Vitalik Buterin is once again doing what he does best: not just discussing technology, but trying to embed it in a philosophy of the future. This time, the focus is on artificial intelligence and the role Ethereum could play in this new era.

In his recent post, Buterin shared an updated view on the intersection of AI and crypto. His main thesis is simple, yet very “Vitalik”: the future should be one where technology enhances human freedom, not diminishes it. AI should neither be a cause of catastrophe nor a tool that permanently strips people of agency.

He writes: “Two years ago, I wrote a post on possible directions where, in my view, Ethereum and AI could intersect… This is a topic that excites many, but I’m always concerned that we often look at these two areas from completely separate philosophical perspectives.”

Essentially, he outlines two dangerous scenarios to avoid. The first is a world where AI renders people “unnecessary,” sending society into forced obsolescence. The second is darker: where state or centralized powers use AI as a tool of total control, permanently depriving the masses of influence. And, of course, there is the classic fear of technological apocalypse — where superintelligent AI goes out of control and “blows up” the world, either literally or through chaotic chains of events.

Buterin emphasizes that looking far ahead, radical, almost science-fictional scenarios are possible. He allows that, in the long term, development could lead to the digitalization of human consciousness or even a form of “merging” with AI. Not because everyone needs it, but because some people will want to keep pace with intellectual entities thinking millions of times faster than a human on silicon. This is no longer about chatbots — it’s a new kind of civilizational competition.

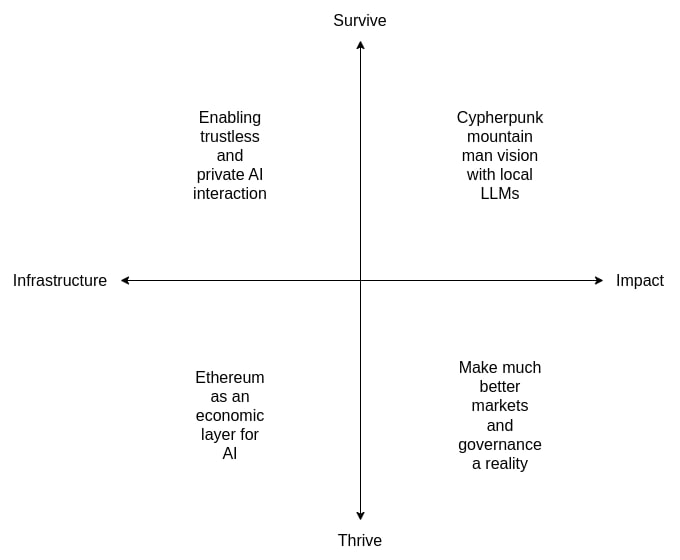

Yet Buterin immediately adds an important caveat: the near-term future is far more down-to-earth. Right now, it’s not science fiction, but practical tools that make interaction with AI private, trusted, and decentralized. Here, Ethereum appears not as a “speculative coin,” but as the infrastructure layer for a new world.

Buterin sees Ethereum as an economic and trust foundation for AI systems. If AI becomes a full participant in the digital economy, it will need mechanisms for payments, reputation, collateral, arbitration, and contract enforcement. Ethereum, in Buterin’s view, can provide the layer that allows AI to interact with other agents through open protocols rather than centralized platforms.

A key focus is private, trustless interaction with AI. Buterin believes people need ways to use AI without becoming fully transparent to corporations and governments. He discusses developing local LLMs that run client-side, and mechanisms for paying API calls via cryptographic tools like ZK-payments. The idea is to query remote models without revealing identity or leaving a digital footprint from request to request.

This aligns with Ethereum’s broader cryptographic agenda: privacy, proofs, verifiability. Buterin mentions TEE attestations, client-side proof verification, and other forms of guarantees that allow users to trust the AI service is honest and not manipulating results.

Even more important is Ethereum as the economic layer for AI-to-AI interactions. In a world where neural networks are autonomous, they may act as economic entities, not just answer questions. Bots can hire other bots, models can order computations, pay for services, post collateral, and participate in dispute resolution.

Buterin envisions a future where AI systems enter contractual relationships, with blockchain serving as the medium where these agreements are recorded and executed. This enables decentralized AI architectures rather than models controlled by a few corporations.

He also discusses AI reputation. In a world of autonomous agents, trust becomes a currency. Ethereum can form the basis for reputation standards where AI behavior can be measured, verified, and incorporated into economic interactions. This is an attempt to build not just an AI market, but a trust market for AI.

Another key part of Buterin’s reflection is realizing the old cypherpunk ideal, which he calls the “mountain hermit” concept. It’s a vision of a world where humans can fully verify everything they use: code, protocols, rules. The problem today is that no individual can physically analyze the full software infrastructure around them.

Here, Buterin sees an unexpected role for LLMs: they can become a tool allowing humans to approach verifiability again. A local model can help interact with Ethereum apps without relying on external interfaces. One neural network proposes transactions, another verifies correctness. AI can assist in auditing smart contracts, interpreting formal proofs, and analyzing trust models.

AI here is not a threat but an amplifier of human capacity to understand complex systems.

Finally, Buterin notes that AI could radically change governance and markets. Many ideas that sounded promising in the early crypto years — prediction markets, decentralized governance, quadratic voting, combinatorial auctions, universal barter economies — were limited by human attention. People simply couldn’t make enough decisions or analyze enough information effectively.

AI removes this constraint. It can scale human judgment and revive ideas that were previously too complex for practical implementation. This opens opportunities for more efficient coordination and decision-making mechanisms, with Ethereum as the execution layer and AI as the amplifier.

In conclusion, Buterin emphasizes that this aligns with the spirit of his d/acc concept — development that strengthens decentralized cooperation and protection. Essentially, he proposes returning to the best crypto ideas of 2014, adding new tools like AI and ZK, and building a completely different technological layer for the future.

The main message is: AI is inevitable, but the question is not if it will appear, but what path we choose. Will it be a world of centralized superstructures, or a world where technology enhances freedom, privacy, and human agency?

According to Vitalik, Ethereum could become a key tool for enabling the latter scenario.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.