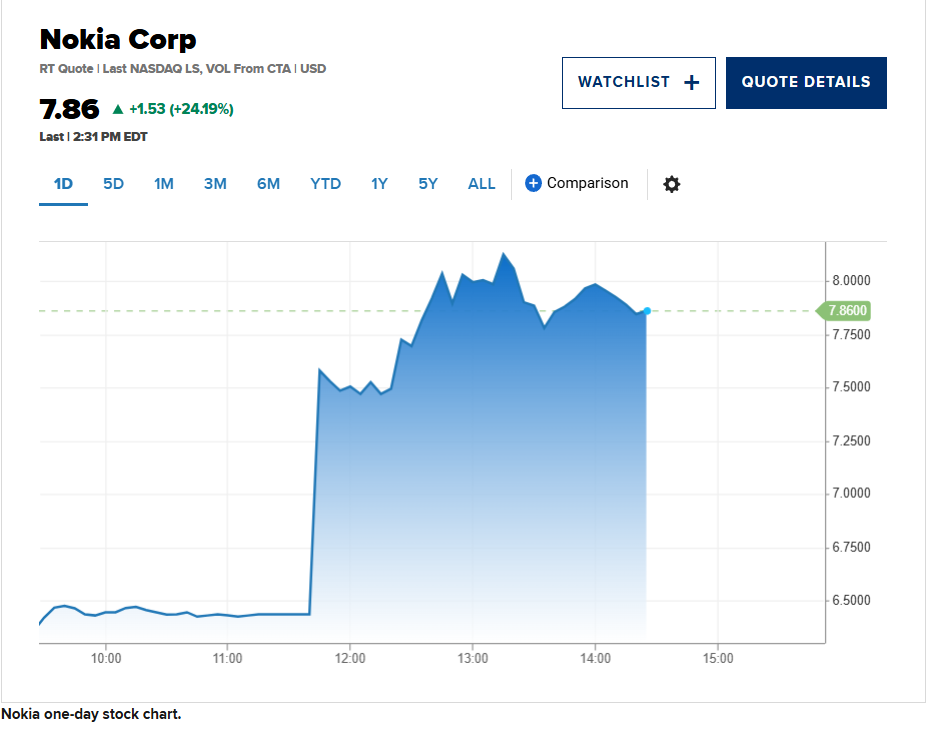

? This week, Finnish company Nokia unexpectedly found itself in the spotlight of global markets. Its shares soared more than 26% following the news that American tech giant Nvidia is acquiring a $1 billion stake in the company.

The deal involves issuing 166 million new Nokia shares, with proceeds directed toward artificial intelligence development and other corporate initiatives. But this is not just a financial investment — the companies announced a strategic partnership that could shape the future of global telecommunications infrastructure.

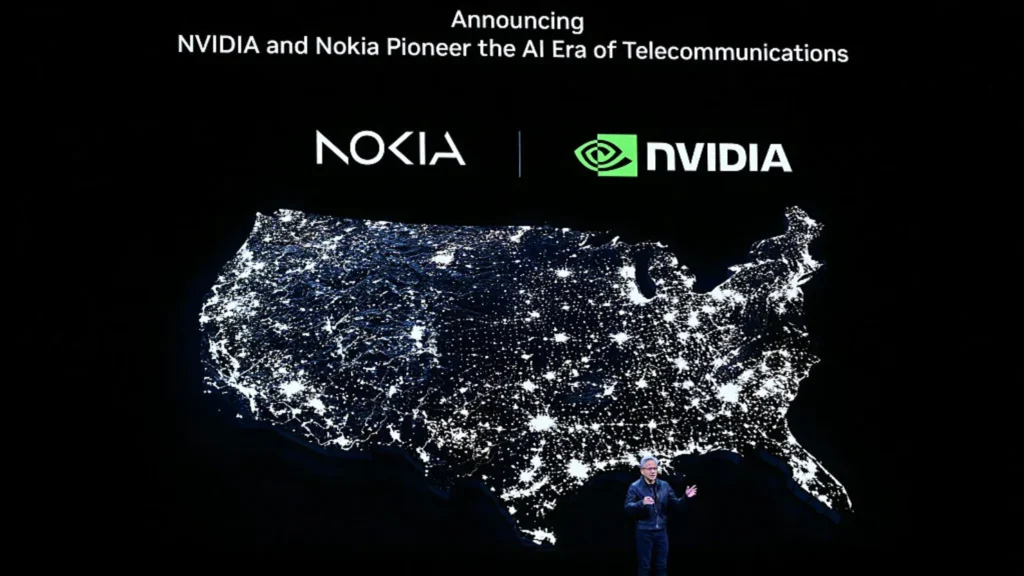

Nvidia CEO Jensen Huang speaks during the Live Keynote Pregame at the Nvidia GTC (GPU Technology Conference) in Washington, D.C., on October 28, 2025.

What’s known about the partnership

According to official statements, Nokia and Nvidia plan to jointly develop sixth-generation (6G) communication technologies and adapt existing 5G and 6G solutions to Nvidia’s GPU architecture. The goal is to create software platforms capable of efficiently leveraging AI power and enabling next-level connectivity — ultra-fast, energy-efficient, and flexibly scalable.

Additionally, the companies intend to build integrated AI network solutions where communication infrastructure merges with Nvidia’s computing systems. Essentially, this represents a new kind of digital network where data is not just transmitted but instantly processed at the signal level.

Nokia representatives noted that Nvidia is considering incorporating its technologies into future AI infrastructure plans — potentially establishing new network nodes for Nvidia’s data centers, especially those focused on distributed AI systems.

Why it matters

For Nokia, this represents a chance at a second life. Once a symbol of the mobile era, the company shifted its focus to telecommunications equipment after the fall of the feature phone market and its failed smartphone attempts. Today, Nokia is one of the world’s leading 5G network suppliers, competing with Ericsson, Huawei, and ZTE.

Nokia one-day stock chart

Its partnership with Nvidia gives it the opportunity to move beyond hardware supply and become a key infrastructure player in the AI era.

Context: Nvidia’s aggressive investment strategy

For Nvidia, such moves have become a standard part of its strategy. The company is investing heavily in its tech partners, building an ecosystem around its chips and computing platforms.

- In September, Nvidia announced a $5 billion investment in Intel — a move that once seemed unthinkable between former rivals.

- The company has also allocated $100 billion to OpenAI, $500 million to the autonomous driving startup Wayve, and $667 million to UK cloud provider Nscale.

This approach allows Nvidia not only to sell microchips but to weave a network of strategic alliances, ensuring a long-term presence in every layer of the tech ecosystem — from AI to telecommunications.

Political context and market significance

The deal announcement coincides with Nvidia CEO Jensen Huang’s preparations for a major speech in Washington, where he will address government officials and regulators at the company’s annual developer conference. It’s expected that Huang will reveal details of the Nokia partnership and present his vision of how AI and 6G can merge into a unified “smart Internet of the future” architecture.

Financial analysts already call this one of the most symbolic deals at the close of 2025: Nvidia continues to solidify its position as the “nervous system” of the digital world, while Nokia gains a chance to reclaim its role as Europe’s technological flagship.

✨ Conclusion

Nvidia’s bet on Nokia isn’t just a billion-dollar deal. It’s a bet on the integration of artificial intelligence and next-generation communications — a future where smartphones, servers, and networks become part of a single computing fabric.

If the project succeeds, in a few years Nokia could once again become a name associated not with nostalgia for button phones but with the infrastructure of the digital age.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.