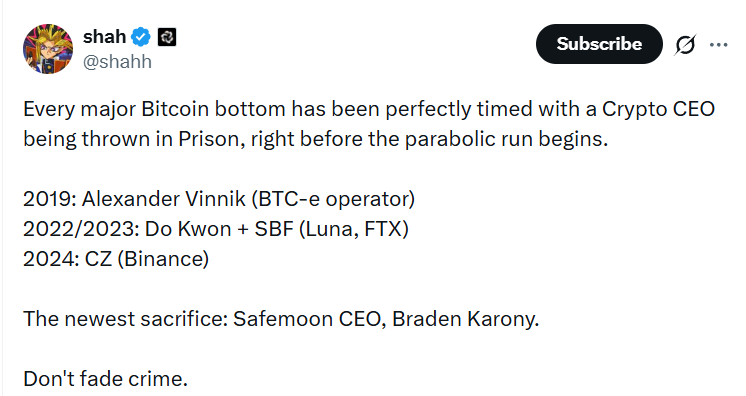

Crypto Twitter (X) has noticed a curious, almost mystical “bottom indicator”: every time a major crypto CEO is sent to prison, Bitcoin seems to be sitting at a local low – and then a new powerful rally begins.

Users are discussing a pattern that looks too symbolic to ignore. According to this theory, the market receives a kind of “sacrifice to the system” – a high-profile court sentence that coincides with peak fear and investor capitulation. And then, almost like a script, recovery begins, followed by that familiar parabolic run upward.

The historical coincidences do look intriguing.

In 2018, the arrest of Alexander Vinnik, linked to BTC-e, happened during the period when Bitcoin was finishing its bottom after the previous cycle’s collapse. The market was in depression, the media was declaring crypto “dead,” and investors were surrendering en masse.

In 2022-2023, amid the collapse of Terra and FTX, the high-profile cases of Do Kwon and Sam Bankman-Fried became symbols of the end of the era of “crazy growth at any cost.” That was exactly when BTC was going through another painful bottom, with sentiment at its darkest.

In 2024, CZ – the founder of Binance – received his sentence. Once again, the timing matched a period of heavy pressure, uncertainty, and expectations that “regulators will now finish off the industry.”

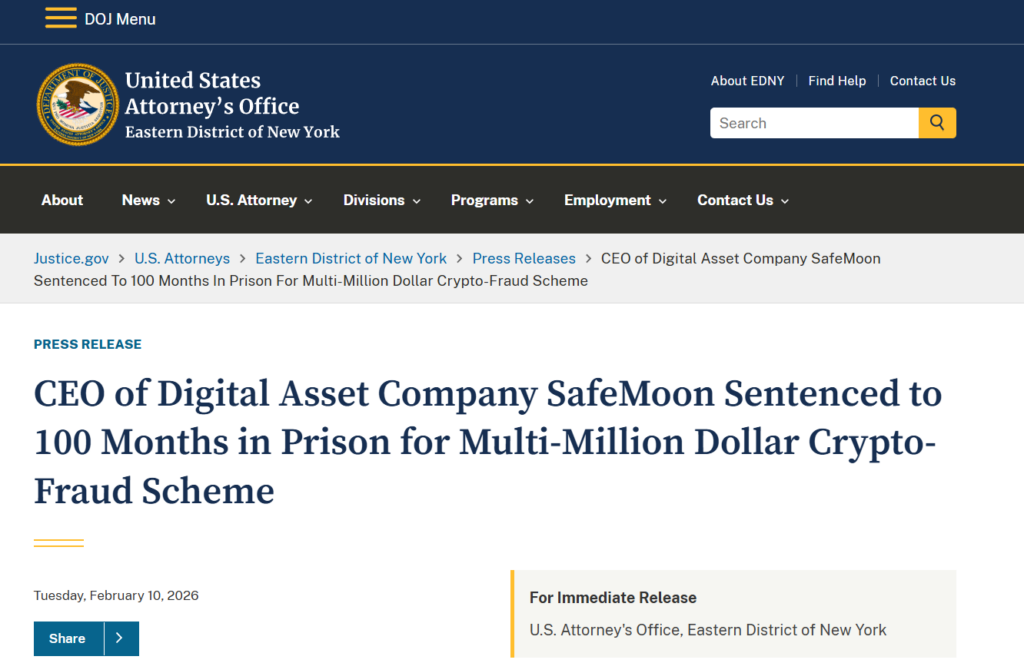

Now, a new case has been added to this “collection of signals.”

On February 10, 2026, SafeMoon CEO Braden Karony was sentenced to 100 months in prison. And at the same time, Bitcoin is trading below $70,000, already pulling back after falling from a recent $126,000 peak. The market once again looks like it is going through a painful cooling phase: fear, sell-offs, doubt, and talk that “the cycle is over.”

The author of the viral post on X even framed it almost as a rule: “Every major Bitcoin bottom perfectly совпides with another crypto CEO being thrown in prison – right before the parabolic run begins.”

The ironic conclusion fits perfectly into crypto folklore: “The newest sacrifice: Safemoon CEO, Braden Karony. Don’t fade crime.”

Of course, this should not be taken seriously as an investment indicator. Rather, it reflects market psychology: major legal cases usually happen after the bubble has already burst, hype has faded, and the industry is going through a painful cleansing process. Those moments often align with the formation of a long-term bottom.

So the question remains open: is it just coincidence, a meme, and a beautiful story for X – or yet another symbolic marker that the market may be nearing a turning point? Are we waiting for “to the moon”? Or simply watching to see who becomes the next “bottom signal.”

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.