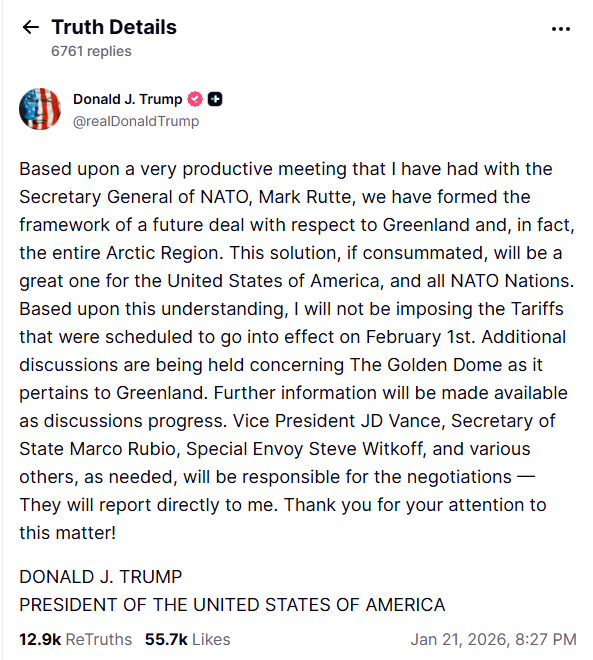

Wednesday, January 22, 2026, marked a sharp and telling shift in sentiment, as investors suddenly remembered that the world is still capable of stepping back from the edge from time to time. Donald Trump publicly abandoned plans to impose tariffs of at least 10 percent on countries in Western and Northern Europe. For the markets, this removed one of the key geopolitical risks that had been hanging in the air for several weeks and weighing on risk appetite.

The statement was made in Davos at the WEF forum and was important not only in form, but also in substance. Beyond the tariff issue, Trump sent two additional signals that the market viewed as critical. First, the United States will not use force in the Greenland issue. Second, the parties reached what was described as a framework for a future deal on access to the island’s resources. This is not about purchasing territory, as it had previously been framed in the media, but about strategic access to rare earth minerals, energy, and defense-related areas. In effect, the US is seeking priority access to resources, which is especially important in the context of global competition with China. For the market, this looks far more rational and predictable than loud territorial ideas.

The reaction was fast and broad. This is worth emphasizing, because the market rose not on the back of a few giants, but across nearly the entire field. The S&P 500, Nasdaq, and Dow Jones each gained around 1.2 percent, while the Russell 2000 rose nearly 2 percent and set a new all-time high at 2703.75. Small-cap stocks are up almost 9 percent year-to-date, a direct signal that risk appetite is returning. When money flows into small caps, the market typically feels more confident than when gains are driven only by mega-caps.

Market breadth looked convincing. Advancing stocks outnumbered declining ones by a wide margin, supporting the view that the market remains investable rather than merely staging a technical bounce. The RSP ETF, which tracks the equal-weighted S&P 500, gained 1.7 percent, showing that gains are being distributed evenly rather than concentrated in a handful of the largest names.

Leadership in certain sectors was particularly noteworthy. Regional banks and transportation stocks were unexpectedly strong. Shipping companies gained around 6 percent, while trucking companies rose more than 5.5 percent. The Dow Transportation Index advanced roughly 3 percent and also set a new all-time high. This move deserves special attention because it occurred against the backdrop of rising fuel prices.

WTI crude held near $61 per barrel, while natural gas posted a daily jump of nearly 29 percent. Despite this, transportation stocks rallied, signaling market confidence in sustained economic activity and demand for shipping. A good example is J.B. Hunt, which gained about 3 percent and is holding firmly above its 21-day exponential moving average, remaining one of the sector’s leaders.

Elsewhere, market performance was more mixed, but without drama. Amgen rose nearly 4 percent and was among the leaders in the Dow. Microsoft, by contrast, fell about 2.3 percent, a reminder that even on strong days the market does not rise across the board. Gold pulled back from its record highs, which is logical given the reduced demand for defensive assets. The yield on US 10-year Treasuries hovered around 4.25 percent, without creating additional pressure on equities.

Market attention is now gradually shifting forward. The focus remains on PCE inflation data, the upcoming Fed meeting, and corporate earnings, with investors particularly awaiting results from companies such as Intel, GE, and Procter and Gamble. It is this combination of macroeconomic data and corporate reporting that will shape market dynamics in the coming weeks.

The main takeaway of the day is simple but important. Geopolitical pressure has eased, the market has confirmed its strength through broad-based gains rather than a narrow rally, but the political factor has not disappeared and volatility will remain. In such an environment, the strategy remains old and time-tested: hold strong stocks, trade from key levels, and avoid chasing the market on every loud headline. History shows that this approach survives political cycles better than most.

All content provided on this website (https://wildinwest.com/) -including attachments, links, or referenced materials — is for informative and entertainment purposes only and should not be considered as financial advice. Third-party materials remain the property of their respective owners.