The well-known crypto analyst and trader Michael van de Poppe, followed by over 800,000 people on X, stated that Bitcoin, in his view, is currently in the final phase of the bear market. If his thesis is correct, the market may be much closer to a reversal than most participants realize.

According to van de Poppe, the peak of the current cycle occurred in December 2024. That, he believes, was when the crypto market reached a local maximum, after which a prolonged correction began. Currently, we are witnessing what the analyst calls the “bottom of the bear market” — the final stage when selling pressure gradually subsides and investor sentiment becomes extremely negative.

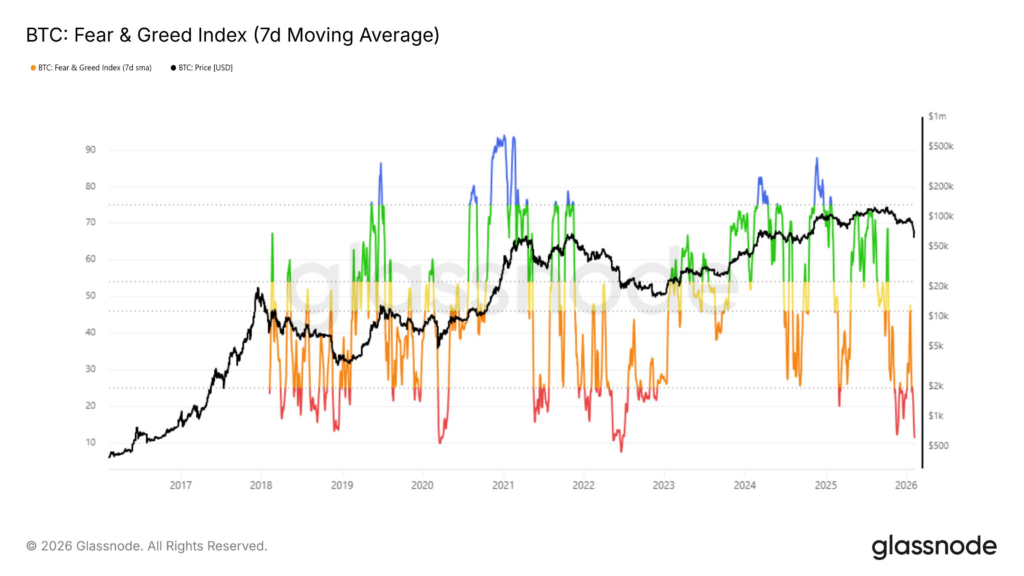

Van de Poppe’s main argument is based on the behavior of the Fear & Greed Index, which reflects the market’s emotional state: when participants are overly optimistic, the index moves into the “greed” zone, and when panic sets in, it drops into “fear.”

At the moment, the index has fallen to extremely low levels, comparable to two of the biggest stress events in recent years: the market crash during Covid-19 in March 2020 and the collapse of the Terra (Luna) ecosystem in May 2022.

And this is where it gets interesting.

Historically, such moments of extreme fear rarely meant the “end of Bitcoin.” On the contrary, they often became turning points. Glassnode data, cited by the analyst, show that when the index enters the “red zone” of extreme fear, it almost always coincides with the formation of a local BTC bottom. In other words, the market reaches a point where there are no more sellers, and further decline loses momentum.

The examples are striking. During the Covid crash, Bitcoin fell to $3,850 and then rose to $69,000 during the next bull cycle (+1,500%). After the Terra crash, the market was again in panic, BTC dropped to $15,476, but then a strong surge followed, pushing the price to new all-time highs.

Van de Poppe’s logic is simple: when fear peaks, the market has already “digested” the bad news. Most weak hands are gone, retail investors are disappointed, social media is full of gloom, and headlines again talk about “crypto death.” These, he believes, are precisely the moments when the best entry opportunities appear.

He emphasizes that extremely low index values are not a signal for continued decline, but rather a marker that the market is close to a reversal. Because a bear market ends not when everyone expects growth, but when no one believes in it anymore.

In his post, the analyst directly states: “These are the periods when the Fear & Greed Index drops so low that that’s precisely when you need to enter the market.

” Of course, it’s important to understand that no indicator gives a 100% guarantee. The market may remain fearful longer than an investor can stay patient. But the idea of a recurring pattern — where panic coincides with the formation of a bottom — remains one of the key characteristics of crypto cycles.

If van de Poppe is right, the current stage is not the start of a new catastrophe, but the final minutes of the bear market drama, after which the market may shift back to bullish conditions. And as is often the case in crypto: when it feels scariest, that’s often when the most profitable chapters are written.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.