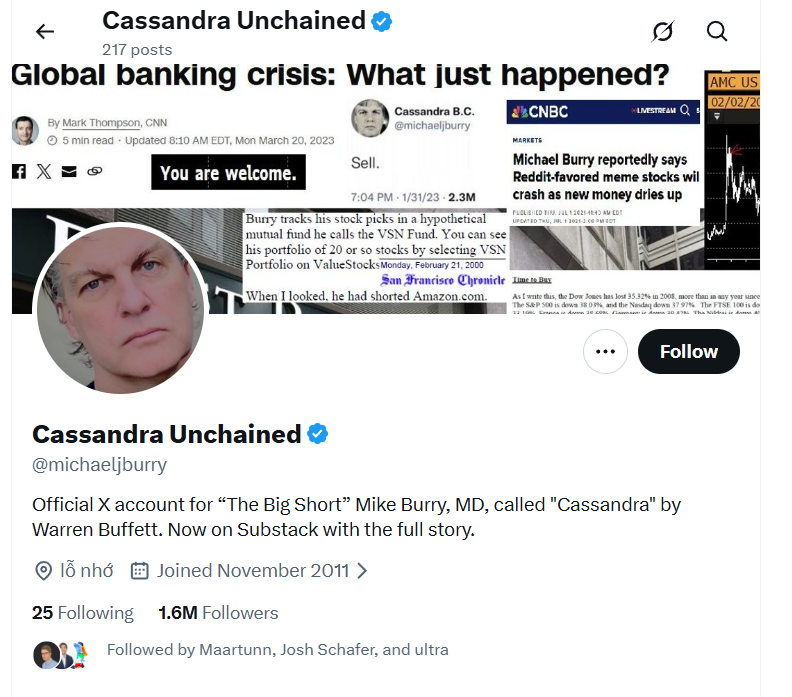

Michael Burry is one of the most well-known investors of the 21st century – the man who saw the U.S. housing bubble coming and made billions during the 2008 financial crisis. His story inspired the film The Big Short, and Burry himself has long been viewed by markets as a symbol of cold calculation and early warning.

That is why his latest comments on Bitcoin and institutional behavior are drawing особое attention. Bitcoin as a Trigger for Systemic Sell-Offs Burry’s main point is simple: Bitcoin’s падение is no longer confined to the crypto sector. When BTC drops sharply, institutional players – funds, trading firms, large holders – face margin requirements, losses, and the need to quickly close positions.

According to Burry, the current BTC динамика is no longer just a local crypto story, but a source of chain reactions that now affect the entire global financial market.

Bitcoin as a Trigger for Systemic Sell-Offs

Burry’s main point is simple: Bitcoin’s падение is no longer confined to the crypto sector. When BTC drops sharply, institutional players – funds, trading firms, large holders – face margin requirements, losses, and the need to quickly close positions.

And here comes the key moment: to offset crypto losses, they sell what can be sold immediately and with minimal friction. Often, this is not altcoins, not venture tokens, and not “future technologies,” but the most liquid traditional assets: gold, silver, Treasury securities, and крупные stocks. In other words, the instruments that were once considered safe havens.

The paradox is clear: Bitcoin falls – and even defensive assets fall with it, because the market is forced to search for liquidity.

Gold Is No Longer an “Island of Safety”

In the past, gold existed in a separate universe. Crypto had its own life, equities had theirs, metals had theirs. Today, that separation no longer works.

Burry emphasizes that rising correlations across markets mean gold and silver are no longer insulated from crypto cycles. If institutions treat gold as a liquidity reserve, then in moments of panic it becomes not protection, but a source of cash to cover losses.

In other words, gold is sold not because it has become a bad asset, but because it remains the last “alive” asset that can be quickly monetized.

Crypto Treasuries: A Strategic Asset Turns into a Trap

Burry also points to a growing risk tied to one of the latest corporate trends – holding Bitcoin as part of company reserves. More and more firms and funds keep BTC on their balance sheets as a “strategic asset of the future.”

But in reality, a sharp Bitcoin decline can:

- the balance value of reserves

- ухудшить capital metrics

- create pressure from creditors

- force asset sales at the worst possible moment

What looks like a “smart strategy” during bull markets becomes a loss multiplier during downturns. This is especially dangerous for those who bought BTC at the top, relied on leverage, or built models assuming endless growth. In such cases, Bitcoin becomes not a hedge, but a source of financial contagion.

Old Diversification Models Stop Working

Burry’s ключевой conclusion is тревожный: the world is entering an era where diversification is no longer a guarantee. In the past, declines in one asset class were often offset by gains in another.

Now, more markets move in sync, because the key driver is not fundamentals, but forced liquidity: BTC falls → margin calls → gold is sold → metals fall → equities are sold → stock markets drop.

These are no longer separate markets, but a single interconnected system of cascading sell-offs.

Conclusion: Bitcoin Has Become Part of Global Risk

Burry is essentially saying that crypto is no longer an “alternative to the system.” It has become embedded within the financial system – with all the consequences:

- leverage

- institutional positioning

- derivatives

- liquidation chains

- systemic sell-offs

That is why any major BTC move can now trigger a domino effect far beyond the crypto market. Markets are becoming increasingly connected. And when one asset forces liquidation across everything else, the old idea of a “safe haven” starts to sound like nostalgia for a time when gold was truly just gold.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.