Work is no longer about earning a living if we look at how the economy is structured today. Previously, the logic was simple: the more people work in a company, the more it produces, and the more it earns. Scale was measured by factories, offices, and armies of employees. Labor was the main source of wealth. But that era is ending.

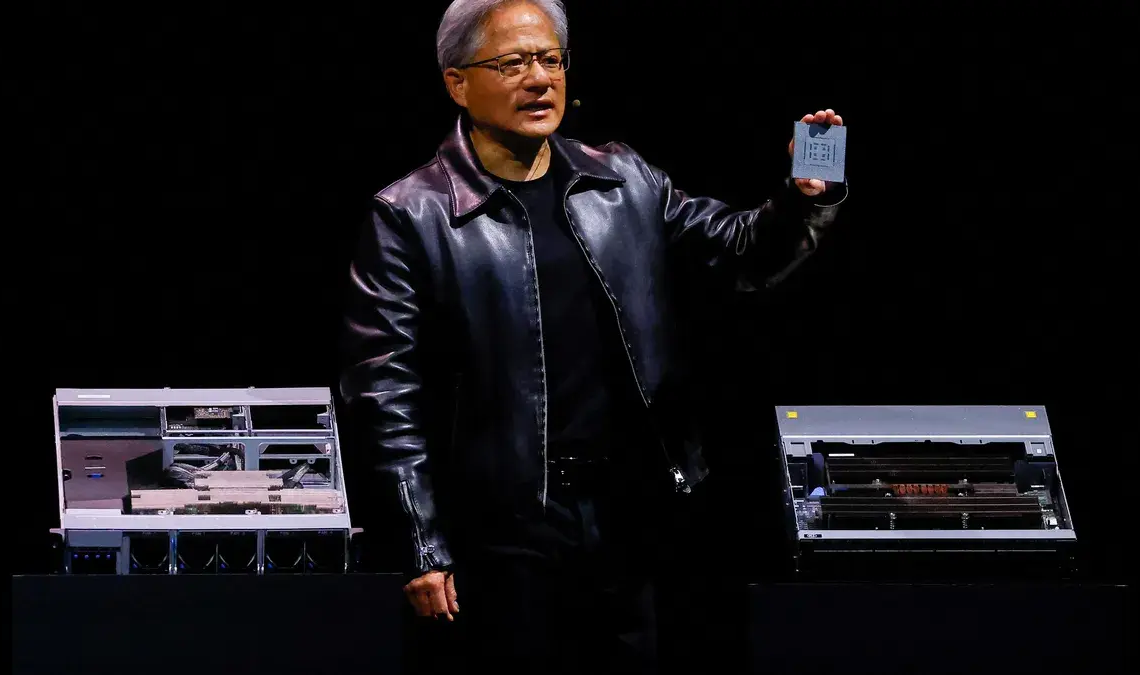

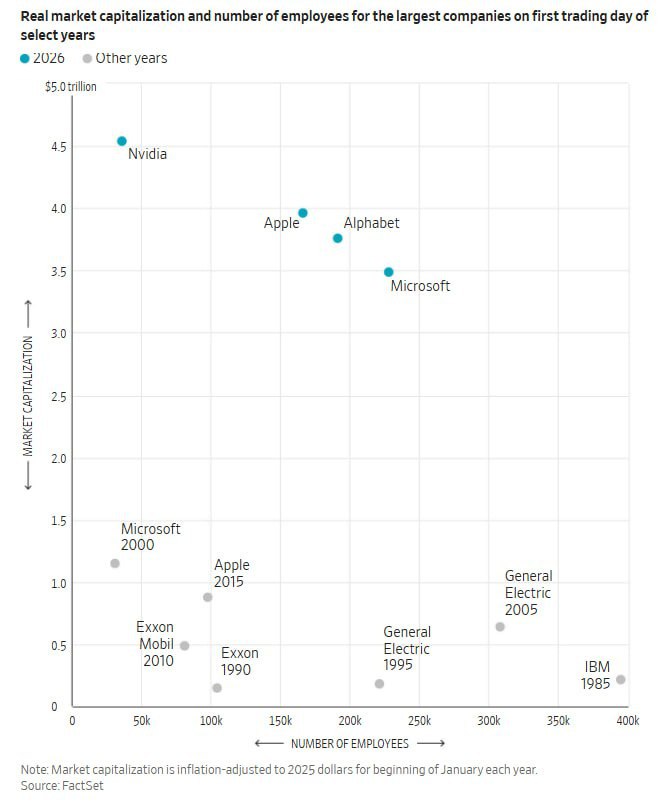

In 1985, IBM was the largest company in the U.S., with a workforce of around 400,000 people. It was a giant sustained by human labor and a massive corporate machine. Today, the world leader is Nvidia.

The company is roughly 20 times more valuable, earns several times more profit (adjusted for inflation), but has far fewer employees. In other words, a business can be enormously wealthy without hiring many people.

Here’s the major shift: the number of employees no longer determines a company’s revenue. Technological progress has squeezed maximum efficiency out of labor. One engineer, supported by AI, today can do what previously required an entire department. One algorithm can replace a team. One product can scale globally without building new factories.

We live in an era where wealth is created not by labor, but by capital. First, factories disappeared — automation displaced workers. Now the turn has come for offices. AI is starting to amplify and displace programmers, analysts, marketers, and managers. White-collar workers are beginning to feel what blue-collar workers felt decades ago: the system no longer needs so many people.

Work is becoming cheaper because productivity increases without raising wages. Labor is rapidly devaluing as a tool for building wealth. Today, the main flow of money goes not to those who work, but to those who own.

As the Wall Street Journal notes, a large portion of the economy flows to companies, top management, and shareholders, and AI will only accelerate this process.

The only exception that can still change the fate of ordinary workers is access to assets. If a person receives not only a salary but also a stake, shares, or participation in the company’s growth, there is a chance for a real leap. Salaries are money that depreciates. Assets are what grow with the system.

The Nvidia example is almost mocking: over time, the company’s shares have risen 477,925%. Imagine if, 20 years ago, part of your salary had been paid not in dollars, but in shares. In the economy of the future, labor remains necessary but no longer guarantees wealth. Wealth is increasingly tied not to what you do, but to what you own.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.