The night in the crypto market unfolded under the sign of real panic. Bitcoin briefly plunged to the $60,000 mark, one of the sharpest downward moves in recent months. The sell-off looked not like an ordinary “nervous impulse,” but like a harsh position dump, resembling classic capitulation phases.

By morning, the price partially bounced back and returned to the $65,000-66,000 range, however this recovery still looks more like a technical pause than the beginning of a full reversal. Pressure on the market remains, and participants continue to act with maximum caution.

Fear has returned to the market for real.

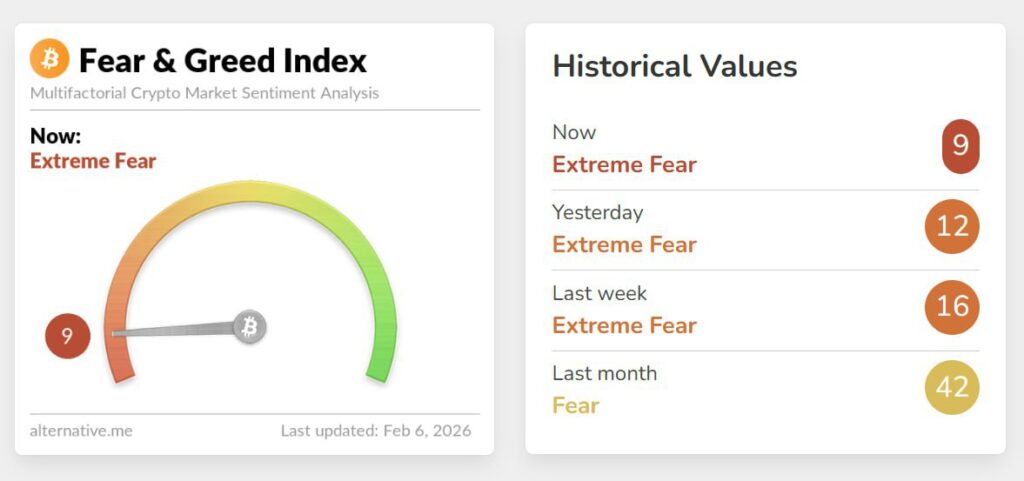

The psychological backdrop is especially telling. The Crypto Fear & Greed Index collapsed to 9 points – an extreme fear zone the market has not seen since June 2022. Back then, the crypto industry was going through one of its hardest periods: the Terra collapse, a chain of bankruptcies, and the overall sense that “the party was over.”

Today’s numbers indicate that investor sentiment is once again approaching crisis levels. In such moments, the market stops reacting rationally to news – the main driver becomes the simple desire to exit risk.

What could have triggered the crash

Analysts point to several potential reasons behind the current drawdown, and all of them are linked not so much to retail traders’ emotions, but to the behavior of major players.

First, there is discussion of possible selling by sovereign wealth funds. If state investment structures действительно began taking profits or reducing positions, it could have created a powerful wave of supply that the market was not ready to absorb quickly.

Second, concerns are growing about liquidity problems among large participants. When there is less free money in the system, even relatively small sales can lead to sharp moves because there simply are not enough buyers.

The China factor as an additional risk

Another source of anxiety is potential selling from Chinese entities. Although official information remains limited, the market traditionally treats any hints of major capital movements from Asia as a destabilizing factor.

The China factor in crypto has always acted as an amplifier: if rumors of selling appear, the reaction can be immediate even without confirmed data.

Liquidations intensify the decline

One should not forget the derivatives market either. Such sharp moves are almost always accompanied by a cascade of liquidations: leveraged positions are closed automatically, selling pressure increases, the price falls even further – and the next wave of margin calls begins.

This is a classic domino effect that makes the crypto market especially brutal during stress. There is no pause “until the exchange opens” – the process runs 24/7.

What’s next

The key question remains the same: is this drop a short-term capitulation or the beginning of a deeper bearish phase.

Historically, extreme fear zones have often coincided with the formation of local bottoms. But the market does not reverse simply because “everyone is scared.” For a sustainable recovery, the following are needed:

- liquidity stabilization

- a decline in forced selling

- the emergence of real demand from long-term investors

For now, the situation resembles a moment when the market is trying to catch its breath after a удар, but has not yet understood whether another one is coming. Bitcoin has once again reminded everyone that in crypto, calm is temporary, and volatility is always somewhere nearby.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.