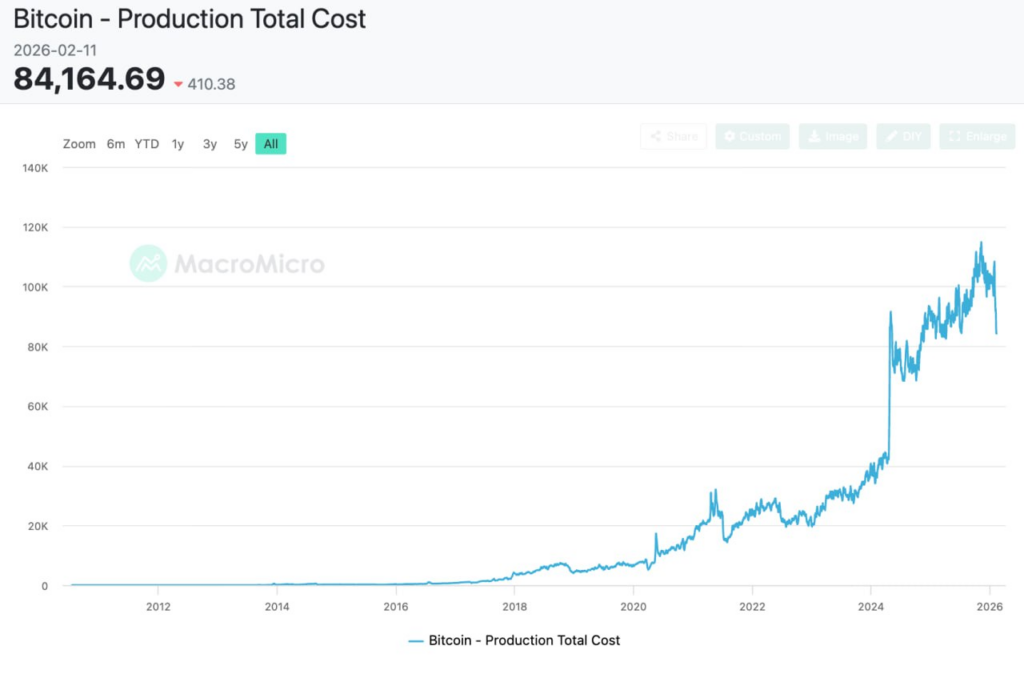

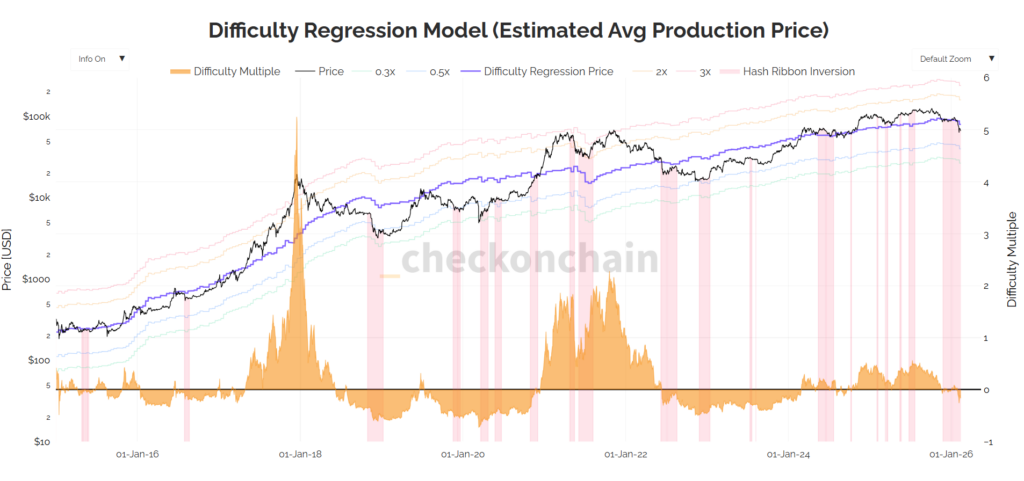

According to MacroMicro data and Checkonchain estimates, the average cost of mining one bitcoin is currently around $84,000, while the market price is holding near $65,000. In other words, mining is taking place under conditions where producers are selling their product for less than it costs them to produce it. In any other industry, this would look like a direct path toward shutting down the business. In crypto, it is called something else – miner capitulation.

It is important to understand that mining cost is not an abstract number pulled out of thin air. The model takes into account the key parameters of the entire network: total hashrate, mining difficulty, hardware energy efficiency, electricity costs, and the broader cost structure of the industry. Network difficulty acts as an indicator of how many resources are required on average to mine a single block. And the higher the difficulty, the more expensive the production of each BTC becomes.

If these estimates are close to reality, then a significant portion of miners are now operating at a serious loss. Their revenues from block rewards and transaction fees do not cover expenses such as electricity, equipment maintenance, facility rentals, and debt payments. This is a classic situation that historically has almost always coincided with a bear market phase.

Bitcoin trading below its production cost is a rare but highly revealing marker. It has happened before in previous cycles. For example, in 2019 and again in 2022, BTC also dropped below its estimated mining cost. Each time, it meant the same thing: the market was in a zone of pain, weaker participants could not survive, and the industry was going through a cleansing process. Afterward, the price gradually returned to the cost level as selling pressure eased.

It is also worth highlighting the dynamics of hashrate. Hashrate represents the total computational power that secures the Bitcoin network. This metric reflects how much processing capacity is being deployed to solve cryptographic tasks. In October, hashrate reached an all-time high of around 1.1 zettahashes per second (ZH/s = one sextillion hashes per second), but then declined by roughly 20%. The reason is simple: less efficient miners were forced to shut down equipment because mining became economically pointless.

In recent weeks, hashrate has partially recovered to around 913 EH/s, which may suggest some stabilization. However, that does not mean the sector is comfortable again. Many miners remain unprofitable at current price levels.

When revenues fall below operating expenses, miners are forced to do what the market fears most: sell their accumulated BTC reserves. These sales are not driven by a desire to exit the asset, but by the need to finance daily operations – paying for electricity, servicing debt, and maintaining infrastructure. This creates additional downward pressure on price and reinforces the bearish trend.

Miner capitulation is one of the most characteristic elements of the late-stage bear market. The sector is under stress, weaker players leave, and the market redistributes coins into stronger hands. That is why periods when Bitcoin trades below mining cost often become not the continuation of the decline, but the zone where the foundation for a future recovery is formed.

Bitcoin is currently in a situation where the economics of mining are cracking: production is more expensive than the market price, miners are selling reserves, hashrate has declined, and the industry is undergoing a stress test. This is painful, but historically these were exactly the periods when the market очищed itself from excess overheating and began building the next growth cycle.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.