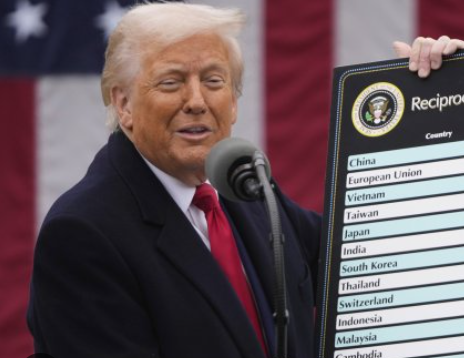

📈 The enforcement of new US tariffs (ranging from 10% to 41%) on goods from 69 countries, including the EU, may become a powerful trigger for the global economy.

Volatility is expected to rise across stock markets, with commodity prices surging and inflationary pressures intensifying.

Investors may shift to safe-haven assets, while cryptocurrencies could gain momentum as an alternative hedge.

Bitcoin and gold may emerge as key beneficiaries amid growing geoeconomic turbulence.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.