? Analyst Timothy Peterson, co-founder of BitGo and one of the first researchers to apply artificial intelligence to market pattern analysis, has presented a forecast outlining possible Bitcoin price scenarios through December 31, 2025.

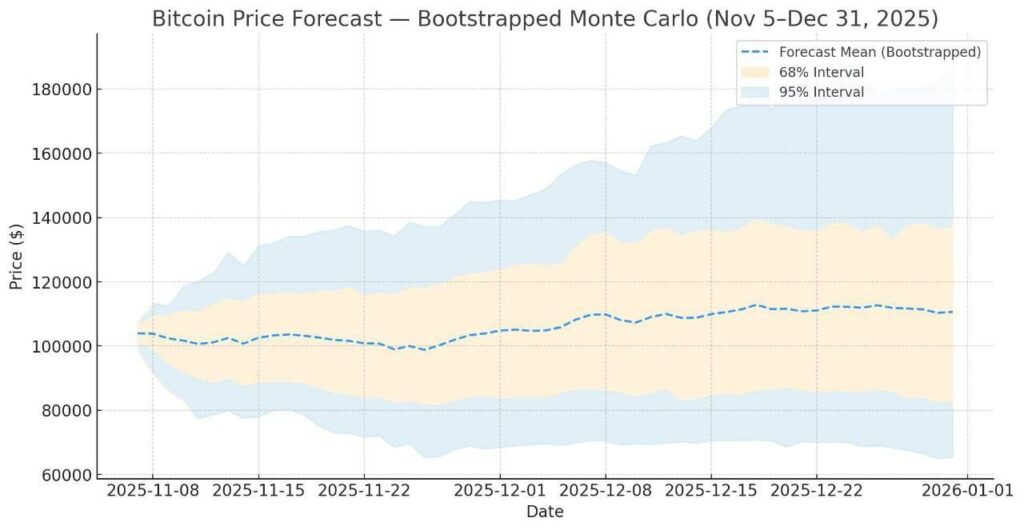

Using a combination of historical data, volatility models, and AI algorithms, Peterson identified the probabilities of three main outcomes:

- 20% chance that Bitcoin will reach $140,000;

- 50% chance that it will exceed $108,000;

- 30% chance that the year will end with a decline in BTC’s value

According to Peterson, the model takes into account macroeconomic trends, money supply dynamics, institutional investor activity, and historical halving cycles. The AI was used to generate probabilistic scenarios, not exact predictions — making the results more of a risk and potential assessment than a traditional forecast.

Although Peterson did not publish detailed numerical projections, several independent analysts and investment firms share similar expectations. Forecasts by Bloomberg Intelligence and Ark Invest suggest Bitcoin could reach $150,000–$200,000 by the end of 2025. These estimates are based on continued institutional inflows, rising capital in crypto ETFs, reduced BTC supply after the halving, and a growing share of long-term holders.

However, some experts warn of possible overheating risks. Among the potential negative factors are tighter Federal Reserve monetary policy, lower global market liquidity, and regulatory restrictions in the US and Europe. Moreover, AI-based models cannot always anticipate unexpected geopolitical or macroeconomic events, such as sanctions, technological disruptions, or sudden shifts in investor sentiment.

It is important to emphasize that forecasts are guidelines, not guarantees. Bitcoin’s actual price trajectory depends on numerous factors — from central bank policies and stock market dynamics to investor psychology.

Investing in digital assets always involves heightened risk, and every strategy requires personal analysis and conscious decision-making.

? In short, AI can help investors better understand probabilities, but even the most advanced algorithms cannot override the market’s fundamental law — uncertainty.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.