?Money Flow Cycle: breaking down altseason

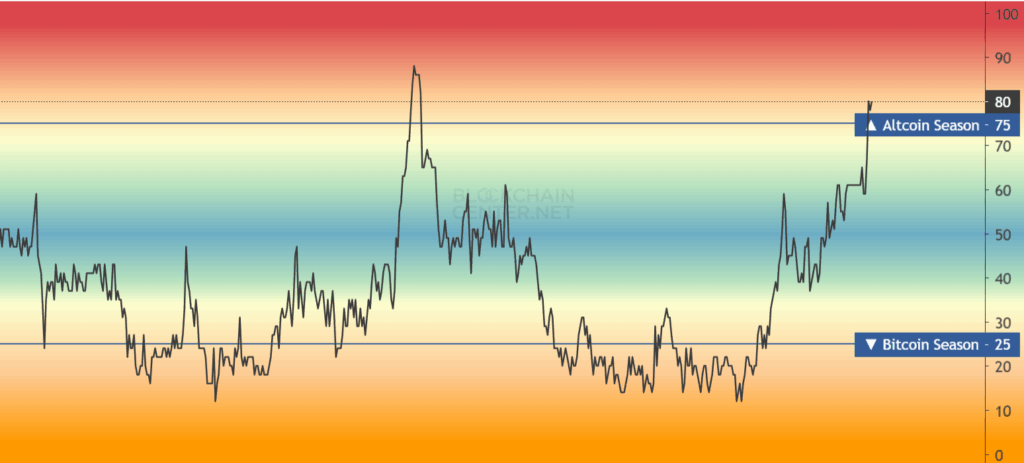

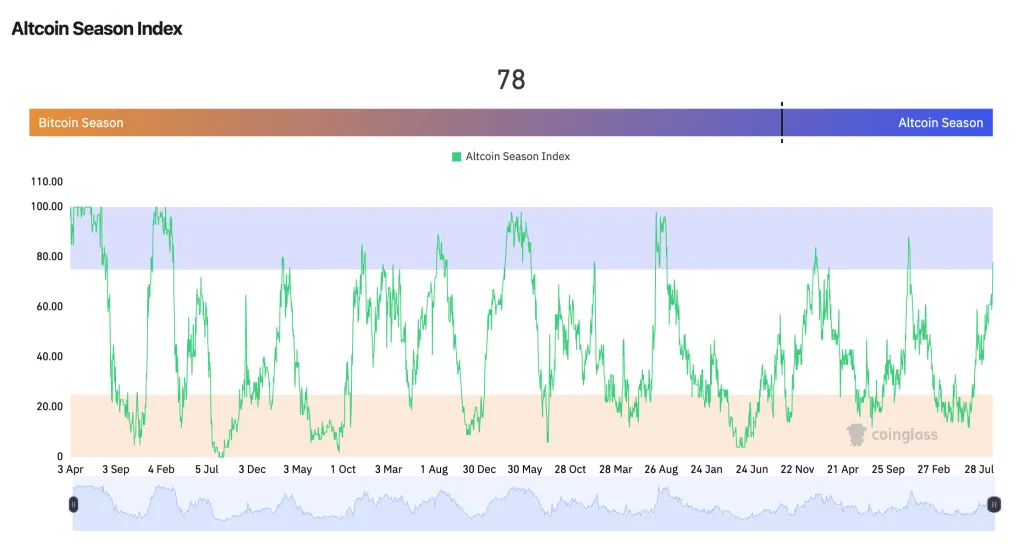

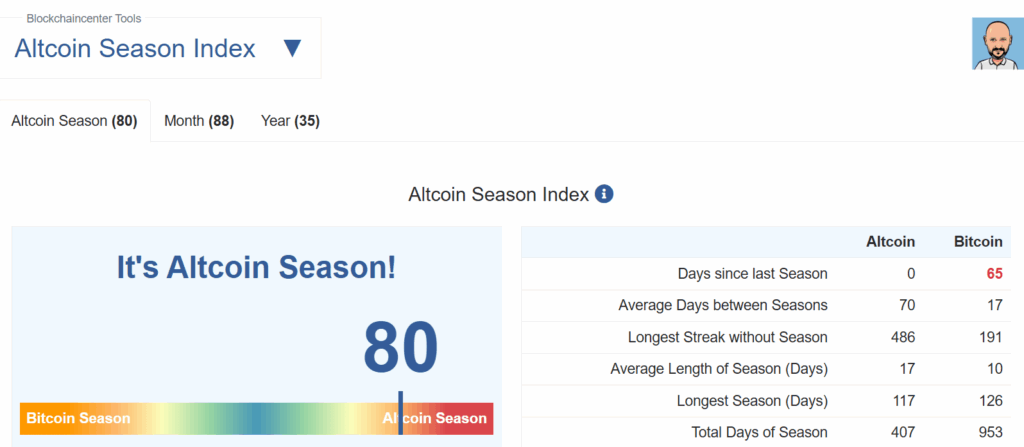

The Altcoin Season Index recently crossed the 75-point mark, which is traditionally considered a signal for the start of altseason. This means that altcoins are starting to outperform Bitcoin in returns, and investors can expect increased activity in the market for small and mid-cap coins. Let’s take a closer look at what altseason is, why it occurs, and how to profit from it.

Source: Blockchain Center.

Source: CoinGlass.

What is altseason

Altcoin season, or altseason, is a period in the crypto market when most alternative cryptocurrencies (altcoins) show above-average growth, outperforming Bitcoin in returns.

The main idea is simple: Bitcoin is the “leading asset” of the crypto market. Once BTC has shown strong growth, investors begin reinvesting profits into altcoins to increase returns. This process is often called the “capital flow” or Money Flow Cycle.

Capital flow stages:

-

Bitcoin rises, strengthening market confidence.

-

- 2. Investors take profits and look for riskier but potentially profitable assets — altcoins.

- 3. Capital flows into altcoins, stimulating the growth of their prices.

Why altcoins grow faster than Bitcoin

The reason lies in market capitalization and capital sensitivity:

- Altcoin market caps are significantly smaller than Bitcoin’s.

- New investments have a more noticeable impact on price than BTC.

- On low-cap tokens, the effect is especially strong — prices can rise hundreds or even thousands of percent in a short period.

Therefore, during altseason, many “small-cap coins” show true price rallies, attracting both retail and institutional investors.

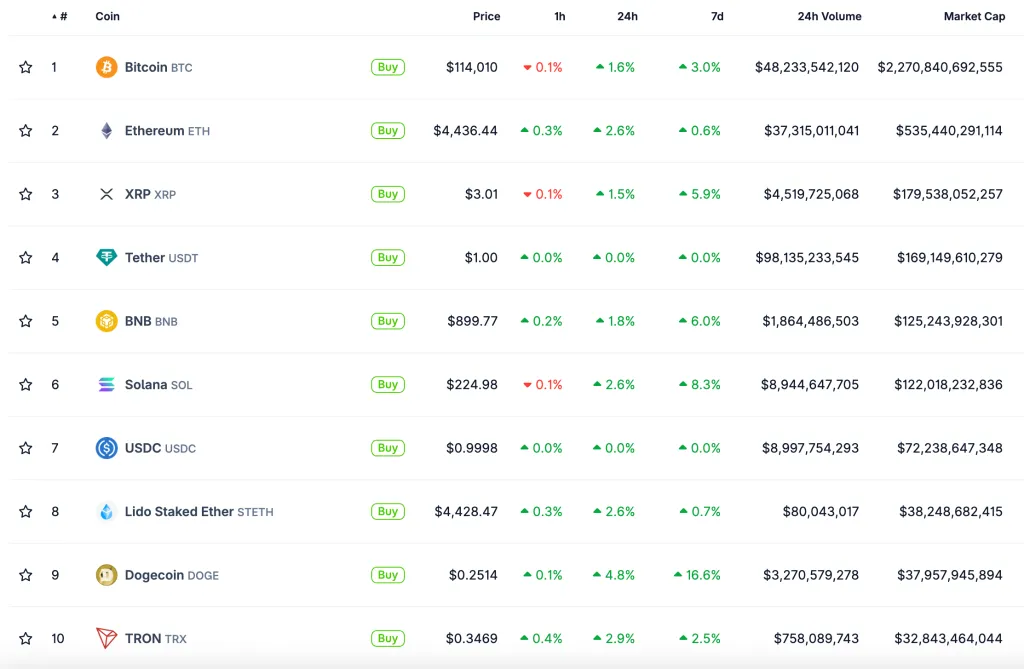

Over the past week, most coins in the top 10 by market cap outperformed Bitcoin in returns. The growth leader was the meme coin Dogecoin, which increased by 16.6% during this period.

Source: CoinGecko.

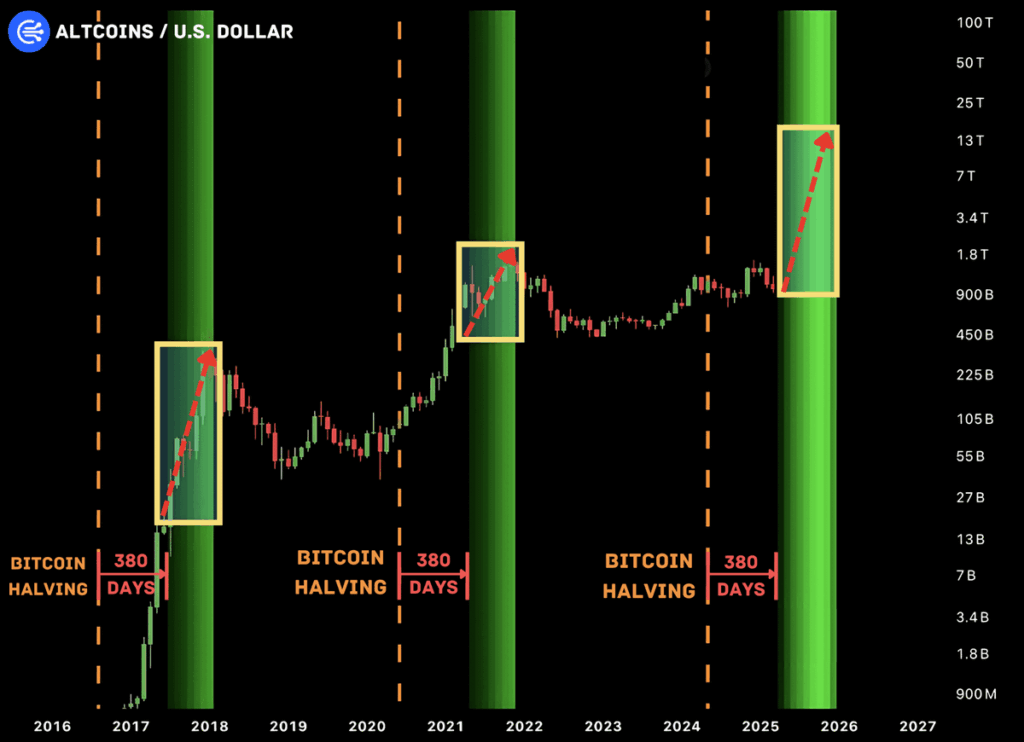

Examples of historical altseasons:

- 2017: ICO boom, when many new tokens grew dozens of times. Ethereum and several other altcoins outperformed Bitcoin by hundreds of percent.

- 2021: After Bitcoin’s sharp rise in summer, capital flowed into DeFi tokens and meme coins, causing massive growth of many altcoins.

These examples show that altseason is a time of opportunity when savvy investors can significantly increase their capital.

Altcoin market capitalization forecast. Source: Wimax.X

How to recognize altseason

Key signals to watch:

- Altcoin Season Index above 70–75 points.

- Strong growth of altcoin market capitalization relative to Bitcoin.

- Increased exchange activity — trading volumes and liquidity rise.

- Growing interest from retail and institutional investors in altcoins.

Altseason risks:

Despite the high profit potential, altseason significantly increases risk:

- Low-cap tokens can fall as quickly as they rise.

- High volatility requires careful risk management.

- Not all altcoins will be successful; it is important to choose projects with a proven history and technological value.

⚡ Conclusion

Altseason is the golden period of the crypto market, when there is a lot of activity, capital, and investment opportunities. For investors, it is a chance to increase returns; for traders, an opportunity to profit from volatility; for beginners, a chance to learn the market.

Watch the Altcoin Season Index, analyze token capitalization, and be ready for fast market movements. In the next article, we will discuss how to participate in altseason most effectively, which strategies work, and what to avoid.

Should we expect altseason to last until the end of 2025? We discussed this here.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.