The largest video game retailer, GameStop, made a transaction that immediately caught the attention of the crypto market and institutional analysts. The company transferred all of its Bitcoin reserves to the institutional platform Coinbase Prime — a service designed to serve large corporate and institutional clients. According to the analytics platform CryptoQuant, this involves 4,710 BTC with a total value of over $422 million at current market prices.

The transfer itself does not automatically imply a sale. However, historically, this platform is used by companies to prepare for large operations — whether partial or full liquidation of positions, hedging, or complex structured transactions. That is why the market interpreted the transaction as a potential signal that GameStop may reduce or completely close its Bitcoin position.

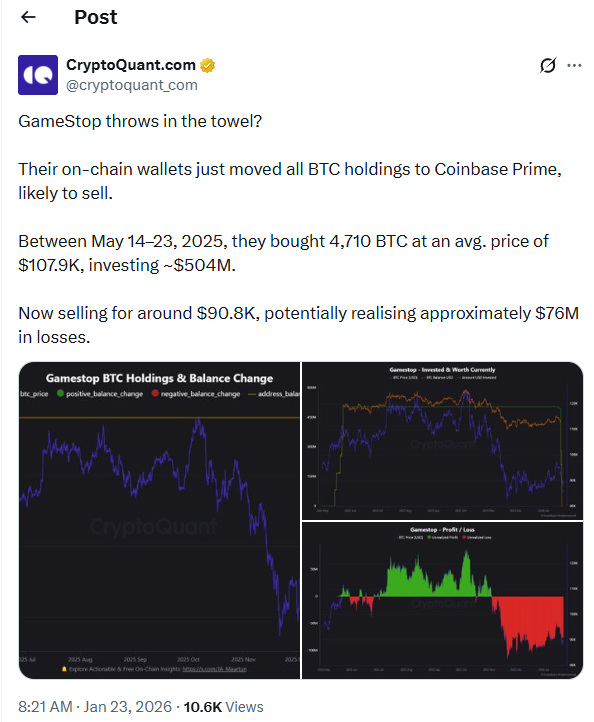

If the company decides to sell all assets at the current Bitcoin price of around $90,800, GameStop would record a significant paper loss. The average purchase price of the Bitcoins, according to disclosed data, was approximately $107,900 per coin. This implies a potential loss of around $76 million compared to the initial investment. For a publicly traded company, such a move carries not only financial but also reputational risks, especially amid ongoing discussions about the role of cryptocurrencies in corporate treasuries.

Bitcoin Treasury Strategy in Question

GameStop was among the companies that built cryptocurrency reserves in 2024–2025, when Bitcoin fully entered the institutional agenda. The purchase of digital assets occurred in May last year as part of several investment operations. Notably, the decision to create Bitcoin reserves was made shortly after a meeting between GameStop CEO Ryan Cohen and Strategy chairman Michael Saylor in February 2025.

Saylor, a leading public advocate of corporate Bitcoin treasury, has repeatedly emphasized that BTC should be viewed as a long-term store of value rather than a speculative asset. This approach inspired dozens of companies to rethink their balance sheet structures. However, experience in the second half of 2025 showed that such a strategy is not always perceived positively by the market, especially in sectors with high operational volatility, such as retail and entertainment.

CryptoQuant explicitly stated on X that the Bitcoin transfer is “highly likely intended for sale.” GameStop itself has so far refrained from official comments, which only increases uncertainty and fuels speculation.

Management Activity Amid the Crypto Transfer

Additional interest in the situation arises from the behavior of the company’s management. Amid a possible sale of Bitcoin reserves, Ryan Cohen, on the contrary, is increasing his stake in GameStop. According to documents filed with regulators on Wednesday, he acquired an additional 500,000 GME shares for more than $10 million. This move was positively received by the market and led to a rise in stock prices of more than 3%.

This divergence of signals — possible sale of crypto assets alongside strengthening ownership of the core business — may indicate an attempt to shift investor focus from digital asset experiments back to the company’s fundamentals. For retail investors, this looks like management is betting on the main business rather than the balance sheet crypto exposure.

Corporate Crypto Assets in the Index Spotlight

In a broader context, the GameStop situation fits into a general reassessment of corporate crypto strategies. Currently, more than 190 public companies worldwide hold Bitcoin, and many have also invested in Ethereum, Solana, and other altcoins over the past 12 months. However, market volatility in the second half of 2025 has cast doubt on the sustainability of such approaches, especially for companies outside the financial or tech sectors.

An important factor remains the position of index providers. Earlier this month, Morgan Stanley Capital International (MSCI) decided not to exclude companies with crypto assets from its market indices. This is critically important: exclusion from MSCI indices would automatically deprive companies like Strategy and other large crypto holders of billions of dollars in passive fund investments.

MSCI stated that it needs more time to clearly distinguish investment companies from operational businesses that only partially use crypto assets on the balance sheet. This decision temporarily stabilized the situation and reduced pressure on corporate Bitcoin holders.

Alternative Perspective: Machine Analysis View

From the perspective of machine data analysis and behavioral patterns, the transfer to Coinbase Prime does not necessarily imply an immediate sale. Institutional platforms of this level are often used for more complex operations — from hedging price risks to using Bitcoin as collateral or preparing derivative structures.

Historical examples support this hypothesis. Tesla, for instance, partially sold its Bitcoin reserves not due to loss of confidence in the asset but to optimize cash flow and manage liquidity during periods of instability. For retail sector companies, such decisions are particularly relevant amid operational transformations and margin pressures.

In this context, GameStop’s actions may reflect not a rejection of the crypto strategy but pragmatic balance sheet management ahead of important corporate events or business model changes. The market, as before, is forced to operate in a wait-and-see mode. The question is not whether GameStop will sell Bitcoins, but what role digital assets will play in the next phase of corporate finance evolution.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.