZEC). According to the company, the platform has already linked over 53% of all ZEC transactions — including both public and private transfers — to known individuals and organizations. More than 48% of network inputs and outputs were matched to specific entities. T

he total value of labeled operations exceeds $420 billion, highlighting the significance of analysis even for anonymous cryptocurrencies. This result is further proof that privacy-focused blockchains do not guarantee complete anonymity under advanced data analysis.

Largest Zcash holders

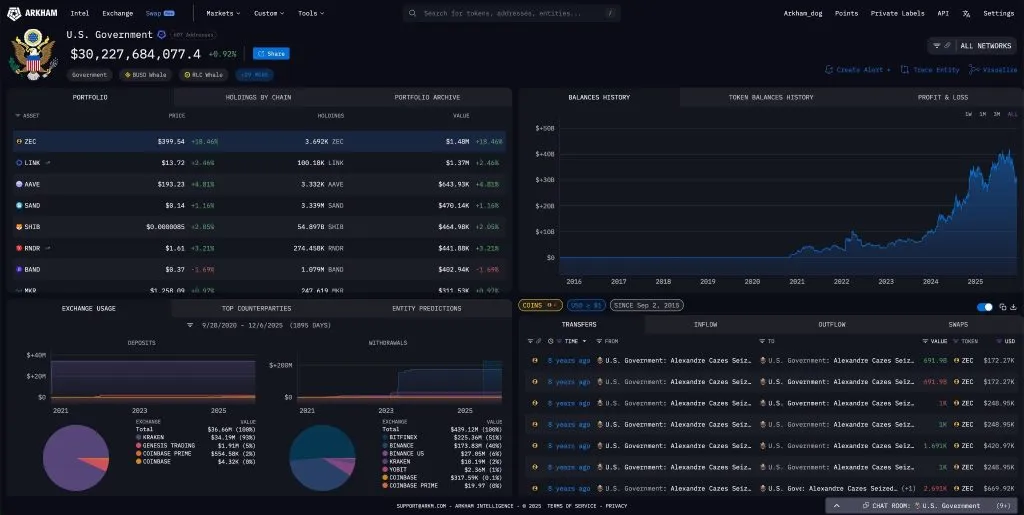

According to Arkham, one of the largest holders of privacy-oriented coins is the US government. In particular, in 2018 authorities seized ZEC worth ~$737,000 from Alexander Cazes, the founder of the AlphaBay darknet market. Over the years, the value of these assets roughly doubled, demonstrating the long-term growth of the coin’s value.

Source: Arkham

However, Zcash creator Zuko Wilcox partially disputed Arkham’s claims. He stated that the platform did not deanonymize “any ZEC” stored in protected privacy pools. “That would be impossible because there is simply no information there. Arkham only tracks wallets that voluntarily chose public transparency. But even the obtained data is impressive,” Wilcox noted.

Privacy crypto rally in 2025

In 2025, Zcash led the growth of privacy cryptocurrencies. From October alone, the coin’s price jumped 1500%, peaking in November above $720 per ZEC. The asset’s market capitalization exceeded $11 billion, allowing it to surpass the nearly perennial sector leader Monero (XMR).

By December, ZEC’s price had noticeably corrected. Crypto enthusiast Crypto Bitlord described the recent price surge as “the most successful Pump & Dump scam in crypto history.” Nevertheless, the asset attracted attention from traders and institutional market participants.

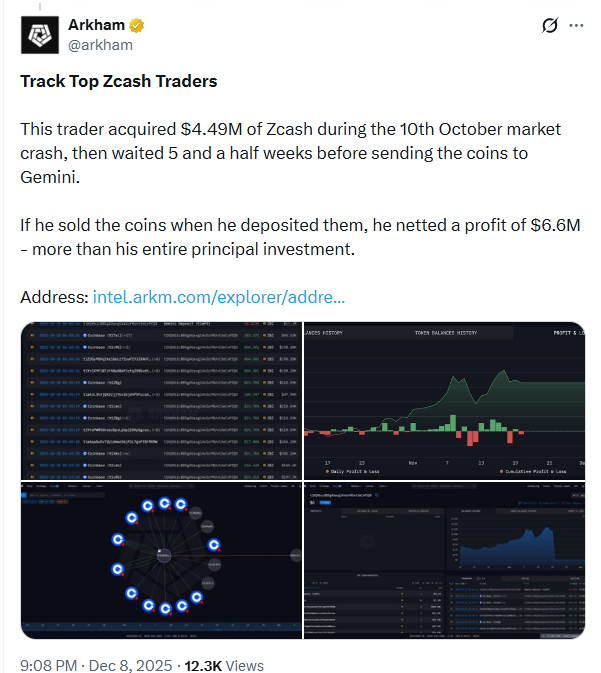

Cases of major traders

Arkham analysts noted a successful speculation case. One trader bought ZEC worth $4.49 million during a major market crash in October. Five and a half weeks later, he transferred the coins to the Gemini exchange, where he could have realized a net profit of $6.6 million, exceeding the initial investment. This case illustrates how dynamic and unpredictable the privacy crypto market can be, even amid obvious volatility.

Conclusions and market implications

Arkham’s results highlight several key trends:

Blockchain privacy is not absolute. Even anonymous coins like Zcash can be analyzed and linked to real users using advanced analytical tools.

- Institutional players and governments have significant influence. Confiscated assets and large transactions create a visible presence of major participants in the network.

- Trader opportunities remain vast. Volatility in privacy cryptocurrencies attracts both private and professional investors willing to take high risks for potential high returns.

- Analytics and transparency are crucial. Platforms like Arkham enable risk assessment and monitoring of large capital movements, which is particularly important for regulators and market participants.

Ultimately, the Zcash case demonstrates that even highly privacy-oriented coins do not guarantee absolute anonymity, and analytical platforms can significantly influence market understanding and the behavior of large players.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.