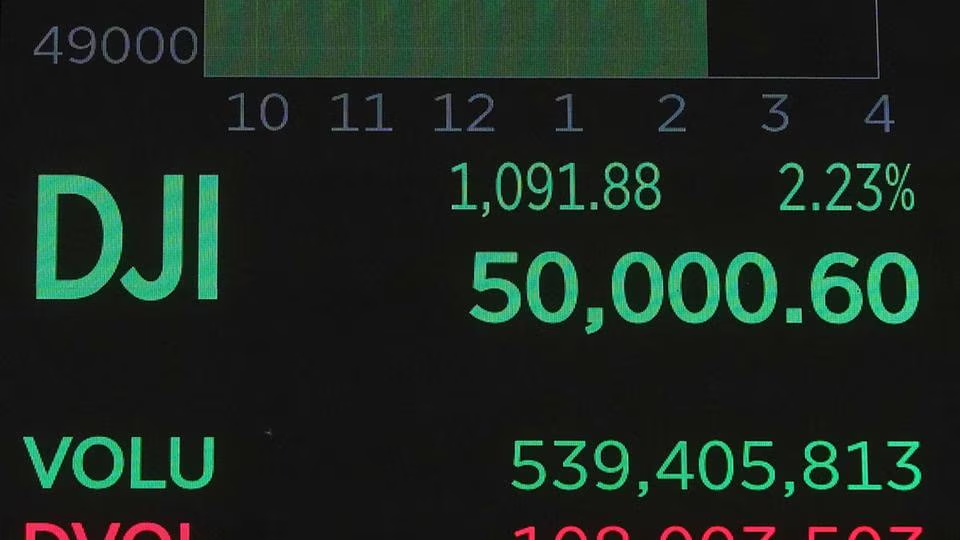

On the surface, everything looks like a celebration: Dow Jones is hitting record highs (already above 50,000!), industrial companies are showing impressive growth, the financial sector is on the rise, and aerospace and energy seem as if they didn’t even notice the recent correction. At first glance, the market appears fully recovered, and investors can rejoice in another wave of bullish sentiment. But looking deeper, the picture is more complex.

The financial world is currently living in two parallel realities. One part of the market feels confident and continues moving upward as if crises or uncertainty never existed. The other remains in a state of uncertainty, particularly noticeable in the technology sector and among growth-oriented companies.

Nasdaq continues to show weakness compared to Dow and S&P. Growth tech and the crypto sector have not recovered their positions after the correction, and the shares of the largest software companies trade below their highs. This is not a classic rally where the entire market rises in unison. It is now clear that investors are making choices, and the market has split between those willing to take risks and those preferring stability.

The main driver this week is artificial intelligence. New investments by Google and Amazon into infrastructure on a massive scale serve as fuel for a wide range of related industries: semiconductor manufacturers, networking equipment, energy, and companies building AI infrastructure.

Unlike previous tech rallies, today the market is betting not on applications and services but on the “picks and shovels” of the AI gold rush — the companies that enable the creation of new solutions, support computing power, and scale systems. These investments are perceived by the market as the foundation for future growth, and companies capable of meeting AI infrastructure demand become magnets for capital.

This week, investors await inflation and employment data, which could significantly adjust expectations for interest rates. Volatility in response to these events is almost guaranteed. This means that any sharp market movements could be amplified both by actual economic figures and by the psychological reactions of participants adjusting portfolios based on the new data.

In the current situation, the market demands discipline and a strategic approach. Strong sectors continue to attract capital, while weak areas remain under pressure and may experience further selling. Investors must manage risks quickly, avoid overloading portfolios, and carefully evaluate every market entry.

This is not euphoria or spontaneous growth — it is the selection of the leaders of 2026. The companies that maintain resilience and continue demonstrating fundamental strength will, in the coming months, set the market’s direction and form the basis for future index growth.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.