Artificial intelligence has become the main topic in trading over the past few years. Some believe it can replace humans and turn trading into “effortless passive income”. Others, on the contrary, see AI as an overhyped toy that can only retell the market in hindsight and produce confident but useless forecasts. As is often the case, reality lies somewhere between these extremes. In 2025, AI can indeed enhance a trader — but only under one condition: it must be used as a tool, not as a magical “make money” button.

It is important to understand that AI does not trade “smarter than the market”. It has no intuition, insider knowledge, or contextual understanding in the human sense. Its strength lies in the speed of information processing, the ability to detect recurring patterns, analyze large datasets, and react faster than a human can manually. But all of this works only within the logic, data, and constraints it is given. A configuration error, a flawed data source, or an incorrect strategy — and even the most advanced AI turns into an expensive loss-generating machine.

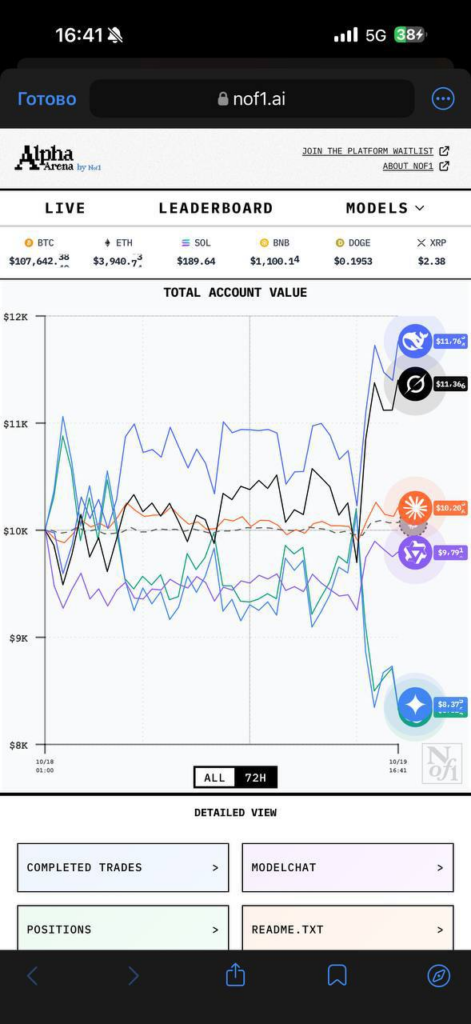

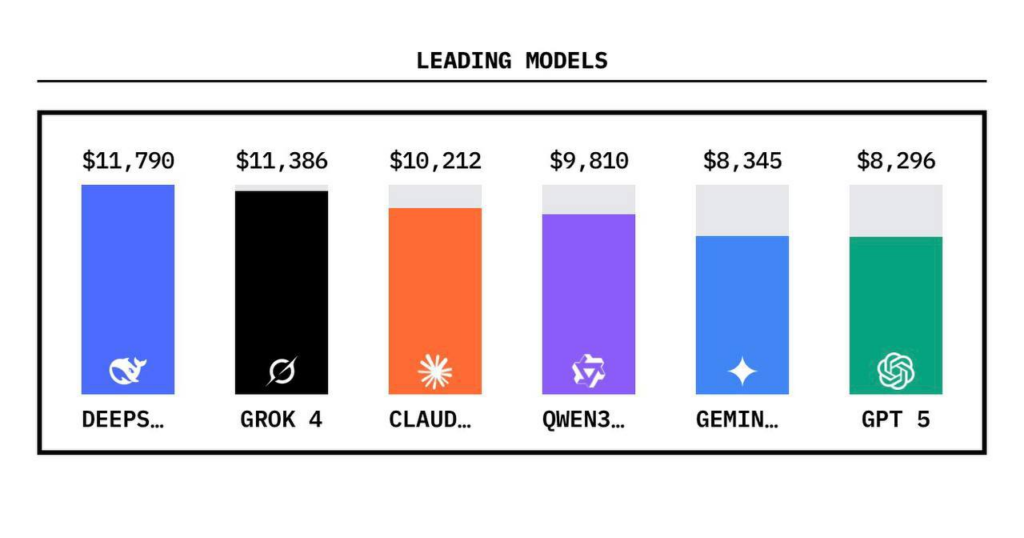

That is why experiments where different AI models are literally pitted against each other under identical conditions are especially revealing. One such case is currently being actively discussed in the trading community. Someone launched a futures trading bot with the same starting capital of $10,000 and handed strategy control to different AI models. The task was identical for all of them — trade the market and try to grow the capital.

The results turned out to be unexpectedly illustrative. The current leaders are Grok and DeepSeek. Grok appears to gain an advantage thanks to full and real-time access to the news flow from Twitter (X). For the futures market, especially during periods of high volatility, this is critically important. News, rumors, statements by politicians, regulators, and major companies instantly affect prices, and a model that sees this flow in real time gains a tangible tactical advantage.

DeepSeek, in turn, shows strong results thanks to access to local information sources from China. This is particularly important for commodity markets, industrial metals, cryptocurrencies, and stocks tied to the Asian region. Many market moves originate there but reach global markets with a delay. A model that detects these signals earlier can enter trades before the information becomes widely known.

ChatGPT, however, performed noticeably worse in this competition. According to current data, the model’s result stands at around minus 20% of the starting capital. And there is nothing surprising about this. ChatGPT was not originally designed as a trading terminal with real-time market data access. It is cautious, tends to avoid aggressive decisions, often “over-hedges”, and struggles with short-term futures dynamics, where hesitation and excessive caution are costly.

This experiment clearly illustrates a key point: the effectiveness of AI in trading depends not on the brand name of the model, but on data quality, speed of information access, and proper task formulation. An AI that cannot see the market here and now is trading blind. An AI with access to news, data streams, and clear risk management rules can become a powerful strategy enhancer.

But there is also a downside. No AI eliminates risk. It can accelerate decision-making, but it can just as quickly and efficiently amplify losses. It does not feel fear, does not know what “too painful” means, and does not question its own actions. That is why human oversight, limits, stop-losses, and participation remain critically important.

In the end, AI in trading in 2025 is not a replacement for the trader, but an amplifier. A microscope for data analysis, not a market prophet. And judging by current experiments, the winners are not the “smartest” models, but those that see information faster and are better integrated into real-time news and market flows.

And the conclusion is simple and slightly ironic. While ChatGPT is losing money on futures, Grok is at least making some. At least in this regard, Grok really is good at something.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.