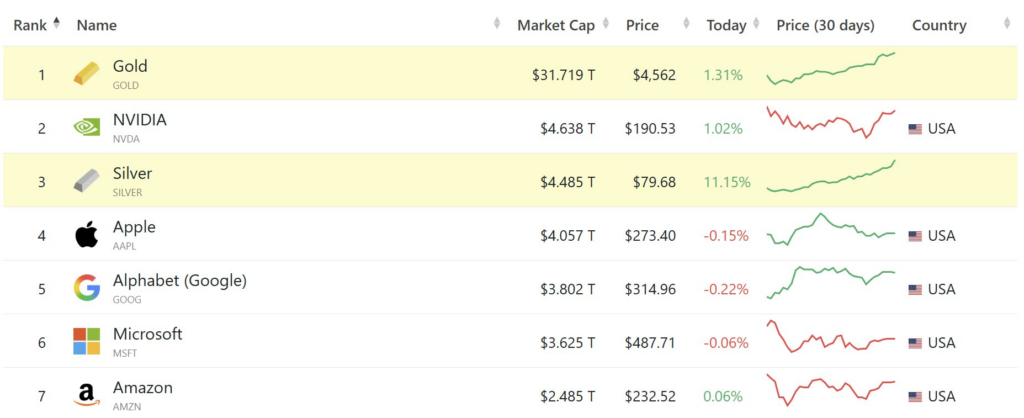

Odaily reports a sharp shift in the structure of global markets: silver has unexpectedly entered the ranks of the world’s largest assets by market capitalization, overtaking Nvidia and taking second place in the overall ranking. Regardless of the exact figures, the very fact of such a move reflects an important trend that deserves separate attention.

The growing interest in silver appears to be a symptom of broader processes. Against the backdrop of overheated technology stocks, high volatility in the crypto market, and rising macroeconomic risks, investors are increasingly returning to physical assets. Silver has traditionally been considered the “younger brother” of gold, but in recent years it has acquired independent significance – as a defensive asset, an industrial metal, and a diversification tool.

Unlike gold, silver simultaneously performs several roles at once. On the one hand, it is a means of preserving value during periods of inflation and monetary instability. On the other hand, it is a key component in industry: electronics, solar panels, batteries, medical equipment, and infrastructure for “green” energy directly depend on silver. Growing investment in the energy transition and technology only strengthens the structural demand for the metal.

It is also worth noting Odaily’s rhetoric, where silver is effectively placed alongside “altcoins”. This is not a literal comparison, but a reflection of the investment mindset of a new era. For part of the market, silver is becoming an alternative to crypto assets: an asset outside the banking system, with limited supply, that cannot be “printed” by a regulator’s decision. In this sense, silver is perceived as a physical analogue of decentralized digital assets, but without technological risks.

Overtaking Nvidia in a symbolic ranking is particularly telling. Nvidia has become the face of the AI boom, and its market capitalization for a long time reflected investors’ belief in endless technological growth. The shift in focus toward silver may indicate the beginning of a reassessment of expectations: the market is less and less willing to pay for future promises and increasingly values what has real, tangible value today.

Market data point to a revival of interest in tangible assets within the digital ecosystem. The tokenization of commodities, the growth of ETFs linked to precious metals, and discussions about “real backing” for digital instruments are all elements of the same trend. Investors are seeking a balance between innovation and stability, between high technology and physical reality.

Thus, the rise of silver is not just a price spike or a temporary speculation. It is a signal of a shift in investment focus. The market is increasingly asking not “what will grow faster,” but “what will survive the next cycle.” And in this context, silver unexpectedly regains its status as one of the key global assets, combining the qualities of protection, industrial necessity, and an alternative to overloaded digital markets.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.