? Micron Technology remains one of the key companies in the semiconductor industry, capable not only of maintaining its position but also of setting new trends. While its name was until recently mostly associated with memory for servers and PCs, today the company is actively developing areas related to artificial intelligence and space.

Innovation: from data centers to orbit

Micron is not limited to producing DRAM and NAND memory. The company focuses on high-value products:

- New PCIe Gen6 NVMe SSDs provide faster data processing and improved energy efficiency, which is critical for AI systems;

- Radiation-hardened chips are already used in space projects where reliability is crucial;

- G9 NAND is used in Nvidia products, confirming Micron’s strategic significance in the AI ecosystem.

Thus, the company is simultaneously working in two “hot” market areas: artificial intelligence and the aerospace industry.

Financial results

Data for Q3 2025 show impressive growth:

- Revenue reached $9.3 billion, up 37% year-on-year;

- EPS was $1.91, an increase of 208%.

The forecast for Q4 looks even more optimistic: expected revenue — $11.2 billion, EPS — $2.85.

The growth in financial indicators is driven not only by increasing demand for memory for data centers but also by the expansion of AI contracts and aerospace project deliveries.

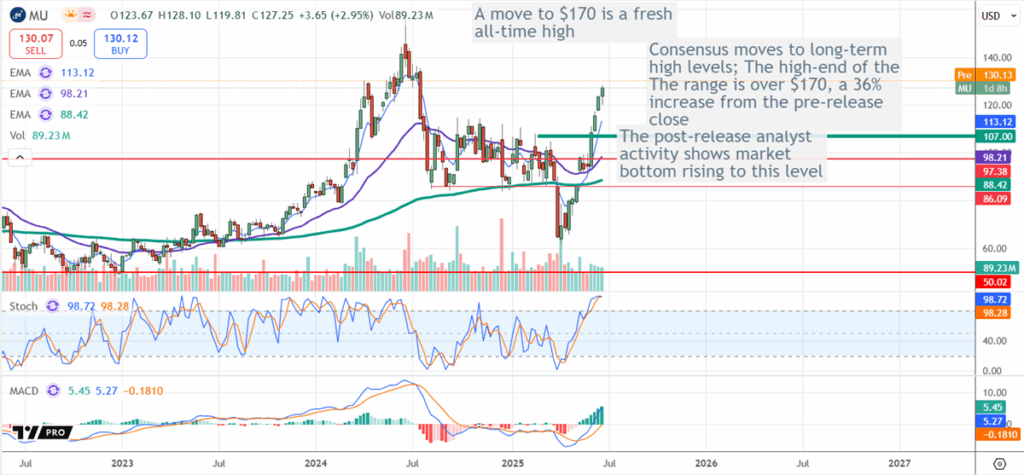

Technical analysis

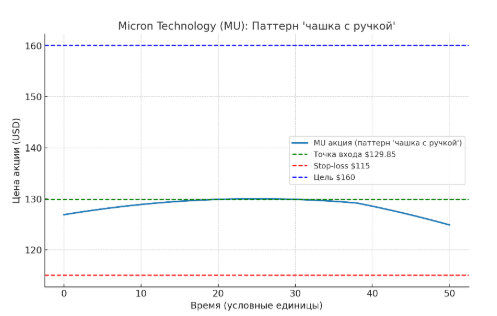

MU stock charts show a “cup” pattern, usually signaling a potential continuation of the upward trend.

- Entry point — $129.85.

- The 50-day moving average is comfortably above the 200-day, confirming trend strength.

- Institutional funds are gradually returning to buying shares, strengthening the positive technical backdrop.

Risks

Despite strong prospects, MU shares are not without uncertainties. Key risks include:

- High volatility in the semiconductor market;

- Dependence on AI industry growth and government space programs;

- Possible disruptions in global supply chains.

Investor recommendations

Buying is recommended upon breaking the $129.85 level.

- A stop-loss at $115 is reasonable to limit potential losses.

- Target price based on the current technical picture — $160.

⚡Conclusion

Micron Technology today demonstrates a rare combination: strong financial performance, strategic innovations, and an attractive technical picture. The company is transforming from a memory supplier into a key player in the AI and space ecosystem, making its shares one of the most interesting investment ideas for the coming quarters.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.