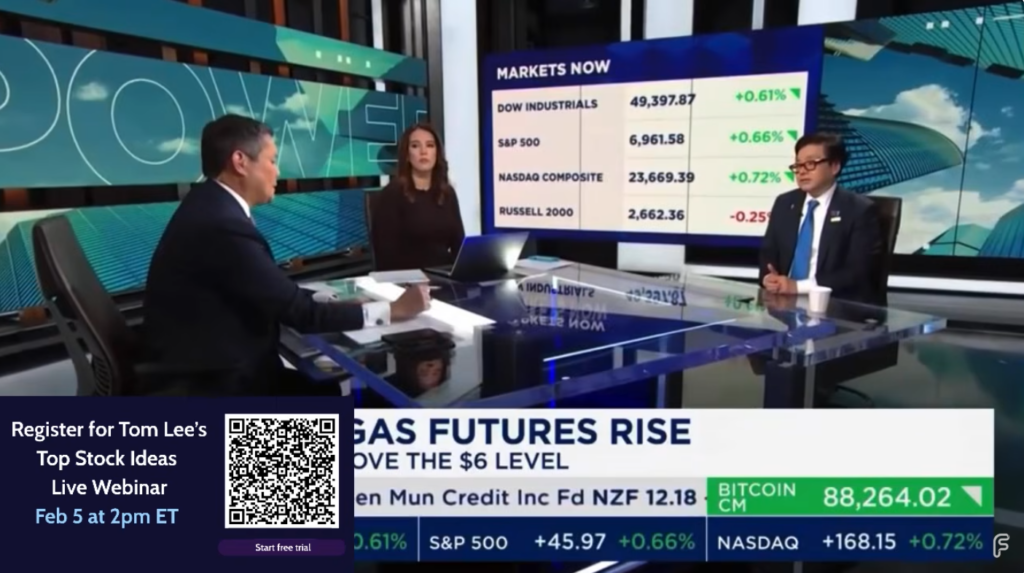

BitMine chairman Tom Lee believes that the current rally in the gold and silver markets appears logical and does not contradict the growth of other asset classes. According to him, the strengthening of precious metals does not mean that digital assets are losing their prospects. On the contrary, Lee is confident that once the rise in gold and silver prices slows down or takes a pause, investor attention and capital flows will shift back toward Bitcoin and Ethereum.

According to Tom Lee, the current market developments confirm the status of gold and silver as a full-fledged and independent asset class. Unlike previous cycles, when the rise of metals was seen only as a reaction to short-term crises, now it reflects more sustainable and fundamental demand. He cites geopolitical tension, a weakening U.S. dollar, and accommodative central bank policies as the main drivers of this growth. In times of uncertainty, investors traditionally seek capital protection, and precious metals are once again in the spotlight.

At the same time, the cryptocurrency market, according to Lee, is still in a recovery phase following a massive deleveraging that occurred during previous periods of tighter financial conditions. Mass liquidation of leveraged positions, bankruptcies of certain players, and a general decline in risk appetite temporarily weakened the digital asset market. However, he believes the fundamental picture is gradually improving. Institutional interest in Bitcoin and Ethereum is growing, infrastructure is becoming more mature, and regulation in several jurisdictions is taking on clearer and more predictable forms.

Tom Lee also highlights the role of tokenization and blockchain technologies, which continue to integrate with traditional finance. Banks, investment funds, and tech companies are increasingly using blockchain for settlements, asset accounting, and the issuance of tokenized instruments. In his view, this creates a long-term foundation for crypto market growth, even if in the short term capital is temporarily reallocating to more conservative assets.

Lee also notes that the current rally in precious metals has effectively diverted investor attention from cryptocurrencies. Part of the capital that might otherwise flow into Bitcoin and Ethereum is now concentrated in gold and silver. However, he believes this trend is temporary. Historical data shows that after periods of strong metal growth, when the market pauses or takes profits, cryptocurrencies often demonstrate accelerated growth, compensating for previous lag.

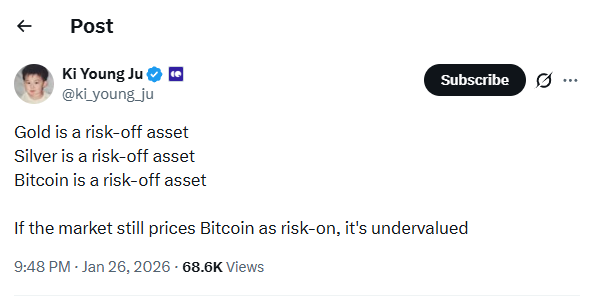

A similar view is expressed by Ki Young Ju, CEO of the analytics platform CryptoQuant. He believes gold, silver, and Bitcoin should be considered assets in demand during risk-off periods. In times of instability, they serve a similar function of preserving value, albeit with different volatility levels. At the same time, Ki Young Ju points out an important nuance: if the market continues to perceive Bitcoin primarily as a risk-on asset — i.e., an instrument for high-risk periods — this may indicate its fundamental undervaluation.

CryptoQuant analysts have previously explained Bitcoin’s lag behind gold and silver as a combination of several factors, including increased demand for traditional safe-haven assets amid geopolitical uncertainty, expectations of lower interest rates, and the relative ease of investing in precious metals via ETFs and other classic instruments. For many large investors, gold and silver remain a more familiar and understandable way to protect capital, especially during turbulent times.

Thus, according to experts, the current market situation does not indicate weakness in cryptocurrencies as an asset class. Rather, it reflects a phase of capital reallocation and a shift in investor priorities amid global uncertainty. If history repeats itself, a pause in precious metal growth could become the trigger that reignites active price movement in Bitcoin and Ethereum.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.