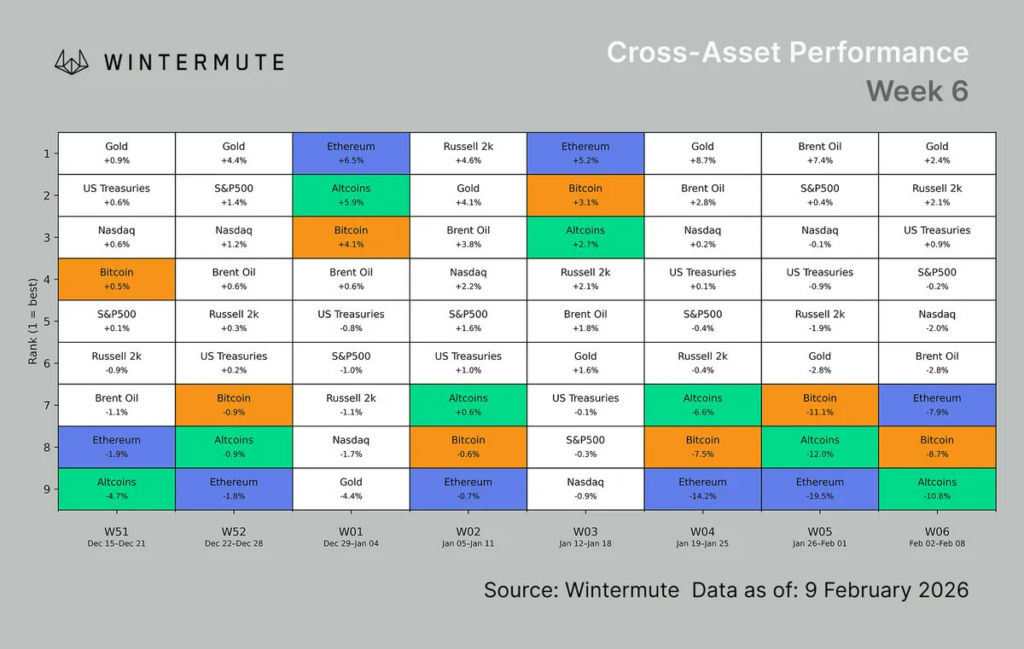

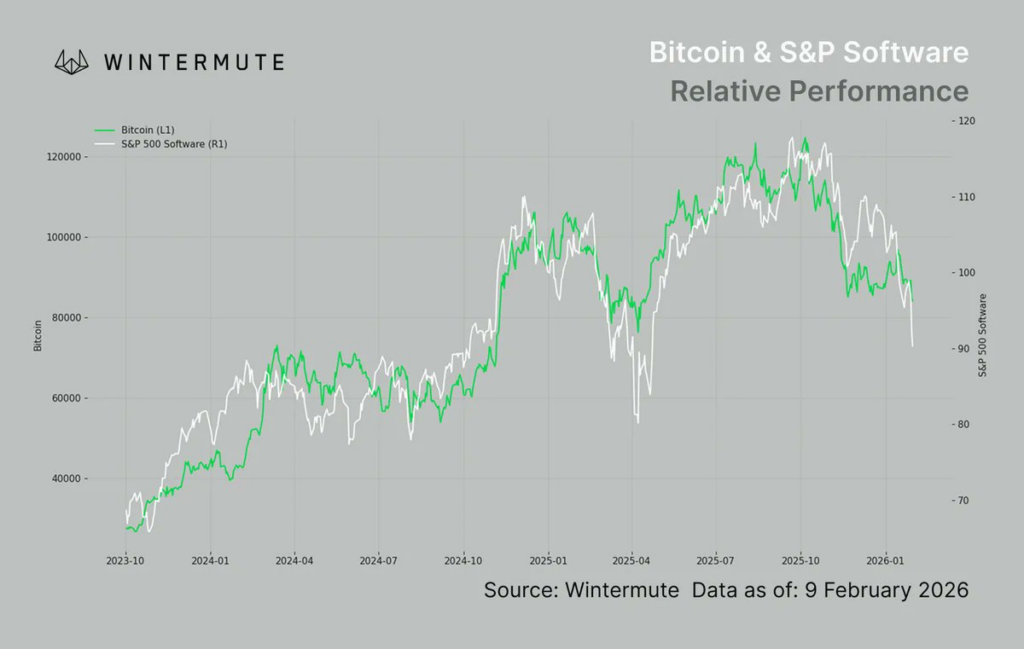

The past week, ending February 8, 2026, became one of the toughest for the cryptocurrency market since 2022. Bitcoin experienced serious turbulence: its price not only fell below the psychological level of $80,000 but intraday reached a low of around $60,000, before returning to the range of approximately $70,000. This effectively erased all the price gains following Donald Trump’s victory in the U.S. presidential elections in November 2024.

Analysts from one of the world’s largest crypto market makers, Wintermute, note that the market has entered a phase of heightened instability with extremely high volatility. In their view, several conditions must be met simultaneously for Bitcoin’s price to resume growth: first, the inflows to exchange-traded funds (Bitcoin ETFs) need to recover; second, a positive premium on the American cryptocurrency exchange Coinbase is required, reflecting investor demand and willingness to pay above the spot price; and finally, the futures market must stabilize, which currently remains highly uncertain.

Wintermute, as one of the world’s largest market makers, provides liquidity on major exchanges and plays a key role in price formation.

What happened on the market:

Bitcoin fell below $80,000 for the first time since April 2025, reaching as low as $60,000 intraday. All gains after Trump’s election in November 2024 were effectively wiped out. Over four months, BTC dropped 50% — from $126,000 in October 2025 to current levels. This represents the steepest decline since 2022, when the crypto market also experienced a severe crash.

Main triggers of simultaneous decline:

First, the appointment of Warsh as head of the U.S. Federal Reserve on January 30 increased expectations for tighter monetary policy. Second, weak earnings reports from major tech companies, such as Microsoft (shares dropped immediately by 10%), added pressure on risky assets. Third, the sharp collapse of precious metals — silver lost 40% in three days — intensified the overall negative sentiment in financial markets.

Who was selling:

The main selling pressure came from U.S. investors. Coinbase Premium has been negative since December 2025, reflecting ongoing pressure from the U.S. Spot Bitcoin ETFs lost $6.2 billion since November — the longest outflow streak since the funds’ launch. Institutional players who previously supported the market and acted as buyers have now largely disappeared from the active arena. IBIT simultaneously became the largest BTC holder and the largest source of sales, reinforcing the downward trend.

AI drains capital:

Bitcoin’s chart almost perfectly mirrors the performance of S&P 500 tech companies. If AI companies are removed from Nasdaq, the crypto lag almost disappears. Until artificial intelligence slows its growth and stabilizes, it will be extremely difficult for crypto to increase in value. Weak Microsoft earnings triggered this process, but it is not sufficient for a global trend reversal.

What’s next:

Companies holding BTC on their balance sheets currently face unrealized losses of around $25 billion, as Bitcoin trades below their average purchase price. Without a return of real demand from investors and institutions, a sideways market with elevated volatility is expected, where prices fluctuate within a wide range without showing sustained growth.

Overall, Wintermute analysts emphasize that the current situation is not a catastrophe for the crypto market, but a phase of cleansing and capital redistribution, where weak hands exit, and strong participants accumulate positions. In such conditions, the market is highly sensitive to external triggers, and any news about demand or institutional flows can provoke sharp moves in both directions.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.