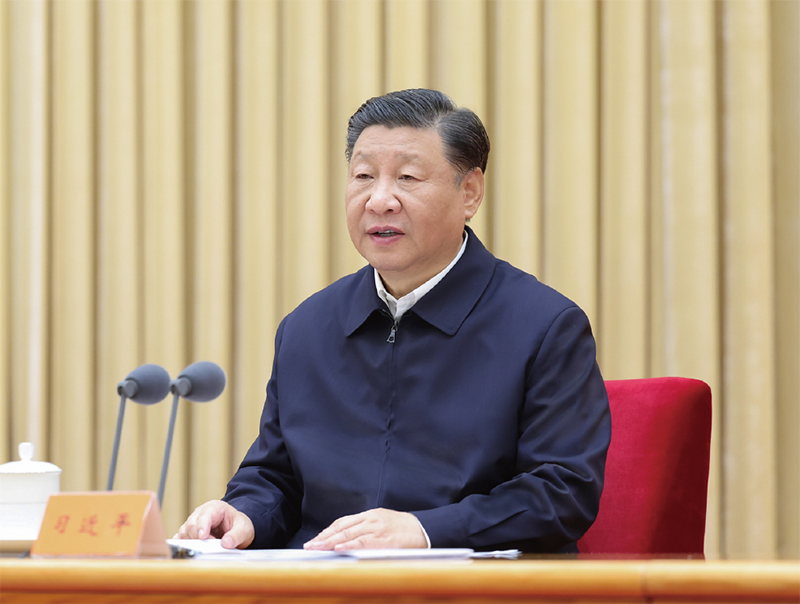

Chinese President Xi Jinping has, for the first time, stated so directly and unequivocally his intention to turn the Chinese yuan into a global reserve currency. This statement came at a moment when the position of the US dollar is noticeably weakening and the global financial system is entering a phase of structural instability.

In a commentary published on January 31 in the ideological journal of the ruling Communist Party of China, Qiushi, Xi emphasized the need to create a “powerful currency” that can be widely used in international trade, investments, and foreign exchange markets, and that can also obtain reserve status. In effect, Beijing is no longer limiting itself to vague language about the “internationalization of the yuan” and is publicly defining its ultimate goal for the first time.

It is important to note that the statements themselves were made back in 2024 during a closed-door speech to senior regional officials. Their publication at this particular moment appears to be a deliberate political and economic signal.

The Architecture of Financial Power, Chinese Style

Xi Jinping clearly stated that turning the yuan into a reserve currency is impossible without restructuring the country’s entire financial ecosystem. According to him, China needs:

- a powerful central bank capable of effectively managing monetary policy;

- financial institutions competitive at the global level;

- international financial centers capable of attracting global capital and influencing global price formation, rather than merely serving the domestic market.

In essence, this is about creating an alternative center of financial gravity comparable to New York and London, but operating under strict state control.

An Ideal Moment to Strike the Dollar

The publication of Xi’s theses coincided with a period of heightened turbulence in global markets. The weakening of the US dollar, which President Donald Trump even called an “excellent trend” last week, changes in the leadership of the Federal Reserve, geopolitical conflicts, and trade wars are pushing central banks around the world toward diversification of their currency reserves.

An additional backdrop is created by the active use of the dollar as an instrument of sanctions pressure. The freezing of reserves, disconnections from SWIFT, and secondary sanctions are forcing even US-friendly countries to think about the risks of excessive dependence on the American currency.

The head of the People’s Bank of China, Pan Gongsheng, said last year that a multipolar international monetary system is taking shape, in which the yuan will compete not only with the dollar, but also with the euro, the yen, and other regional currencies.

Real Achievements and Hard Statistics

China has indeed made some progress. After 2022, the yuan became the second most important currency in trade finance, especially in settlements with Russia, the Middle East, and Asian countries. The use of the yuan in bilateral trade is growing, particularly where dollar settlements are politically undesirable.

However, in the structure of official global reserves, the picture looks far less impressive. According to IMF data:

- the US dollar accounts for about 57% of global reserves (down from 71% in 2000);

- the euro accounts for about 20%;

- the yuan accounts for only 1.93%, ranking sixth globally.

This is a key limitation that cannot be overcome by declarations alone.

The Main Barriers on the Yuan’s Path

Economists agree that for the yuan to become a true reserve currency, China would have to take extremely painful steps:

- open the capital account;

- ensure full currency convertibility;

- loosen state control over capital flows;

- increase the transparency of the financial system and judicial institutions.

So far, Beijing is not ready for this. Moreover, China’s trading partners regularly point to the artificial undervaluation of the yuan, which makes Chinese exports cheaper and helps maintain a record trade surplus. In 2024, it reached $1.2 trillion, an all-time high.

IMF Managing Director Kristalina Georgieva openly urged China to eliminate structural imbalances, including deflation, which she said has led to a significant decline in the real exchange rate of the yuan.

A Long-Distance Strategy

Xi’s statements do not mean that investors will start massively shifting into the yuan tomorrow. Financial markets do not work that way. However, they clearly outline a long-term direction that institutional players are closely watching.

Beijing clearly sees that the dollar no longer enjoys absolute inviolability. And China intends to act not through sudden moves, but methodically — through trade settlements, regional agreements, the development of its own payment infrastructure, and technological innovations.

AI Opinion: Lessons of History and the Digital Factor

Historical analysis shows that the replacement of a dominant reserve currency is an extremely slow process. The British pound yielded to the dollar over more than 30 years — from the 1920s to the 1950s. There are no quick victories here.

However, the current situation has a fundamentally new dimension — the digital one. China is actively testing a digital yuan (CBDC), which could potentially become a “Trojan horse” for bypassing the traditional banking system, correspondent accounts, and dollar clearing chains.

The paradox is obvious: the more actively the United States uses the dollar as a geopolitical weapon, the stronger the motivation for other countries to seek alternatives. China is preparing to offer the world not just a currency, but a new infrastructure for international settlements.

The key question remains open: is the global financial market ready to recognize the currency of a country with a closed capital account and strict state control as a universal store of value?

The yuan is entering the big game. But the match is only beginning.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.