The Trend Research fund has recorded one of the loudest and most painful failures in the Ethereum market in recent times. This is not a small drawdown or temporary volatility, but a systemic mistake in position management that ultimately led to losses of nearly three quarters of a billion dollars.

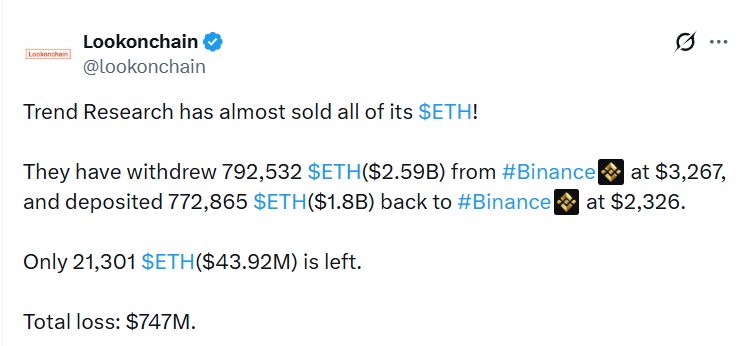

Trend Research accumulated an impressive ETH treasury – 792,532 ETH, which at current estimates was worth about $2.59 billion. The average entry price was $3,267 per coin. This means the fund was betting on Ethereum’s continued growth and viewed the asset as a strategic reserve, a kind of crypto analogue to corporate Bitcoin treasuries.

However, the market moved in the opposite direction. Instead of a continued rally, a harsh sell-off began, and Trend Research found itself in a situation where holding the position became not just unpleasant, but dangerous. Almost the entire volume – 772,865 ETH – was sold at an average price of $2,326. In effect, the fund exited near the most painful part of the decline.

The result is simple and brutal: minus $747 million, according to blockchain analyst Yu Jin.

It is especially telling that this was not the fund’s first cycle. Trend Research had previously demonstrated the ability to profit from ETH. In an earlier market phase, they opened long positions in the $1,000-$2,000 range and took profit around $4,000, earning roughly $315 million. At the time, it looked like an example of a solid strategy: buy in fear, sell in euphoria.

But this time, the market turned against them. Losses reached $763 million, which not only wiped out all previous profit but also resulted in an additional minus $448 million from the initial capital. In other words, the fund did not simply “return to zero” – it sank deeply into negative territory.

The details show that this was not a one-time panic, but a forced unloading process under the pressure of leverage. From February 1 and over just a little more than five days, Trend Research sold a total of 255,500 ETH worth about $554 million at an average price of $2,168. At the same time, the fund withdrew $483 million in USDT from Binance to repay loans and reduce leverage exposure.

This is the key point: the fund fell into the classic leverage trap. When the market drops, an investor is forced to sell not because they “changed their mind,” but because otherwise liquidation will do it for them. The sell-off becomes not a strategic decision, but a fire evacuation.

At this stage, the liquidation price for several leveraged ETH positions has been lowered into the $1,509-$1,708 range, mostly around $1,560. This means the fund remains vulnerable: if ETH continues to fall, pressure on the remaining positions will intensify.

Currently, Trend Research’s assets include around 396,000 ETH worth $754 million, with an average cost basis of $3,180. The fund is still holding a large amount, but it is now deeply underwater relative to the entry price.

The overall loss structure looks like this:

- total loss: $763 million

- realized loss: $258 million

- unrealized loss: $505 million

- leveraged loans: $526 million

This story clearly shows how even large, experienced players can get caught in the trap of market dynamics. Ethereum remains a highly volatile asset, but the main issue here is not even the price decline itself – it is that borrowed capital turns an ordinary correction into a catastrophe.

Trend Research initially looked like a smart institutional player that knew how to buy low and sell high. But the market reminded everyone of an old truth: one successful cycle does not make a strategy immortal. Especially in crypto, where emotions, leverage, and liquidity can erase not only profits but the capital itself within days.

This situation is yet another signal: the crypto industry is maturing, but its risks remain just as brutal. And when even funds lose hundreds of millions through forced selling, it means the market still operates not only by the laws of finance, but also by the laws of psychology – fear, greed, and margin requirements.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.