Bitcoin went through one of the most dramatic crashes in the entire history of the crypto market. For the first time since November 2024, the price of BTC fell below $60,000, and the daily drop exceeded $10,000 – the market had never seen anything like this. The correction amounted to 52.5% from the October all-time high of $126,080, and in scale it turned out to be deeper than the sell-offs during the COVID-19 pandemic and even the FTX collapse.

In three weeks, the cryptocurrency market lost about one trillion dollars in capitalization. The Fear and Greed Index collapsed to the level of 5 points – an absolute historical minimum. This is not just a state of panic, but a collective shock, when the market begins to doubt not individual assets, but the very idea of the sustainability of the crypto economy.

The main question investors are asking themselves now sounds simple: what caused such a collapse – and is this the bottom or only the beginning of a larger wave?

1-week BTC/USD chart. Source: Bitstamp

Five reasons for the historic падіння

The first and most unexpected trigger of the sell-off was political news from the United States. On January 30, the nomination of Kevin Warsh as Chairman of the Federal Reserve was announced. Warsh has long been known as a supporter of the максимально strict monetary policy. He criticized the era of quantitative easing and advocated for сокращення the Fed’s balance sheet, meaning a return to “expensive money” and discipline, which markets давно forgot how to воспринимать calmly.

The reaction was immediate. In just 72 hours after the announcement, about $250 billion evaporated from the crypto market. QCP Capital and other trading firms directly pointed out: the market is pricing in the risk of a change in the entire “reaction function” of the central bank. In crypto, this means one thing – less liquidity, less appetite for risk, and less room for speculative growth.

The second удар came from macroeconomics. American employers announced layoffs of more than 108,000 employees in January – the highest since 2009 and a 118% increase year over year. Such a signal intensified anxiety: the US economy is entering a phase of instability, and therefore markets are once again forced to revise expectations on rates and risky assets.

The third factor was pressure from the technology sector. Alphabet surprised investors with a capital expenditure forecast for 2026 in the range of $175-185 billion – almost twice last year’s level. This caused concerns that the AI race is turning into an endless денежная funnel, where future profits will be “eaten” by the infrastructure cycle.

At the same time, the shortage of memory chips intensified: manufacturers are redirecting capacity from consumer devices to high-performance memory for AI data centers. This is another sign of overheating in the технологической economy, which markets воспринимают painfully.

The fourth reason is the classic domino effect inside the crypto market. About 44% of all Bitcoin holders found themselves in losing positions. In just 24 hours on February 6, positions worth $2.6 billion were liquidated. This is forced closure of trades, when traders are literally knocked out of the market automatically, intensifying the sell-off and creating an avalanche-like cascade.

The fifth reason is pressure on corporate holders. Strategy recorded a net loss of $12.4 billion for the fourth quarter of 2025. Yes, the CFO said that the company’s position is “stronger and more sustainable than ever,” but the market heard something else: the largest corporate BTC holder is already suffering accounting losses, and this becomes a systemic risk.

Japan’s Metaplanet, holding 35,102 bitcoins, stated it will continue buying despite the crash. However, such statements in a bear market sound not like confidence, but like a stress test: will corporate whales really be able to “not sell” if the падіння drags on?

Geopolitical struggle for financial influence

Against the backdrop of market turbulence, China took a step that goes far beyond cryptocurrencies. Xi Jinping stated his intention to turn the yuan into a global reserve currency. This is a direct challenge to the dollar system, which for decades has defined the world’s financial architecture.

But reality is still harsher than ambitions. According to the IMF, the dollar accounts for about 57% of global reserves, the euro about 20%, and the yuan is only in sixth place with a share of 1.93%. China’s main problem is a closed capital account and limited convertibility, without which the yuan cannot become a полноценный reserve asset.

Interestingly, at the same time Beijing banned the issuance of stablecoins pegged to the yuan and the tokenization of real assets. The People’s Bank of China explained this by saying that stablecoins фактически perform the functions of fiat currencies. This means a strategic approach: China does not want private crypto instruments, it wants the digital yuan as the only acceptable mechanism.

Regulators and institutional movement

In the US, the Trump administration held meetings with leaders of the crypto and banking sectors, discussing stablecoin regulation and the CLARITY Act bill. Tokenized securities, DeFi, ethical standards for officials, and yield questions for stablecoins were discussed.

Trump again emphasized that he considers himself the main political ally of the crypto industry. But the market speaks in numbers: from January 2025 to February 2026, bitcoin fell from $92,000 to $69,500, losing about 24.5%. Tariff policy and economic uncertainty exerted more pressure than political statements could offset.

Meanwhile, the EU presented its 20th sanctions package against Russia, including tough measures against crypto platforms and digital assets. This shows that cryptocurrencies have finally become part of geopolitical war – not an alternative to the system, but its instrument and object of control.

Artificial intelligence changes the rules of the game

Another layer of what is happening is technological. China has captured the market of open AI models: all six best open-source models belong to Chinese companies. Their share in global usage grew from 1.2% at the end of 2024 to almost 30% in December.

This is no longer just a technological race. It is a new element of currency competition. Whoever controls AI infrastructure controls future financial flows, data, and the digital economy.

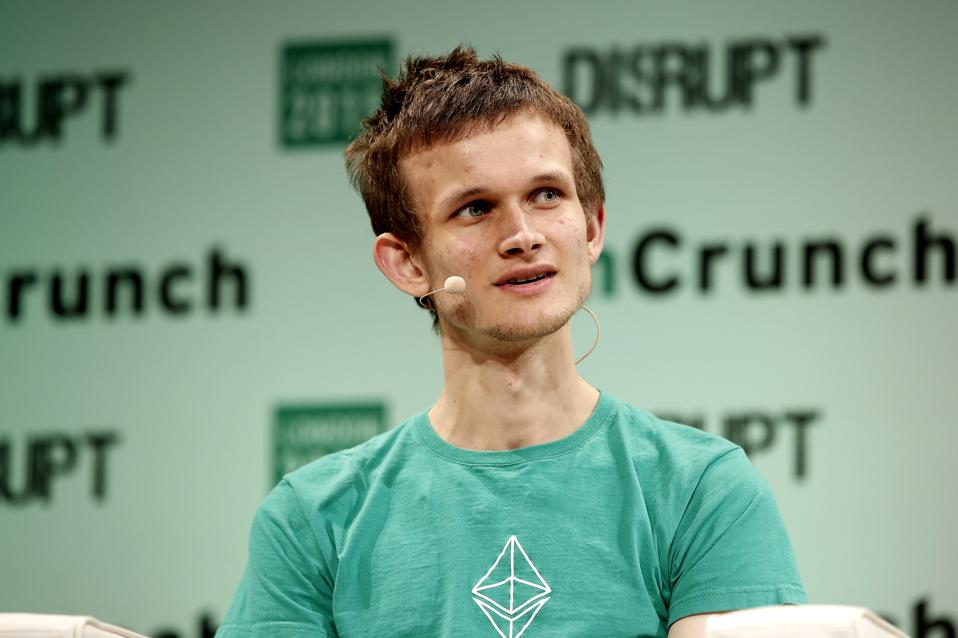

Against this background, Vitalik Buterin proposes new models of content tokenization, Uma Protocol launches platforms where AI agents hire people, and Crypto.com introduces autonomous agents for retail users.

But along with AI growth, risks also grow: companies increasingly send corporate data into public AI services, and about 60% of organizations still have no control policy. This is a new vulnerability zone comparable in scale to banking risks of the early 21st century.

Bottom or a new wave of decline?

After the crash, bitcoin rebounded by 19% to $71,673, but failed to закрепиться above. Technical indicators are unprecedented: BTC dropped 2.88 standard deviations below the 200-day average – something that did not happen even during COVID or FTX.

Michael Burry warned of a possible “death spiral” if it falls below $50,000, which could trigger a wave of bankruptcies among miners. Mining difficulty has already fallen by 11.16% – the sharpest decline since 2021.

Interestingly, at the same time major banks forecast gold at $6,000-6,300 per ounce. JPMorgan explains this by rising demand from central banks and investors. Even Tether is buying a stake in Gold.com, expanding access to tokenized gold.

AI opinion: a structural shift of the era

The week’s events look like a single structural turning point. Warsh’s nomination, China’s yuan ambitions, China’s dominance in AI, and bitcoin’s historic crash form a picture of a transition from a unipolar dollar system to a multipolar architecture, where technological leadership becomes a currency weapon.

The paradox is that the institutionalization of cryptocurrencies did not reduce volatility, but increased it. Professional algorithms, banking risk models, and corporate reserves made the market more vulnerable than the chaotic эпоха of retail dominance.

The market has reached a crossroads. Extreme fear historically preceded reversals. But the unprecedented combination of макроeconomics, geopolitics, and technological transformation makes the current cycle unique.

And the main question now is not “will bitcoin fall further.” The main question is – who will be able to endure if it falls long enough.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.