? The US Federal Reserve is approaching the December meeting in a state that economists describe as “the highest tension in all eight years” of Jerome Powell’s leadership. The WSJ reports that the most acute and fundamental conflict has erupted within the agency – not just a disagreement, but a structural rift between two groups that see the future of monetary policy very differently.

And while discussions inside the Fed are usually calm and behind closed doors, this time the split is surfacing – the risks differ too much, the new economic conditions are too unpredictable, and the cost of a mistake is too high.

Disagreements that cannot be hidden

According to the WSJ, the Fed’s leadership is trying to answer the main question: what is more dangerous – re-accelerating inflation or a rapidly cooling labor market? It’s difficult to answer: the economy is showing a combination of factors that do not fit the usual models.

Additional chaos was created by the temporary shutdown of the US government, which delayed the publication of statistics. The Fed is essentially forced to make decisions almost blindly – without a full set of data.

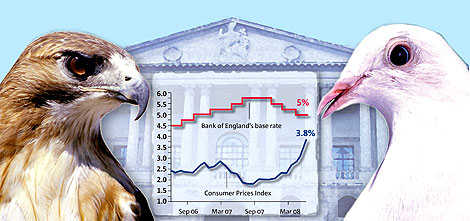

The battle of “hawks” and “doves”

Hawks

Supporters of tight policy are convinced that the Fed cannot lower the rate further. Moreover, they believe that even the previous two cuts (totalling 50 bps) were too sharp. At the end of October, the rate was brought to the 3.75-4.00% range, and the hawks propose putting the series of cuts on pause.

Their main argument: inflation is accelerating again, and companies will most likely pass on higher costs – caused by the Trump administration’s tariffs – to consumers.

Doves

Supporters of a loose policy, on the contrary, see rising recession risks. The labor market is weakening, companies are hiring less frequently, and wage growth is slowing. But their position is now weaker – hard data on their side is missing due to delayed statistics.

The economy is entering stagflation mode

The unique situation is that inflation is rising while job creation is slowing. This is classic stagflation – a nightmare for any central bank because measures against inflation worsen employment, while measures against weak labor markets accelerate prices.

Many experts believe the cause lies in the sharp shift in US economic policy after the Trump administration arrived – especially in trade, tariffs, and immigration restrictions.

KPMG’s chief economist Diane Swonk says: “It was easy to assume we’d face a stagflation episode. Much harder – to live through it.”

The last inflation indicator published before the shutdown showed growth to 2.9% in August – still above the Fed’s 2% target.

Three key areas of dispute

How persistent is the inflation spike?

- Hawks are sure companies will continue raising prices under tariff pressure.

- Doves think businesses are afraid to raise prices due to weak demand – meaning inflation will fade on its own.

Why has wage growth slowed?

- If the reason is weak demand for labor, high rates will cause a recession.

- If the reason is shrinking labor supply due to immigration restrictions, lowering rates will accelerate inflation.

How restrictive is the current rate?

- Hawks: after two cuts this year, the rate has approached neutral – lowering further is dangerous.

- Doves: rates are still weighing on the economy – they need to be cut to support employment.

After the October meeting, Powell noted: “We simply assess risks differently. Hence the different views.”

? What markets think

Most investors still believe the rate will be cut by another 25 bps in December. However, Powell made it clear: the decision is not predetermined.

The Fed meeting will take place on December 9-10, and it promises to be one of the most dramatic in recent years.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.