Sometimes it feels as if the world is a giant safe containing money, houses, factories, stocks, resources, and everything that is commonly called capital. But once you ask a simple question – how much is all of it worth in total – it turns out there is no single answer. It all depends on what exactly is counted as wealth: only financial assets, or also real estate, resources, infrastructure, and whether debts and liabilities are included.

That is why instead of one number, there are several major estimates.

The broadest one comes from the McKinsey Global Institute. According to their data, the total value of all assets in the global economy – including real estate, equities, bonds, and other real and financial assets – was about $1.7 quadrillion at the end of 2024. This is a gross figure, meaning it does not subtract debt.

If we calculate net wealth instead – assets minus liabilities – the estimates become much lower. McKinsey suggests roughly $600 trillion, while UBS and BCG give a range of about $470-512 trillion. This is closer to what humanity actually has “left over” after all credit structures and debt obligations.

There is also a narrower view: the value of only those assets that are traded in markets – stocks, bonds, private equity. Here the figures are around $250-260 trillion. And if we talk about the capital managed by the fund and asset management industry, that is about $128-147 trillion.

If we translate this into a simple picture, it looks like this: the world owns assets worth roughly $1.6-1.8 quadrillion, but net wealth after debt is about $600 trillion, and the main investment assets make up only a quarter of that amount.

And here lies the main paradox. Global GDP today is around $110 trillion per year, while assets are 15-16 times larger. Humanity lives not so much by production, but by valuation. The capitalism of factories is increasingly turning into the capitalism of charts.

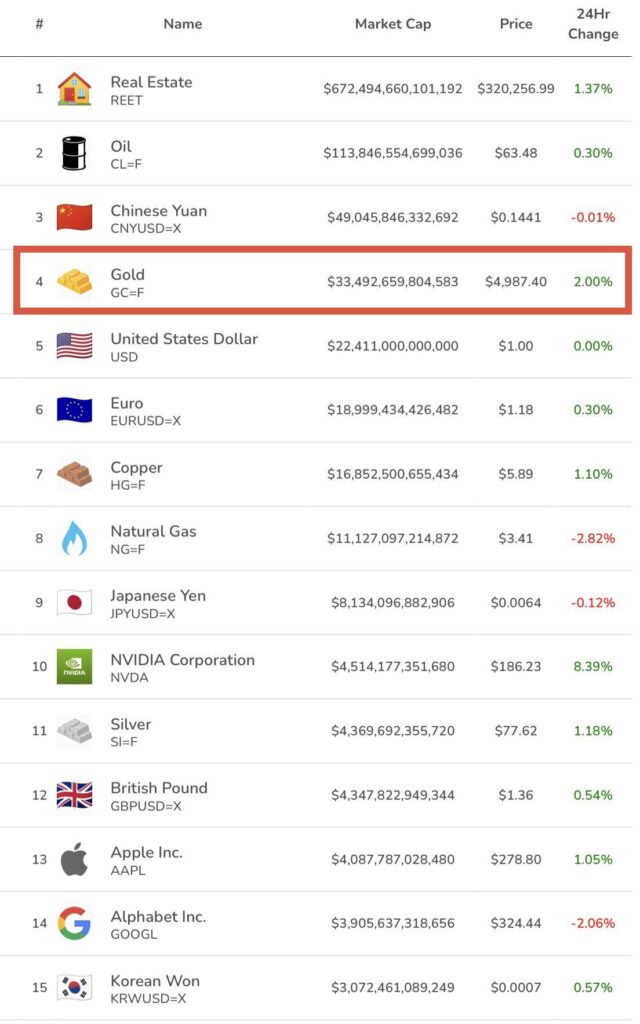

The key component of global wealth is real estate. Its volume is estimated at $350-400 trillion, making it the largest asset class on the planet – bigger than stocks, bonds, and gold combined. That is why any problems in real estate become systemic. The 2008 crisis was not an accident, but a reminder that the world’s largest asset can bring down the entire structure.

Financial assets also dominate the real economy. Their value depends less and less on factories and goods, and more and more on interest rates, liquidity, trust, and the news cycle. Markets live on expectations and belief more than on facts.

The most alarming part is that most wealth is “paper” in nature. Gold accounts for only 2-3% of global assets. The rest is financial valuation. A 10% drop in asset prices wipes out around $170 trillion – a sum larger than the annual GDP of the United States. Modern wealth can disappear faster than it is created.

The system’s main vulnerability is simple: it relies on low interest rates, credit expansion, and constant growth in asset prices. As long as assets keep rising, everything looks stable. But once that process stops, the system begins to fall out of balance.

We live in a world where wealth is increasingly not the result of creation, but the result of revaluation. And the key question of the future is not “how much is the world worth,” but how much of that wealth will remain if market faith disappears.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.