On Tuesday, February 3, Bitcoin dropped to $72,863, marking a 42% decline from its October all-time high. For the market, this is not just another volatile candle – it is a psychologically important threshold that changes investor behavior. After months of euphoria and talk of a “new era” for BTC, the market has entered a phase where the key driver is no longer demand, but the survival of holders.

1-day BTC/USD chart. Source: Bitstamp.

Most Bitcoin Holders Are Underwater

One of the most alarming signals comes from investor position data. According to trader BitBull, around 44% of all Bitcoin holders are currently in the red. This means nearly half of market participants are holding coins below their purchase price.

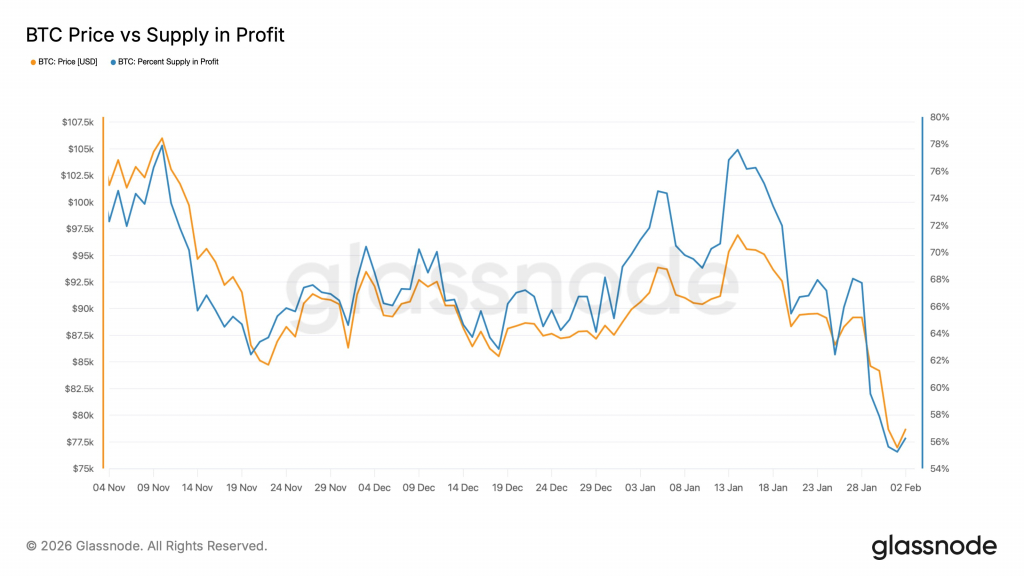

Comparison of Bitcoin price dynamics and the share of profitable holders. Source: BitBull

Over the past month, Bitcoin fell from $108,000 to $76,000 – a drop of about 30%. At the same time, the share of profitable positions declined from 78% to 56%. This dynamic highlights an important point: a significant portion of capital entered the market late in the rally, close to the top.

This creates what is known as a “supply zone” near recent highs. These investors are now psychologically trapped: they did not take profits, and now they are sitting on losses, waiting at least for a break-even return.

“When the price starts to rise, many of these holders may begin selling just to get back to zero. This can slow down the recovery,” BitBull explains. This is a classic market mechanism: the more people bought at the top, the stronger the resistance during any rebound. Every bounce becomes not the start of a new rally, but an opportunity to “escape without losses.”

BitBull emphasizes that the market is no longer driven by enthusiasm or fresh buyers. Instead, it is defined by the behavior of existing holders – those already inside the trade, deciding whether to endure or capitulate. The coming weeks will be critical: will investors hold through losses, or will selling pressure intensify, turning the correction into a deeper decline?

Technical Analysis Confirms Bearish Sentiment

Trader Crypto Candy notes that Bitcoin continues to move strictly within a bearish scenario, dropping another 7% since the last review. Although price is still holding above $74,700, the market remains extremely fragile.

Any upside move without reclaiming $84,000 could prove to be just a temporary bounce. In such phases, rebounds often become “bull traps”: price rises to attract buyers, only to continue lower afterward. If BTC fails to return at least into the $84,000-$90,000 range, the probability of testing lower levels will remain high.

The Most Pessimistic View: Capitulation Still Ahead

An even harsher assessment comes from trader Roman, who calls the current situation an “astonishing bear market.” He points out that Bitcoin has already lost nearly $60,000 from the peak, yet a large part of the market still remains bullish.This is the main paradox of the late-cycle stage: price is falling, but crowd sentiment has not fully broken.

Roman believes true buying opportunities will appear only after optimistic holders capitulate – at levels around $40,000-$50,000, when belief in a “quick return to ATH” is finally destroyed. This approach is typical of veteran traders: they don’t look for the bottom on charts – they look for the bottom in market emotions.

An Alternative View: The Bear Cycle May Be Near Its End

However, not all analysts share such bleak expectations. Well-known trader Michaël van de Poppe says he is not selling his positions and believes the market is in the final stage of the bear cycle. In his view, gold and silver have already peaked, while Bitcoin is finishing its pressure phase. “A new cycle will begin soon,” he claims, maintaining his altcoin holdings.

This reflects a different philosophy: the market is cleansing itself, weak hands exit, strong hands accumulate. For such investors, corrections are not disasters, but preparation for the next growth stage.

AI Perspective: Corrections as a Transfer of Ownership

Historical analysis reveals an interesting pattern: Bitcoin drawdowns of 40-50% almost always coincide with periods of retail capitulation. Yet paradoxically, these same periods often become entry points for institutional capital.

The events of 2018 and 2022 unfolded in a similar way: widespread losses, panic, talk of “Bitcoin’s death” – followed by a gradual transfer of coins from weak holders to stronger players.

In these moments, the market does not die – it redistributes.

A War of Interpretations: The Market at a Turning Point

The key paradox of the current situation is that experienced traders look at the same charts but see completely different сценарios. Bears treat every bounce as an opportunity to short. Bulls see the decline as an accumulation phase before the next upward impulse.

This “war of interpretations” becomes especially intense during transitional moments between cycles, when old patterns stop working and the new trend has not yet formed. That is why the coming weeks will be decisive: the market will either confirm a deep capitulation scenario, or begin laying the groundwork for the next growth cycle.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.